A snapshot of the German e-commerce market

Despite a tough year in 2023, the 5-year online growth forecast is positive for Germany’s pet supplies category. We take a look at the changing market dynamics.

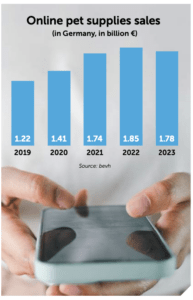

Last year was a tough one for German e-commerce. Despite showing good performance in the first half of the year, the pet food and pet supplies industry was not able to buck the downward trend. As a result, the gross merchandise volume of pet supplies fell by 4.2% to €1.78 billion ($1.95B) overall.

Online sales expected to grow

Nevertheless, this downturn was significantly lower than the drop in total online order sales made by German consumers, which declined by 11.8% to €79.7 billion ($87.2B). In fact, pet supplies are considered to be one of the e-commerce categories that will continue to grow over the next 5 years. This is despite the sector’s rapid growth during the pandemic, equating to a 45.4% increase in total volume since 2019.

A closer look at the past year on a quarter-by-quarter basis reveals that sales in the third quarter rose to their highest level ever at €498 million ($545M). Unlike for most other product groups, the third quarter has always been much more important for online pet supplies than the holiday season in the fourth quarter.

Concentration of players

Despite the rapid growth in recent years, there have been winners and losers. When it comes to German consumers’ online buying preferences for pet supplies, purchases through online marketplaces have increased the most and now account for more than every second order in this online segment. This growth has been at the expense of internet pure players in particular.

There are signs of considerable concentration in the e-commerce sector. In February, the multichannel retailer Fressnapf announced it had achieved online growth of around 20% to almost €400 million ($437M) in 2023. However, these sales relate to all countries in which the company is active online. Therefore, it equates to only around 20% of what the pure online retailer Zooplus achieved globally in the year of its delisting from the stock exchange (2021/22).

These 2 retailers are likely to account for more than a third – if not almost half – of the entire online pet supplies trade in Germany. Their success is buoyed by the fact that Das Futterhaus, Fressnapf’s main bricks- and-mortar competitor, has so far not engaged in online trading.

The German e-commerce market is characterized by a very large number of smaller players, and the pet sector is no exception. For example, there are long- established mail order companies such as Schecker, Clevercat, Alsa Hundewelt and M&S Reptilien.

Above all, however, more and more suppliers of pet food and supplements are entering the online market. Reliable and fast deliveries also allow frozen raw food to be purchased from online butchers, such as Frostfutter Perleberg or Frostfutter Plauen. The German market is even large enough for suppliers of frozen food for fish or reptiles.

Reliability and speed

While reliable delivery is one of the levers for success, speed seems to be even more important to customers looking to buy pet supplies online. While only 4.9% of the German population as a whole say they regularly order from fast delivery services such as Flink or Getir, the proportion of buyers of pet supplies and pet food is almost twice as high at 8.6%.

This is according to survey by the German industry body of online and mail order retailers bevh among 2,500 online shoppers carried out between April and June 2023.

Rise of direct-to-consumer

Although they still only account for a small percentage of the market, the dynamic growth of direct-to- consumer (D2C) providers is striking. These are companies that manufacture products themselves (or have them produced as private label) and sell them directly to end customers. If orders placed with manufacturers and producers who sell exclusively via marketplaces were included in the table, the percentage of D2C orders would probably be even higher.

One example of a hybrid approach is AlphaPet Ventures. The company, which was originally formed by the merger of 2 online providers, acquires manufacturer brands. If a product launch proves successful in direct online sales, the product is often subsequently sold via bricks-and-mortar retailers too.

Subscription models

Pet food subscriptions are seen by many as another key lever for growth. In Germany, they are currently offered by Amazon in addition to the ‘top dogs’ Zooplus and Fressnapf.

However, successful long-term e-commerce businesses have only been built exclusively on subscription models in a few cases. This is because customers primarily opt for subscription models because of the financial benefits and to avoid the inconvenience of going shopping.

One of the disadvantages for e-commerce players is that heavy bags of pet food incur high transport and logistics costs. Additionally, subscription models remove the chance for consumers to make impulse purchases when browsing the online range. Fressnapf has therefore recently entered the market with a ‘surprise box’ for dogs and cats. It is easier to handle, plus includes product samples that create the opportunity to generate new sales.