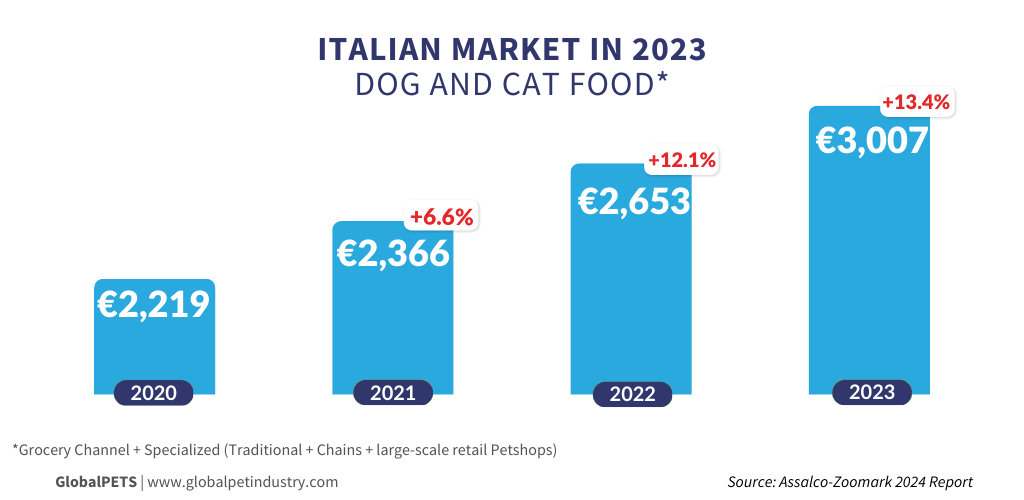

€3 billion in pet food sales: a snapshot of the Italian industry in 2023

The wet pet food segment accounted for more than half of the country’s pet industry’s business in a year impacted by inflation.

New data released by Zoomark and the Italian Association for Pet Feeding and Care (ASSALCO) suggests that the pet food industry in Italy was resilient in 2023 despite inflation as pet parents “absorbed price increases by safeguarding the quantities purchased.”

Sales of dog and cat food by volume remained the same in 2022 and 2023, with 673,000 tons sold each year.

Despite volume stability, the value of the market through grocery and specialized channels increased by 13.4%, from €2.75 billion ($2.98B) in 2022 to €3 billion ($3.2B) last year. Like most fast-moving consumer goods (FMCG) categories, this was impacted by the inflationary environment.

Breakdown by animal

Cat food—which makes up 55.3% of the total market share—witnessed a 15.7% annual increase to €1.66 billion ($1.8B), while dog food—which accounts for 44.7% of the market share— grew 10.7% to €1.34 billion ($1.45B).

Italy’s small pet food market (including birds, rodents, turtles and fish) posted a turnover of €14 million ($15.2M) in 2023, a 5.8% increase.

The pet population in Italy stood at 65 million in 2023, the same as in 2022. Fish (29.9 million) accounted for most, followed by birds (12.9 million). There were 10.2 million cats and 8.8 million dogs in the country. Small mammals and reptiles made up the smallest pool, with 3.2 million.

Wet and dry

The wet pet food segment accounted for over half (54.4%) of Italian pet food sales in 2023. According to Zoomark and ASSALCO’s data, it posted a turnover of €1.46 billion ($1.58B).

Dry food made €1.2 billion ($1.3B) in sales in 2023, representing a 40.8% market share.

Both wet and dry pet food saw an increase in turnover of 13.4% each, while volume rose by 1.1%.

Most pet food sales in Italy were made via the grocery channel last year: 73% for wet and nearly 50% for dry.

Snacks and accessories

According to the figures, snacks represented 10.5% of the pet food market in Italy in 2023.

Between 2022 and 2023, the value of cat and dog functional and off-meal snacks and treats increased by 13%, but volume fell by 0.5%.

The grocery channel led sales for cat snacks, which grew 26.3% in value and 17% in volume. Dog snacks via this channel grew by 11.1% in value and decreased by 1.7% in volume.

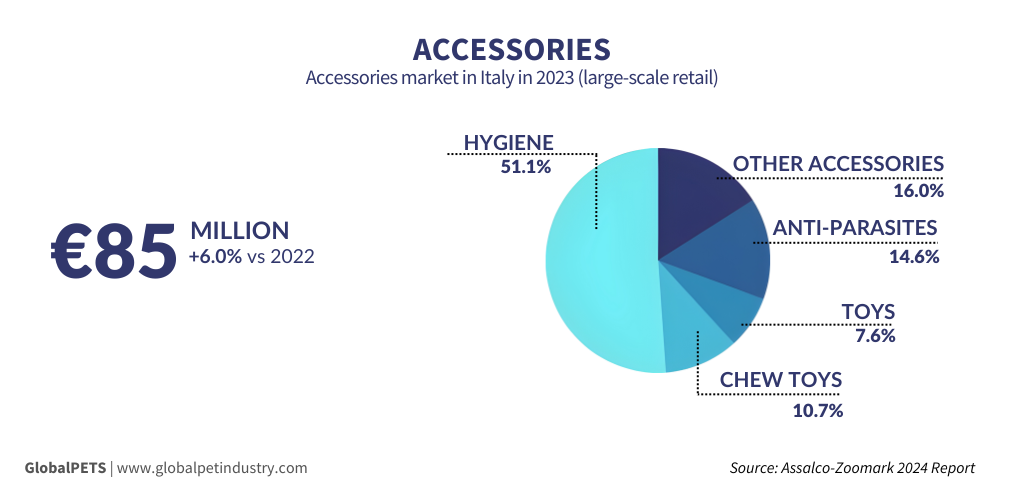

The accessory market witnessed 6% growth, increasing its value to €85 million ($92.3M). Hygiene (51.1%), chew toys (10.7%) and toys (7.6%) were the top 3 categories with the largest market share in the segment.

The Italian cat litter market also grew by 14% to €100 million ($108.7M).