Seafood ingredients and the impact of fish shortages

Algal oil could make its way into more pet food formulations as manufacturers look for ways to protect themselves against volatile fish oil prices.

Concerns about both the supply and sustainability of traditional fish oils are leading manufacturers to explore other avenues. As demand for fish oil continues to grow in the pet food market, algal oil may become a viable alternative – despite also commanding a high price.

Global shortage

Fish oil prices spiked in 2023 as a result of the cancellation of the April-July fishing season off the coast of Peru, which has triggered a shortage of fishmeal, fish oil and related marine ingredients.

The cancellation was not necessarily unexpected, as the catch in the country is typically limited during El Niño, a natural climate phenomenon that involves warmer surface temperatures in the waters of the Pacific Ocean. Enrico Bachis, Director of Market

Research at the Marine Ingredients Organization (IFFO), says that the warmer temperatures cause anchovies to move into deeper waters in search of food, which in turn limits the size of the catch in Peru and along other parts of the South American coastline.

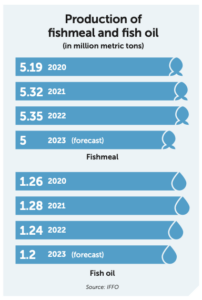

As of mid-January, IFFO reported that fishmeal production during the first 11 months of 2023 was down by 16% compared with the same period in 2022, with decreased fishing in Peru accounting for 41% of the total decline. Fish oil production fell almost 20% in the same period.

The pet food industry is somewhat insulated from these global dynamics because most pet formulators prefer salmon meal and salmon oil, which is typically made from filet processing byproducts, to meals and oils of marine origin. But, according to Bachis, demand from the pet food market for fish oil continues to grow, while the supply of salmon meal and oil remains relatively finite.

“We expect inclusion levels to be adjusted to have enough fishmeal and fish oil to accommodate growing pet food production,” he says. “The overall consumption of marine ingredients by the pet food sector however could still grow depending on the willingness of pet owners to pay for the best quality feed for their animals.”

Sustainability and quality

The sustainability of these marine ingredients is also in question – and not just in terms of the environmental impact. Research published last June in the journal Nature Sustainability estimated that environmental challenges, including climate change, threaten 90% of the world’s marine food production.

There’s also the matter of the quality of these ingredients. In addition to the reduced catch, fishers around the world have found that fish contain less oil than in the past, according to George Josef, Global Head of Marketing and Nutritional Lipids at DSM-Firmenich, the global distributor for Veramaris algal oil. Wild-caught marine ingredients may also contain contaminants such as heavy metals.

Widening the ingredient net

Pet food manufacturers have turned to ingredient diversification as a strategy to cope with growing demand for fish oil and concern about supply stability. Algal oil, which comes from specific species of algae that are grown commercially in industrial vats, offers one such strategy.

Aquaculture still represents the majority of Veramaris algal oil sales, but the company began marketing to the pet food sector in 2021 in the belief that the oil’s nutritional profile could make it a desired ingredient in the pet market. Cats and dogs need adequate levels of certain omega-3 fatty acids in their diet, including eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), and Josef says that there is simply not enough marine oil available to supply global demand.

Josef says that is going to be a “big market”. “Today, we already have global companies on the super-premium market using our oil, so this is not something we are looking to in the future, this is something we are looking to in the present,” he says.

Alternative to fish oil

Glenn Gorham, owner of Californian pet food manufacturer The Real Meat Company, says that the business has added algal oil to all its dog and cat food formulations since the oil was approved in the US to boost its products’ omega-3 content.

However, The Real Meat Company hasn’t increased its use of algal oil in response to rising fish oil prices, Gorham says, although it has ruled out making an all-fish diet on account of cost. Given the steep increase in the cost of raw materials – and the fact that algal oil is by no means a cost-saving ingredient – Gorham says that the company has opted to raise its own prices rather than change its formulations.

According to DSM-Firmenich’s Josef, this is to be expected as strict labeling requirements mean pet food manufacturers are typically slow to change their formulations. The majority of pet food manufacturers are still in the process of incorporating algal oil into their pet diets, and most pet products containing algal oil have yet to hit the shelves.

Future formulas

Josef is a believer in the strategic advantages of algal oil. Concerns about fish oil availability and price volatility, he says, mean pet food companies will likely use algal oil in combination with fish oil as a hedge against price shocks.

The IFFO’s Bachis points out that supplies of algal oil remain somewhat limited and global production of algal oil still totals less than 100,000 metric tons. In 2022, the global pet food industry consumed between 100,000 and 150,000 metric tons of fish oil. “Market forces ration the available and finite supply of fishmeal and fish oil, meaning that the market segment that can afford to pay the highest price will get the needed marine ingredients,” he explains.

The pet food sector so far has shown it has this ability, increasing year after year the amount of fishmeal and fish oil used. In the short to medium term, “we expect this not to change”, concludes Bachis.