Pet product online sales from a Chinese perspective

China’s e-commerce giant Alibaba is witnessing continuing expansion in pet supplies marketing via different online channels – including its own, Tmall.

Launched in 2008, Alibaba’s Tmall serves as a platform for consumers in China and overseas where they can buy both home-grown and international branded products, as well as products not available in traditional retail outlets. A large number of international and Chinese brands and retailers have opened storefronts on Tmall.

Robust demand for food

Wet, freeze-dried and functional food, plus pet supplements, are fast-growing categories on Tmall Global, with many successful international brands represented. During the 2022 edition of the Double 11 online shopping festival, the largest e-commerce event in China, imported pet food grew much faster than non-imported products – despite often being 50% more expensive than national brands.

At present, China has more than 70 million pet owners and the total number of pet dogs and cats exceeds 100 million. At the same time, the average annual consumption basket for pets continues to increase. It hit ¥2,216.3 ($306.62/€283.49) in 2021 and is expected to reach ¥3,500 ($484.21/€447.69) by 2025.

Special diets and health products

The global pet food industry is increasingly focused on meeting the special dietary needs of pets. As a result, there are many different types of pet food on the Chinese market too. This includes grain-free products and hypoallergenic formulations, as well as high protein and low-fat foods.

Tmall Global is also expanding its range of pet health products, including nutritional creams, calcium tablets, hair cream and even sheep milk powder. All the most popular items come from official online brand stores, which helps to build the trust needed for pet owners to use the flagship stores on e-commerce platforms such as Tmall.

Rising sales of smart fountains

The pet supply industry in China is forecast to reach ¥50 billion ($6.92B/€6.39B) by next year. Increasing numbers of pet owners, and the pet-related behavior and lifestyles of the younger generation, are catalysts for the development of intelligent supplies. Drinking fountains, safety cameras and automatic feeders are some of the many new products on the market.

Pet parent preferences for smart supplies are seen mainly with regard to their pet’s food, housing and entertainment. Between April and September 2023, 63% of Tmall customers buying pet supplies also purchased a smart drinking fountain.

Other popular products on the platform are quilts, dryers and electric blankets for kennels, plus other products designed to enhance a pet’s comfort. At the same time, training and monitoring products are now attracting a lot of pet consumer interest on Tmall. The demand for smart supplies has noticeably shifted from simple diet concerns to more extensive health monitoring.

The trend toward digitalization and intelligent upgrading is certainly the future of product development in China’s pet sector, and players such as tech giant Xiaomi, electrical appliance producer Midea and consumer electronics brand Haier have recently ventured into the industry.

Rapid growth of e-commerce

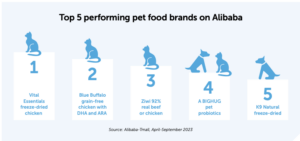

E-commerce platforms are the preferred purchasing channel for pet owners in China, followed by veterinary clinics and specialist pet stores. As of July 2022, pet food sales on Alibaba’s Taobao and Tmall platforms reached ¥24.76 billion ($3.42B/€3.17B).

Financial services multinational Deloitte predicts that e-commerce channel sales within China’s pet food industry will reach 72% by 2026, a 21% increase.

Self-operated stores

In addition to opening official flagship stores on e-commerce platforms, brands can also sell their products through self-operated stores – the so-called supplier model – and leverage other distribution channels.

One example is Tao Fen Xiao, an Alibaba distribution platform that helps brands or suppliers to build, manage and operate their online sales by introducing other merchants who can sell their products.

The role of social media

In China, e-commerce platforms and short video platforms are the main channels where consumers can obtain information about pet food. With the rise of platforms like TikTok and Instagram Reels during and after the pandemic, internet users have been bombarded with video content more than ever before.

Advertising on social media can be very effective in terms of reaching, informing and influencing the consumer. With the introduction in recent years of short video platforms such as Douyin – the TikTok application for China – and XiaoHongshu, which has been described as ‘China’s answer to Instagram’, as well as other lifestyle social media, pet food players have gained a new brand-building channel.

More marketing methods

The ways to advertise your brand are now endless – in China too – and include brand endorsement, variety sponsorship, joint games and other pan-entertainment options, to name just a few of the most important marketing opportunities now available.