How is inflation still affecting pet owners’ spending habits?

The simple answer to the question is yes. But how consumers are dealing with higher prices for their pet products and services varies according to country.

Inflation was one of the hot topics and a concern for consumers in 2023, with devastating effects for 1,000s of pet owners. As price hikes slowly ease around the world, it was time for a new survey – to assess whether inflation remains a concern for pet parents. Findings show that this definitely is the case, with almost a third of consumers reducing their spending.

Effect on household finances

A recent PETS International survey, conducted in partnership with Yummypets, of 945 pet parents from France, Canada, the US and the UK, concludes that nearly 8 out of 10 consumers (79%) are fully aware of the economic crisis and its impact on the cost of living.

Unsurprisingly, 85% of them also say that the crisis affects their household’s financial situation, with people in the UK the least likely to be impacted in their finances (79%).

This has also influenced consumers’ spending habits, with 29% reducing their spending. Pet owners in the US (43%) and Canada (40%) are the most likely to feel the strain, so they’re decreasing their spending on items such as food, treats or toys.

French consumers, on the other hand, are the least likely to feel any impact, with 62% stating that they have even increased their spending. Pet parents in France are also the least likely to cut down on the amount of food they give to their pets (7%).

More affordable options

Overall, 8 in 10 consumers (82%) say they are not reducing the amount of food they give their pets. Despite that, nearly half (48%) admit that the impact of the economic crisis influences their decisions about whether or not to buy more affordable options.

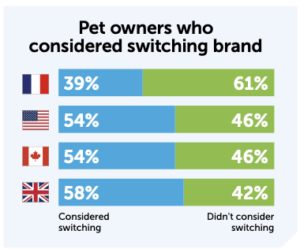

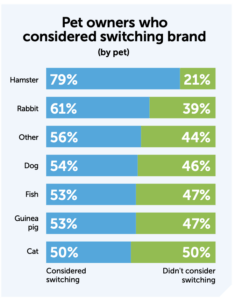

The PETS International and Yummypets research found that the strain is particularly felt in North America, where 54% of US and Canadian pet owners have switched brands or are considering doing so. Americans are also more likely to reduce the amount of food they give (25%) due to the economic crisis than people in other countries.

By contrast, only a third of French consumers (34%) consider more affordable options due to the effect of the crisis, and they are the least likely to even consider switching brands (61%).

Cutting down on treats and toys

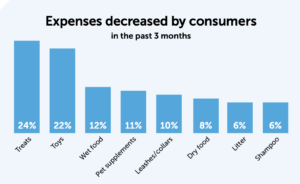

Despite not cutting back on essentials such as food, many consumers do look at reducing expenses that are not absolutely necessary.

According to the survey, the categories where pet parents are cutting down their expenditure the most are treats (24%) and toys (22%), followed by wet food (12%) and supplements (11%). Interestingly, this is a trend where there are no differences between the 4 markets.

Vets not immune

There is no doubt that pet owners will go to great lengths to care for their pets, but vet bills have increased in many countries, putting a further strain on consumers. American pet parents are the most likely to reduce their trips to vet clinics (37%), followed by people in Canada (30%) and the UK (20%).

Here again, French consumers are the ones most likely to maintain their current habits. Still, many pet owners have reported cutting back on vet services, particularly vaccinations. As one of them said: “I no longer vaccinate my oldest cat. He doesn’t leave the house anymore.”

In the UK, many respondents mention the importance of insurance and how that helps with their vet bills.

Pet services feel the pinch

With so much pressure on consumers, pet care services such as grooming, pet sitting and dog walking have also been impacted to some extent.

Globally, 37% of respondents have cut back on the use of these services. It is in the US that these services have suffered the most, with 43% of consumers cutting back on this type of expense. Dog owners are also more likely (44%) to reduce their use of these services than cat owners (35%).

Latest price rise data

In the UK, the consumer price index (CPI) rose by 3.8% in the 12 months to February 2024, down from 9.2% in 2023. As of February, US prices have risen 3.2% (6% last year) and in Canada, they increased 2.8% (5.2% last year). In March 2024, consumer prices in France are expected to increase by 2.3%, down from 6.6% in 2023.