Regional report: Eastern Europe – Snapshot of a pet care market in turbulent times

Inflation causes fluctuations in the Eastern European pet care market post-pandemic. But pet humanization and health claims are driving the market.

Like other global markets, the Eastern European pet care market experienced a surge during the COVID-19 pandemic. In 2020, the total pet population in the Eastern European region had increased by 2%. Niche categories such as small mammals and reptiles experienced a more substantial growth of 6%, thanks to their reputation for easy maintenance. This resulted in pet food market growth of 8% in volume terms, with Romania, Bulgaria and Ukraine showing the fastest development.

Decline in overall pet population

With a general decline in purchases of pet supplies in post-COVID times, pet populations in the Czech Republic, Hungary and Poland remained stagnant in 2022, while in Bulgaria, Romania and Slovakia there was actually a slight decrease, but not amounting to more than 0.5%. In Ukraine, the war led to a 16% drop in the pet population, contributing to a 1.9% decline in the overall pet population of Eastern Europe.

Historically, Russia had accounted for nearly half of the pet care market in Eastern Europe, experiencing growth driven by the increasing humanization of pets and the expansion of the middle class. But the war in Ukraine has changed the dynamics, disrupting supply chains and prompting numerous market players to exit or curtail their operations due to the sanctions imposed on Russia.

Inflation and the cost of living

The performance of pet care in Eastern Europe has been impacted by inflation, which continues to put pressure on pet owners’ disposable income. The impact has been more severe in Eastern European markets compared to other regions as they were more reliant on supply chains originating in Russia and Ukraine.

On average, if you exclude Russia and Ukraine, the unit price of pet care products in Eastern Europe saw a 14% increase in 2022. The most significant rise in pet care product prices – at 22% in local currency – was noted in Hungary, with Romania following closely at 19%.

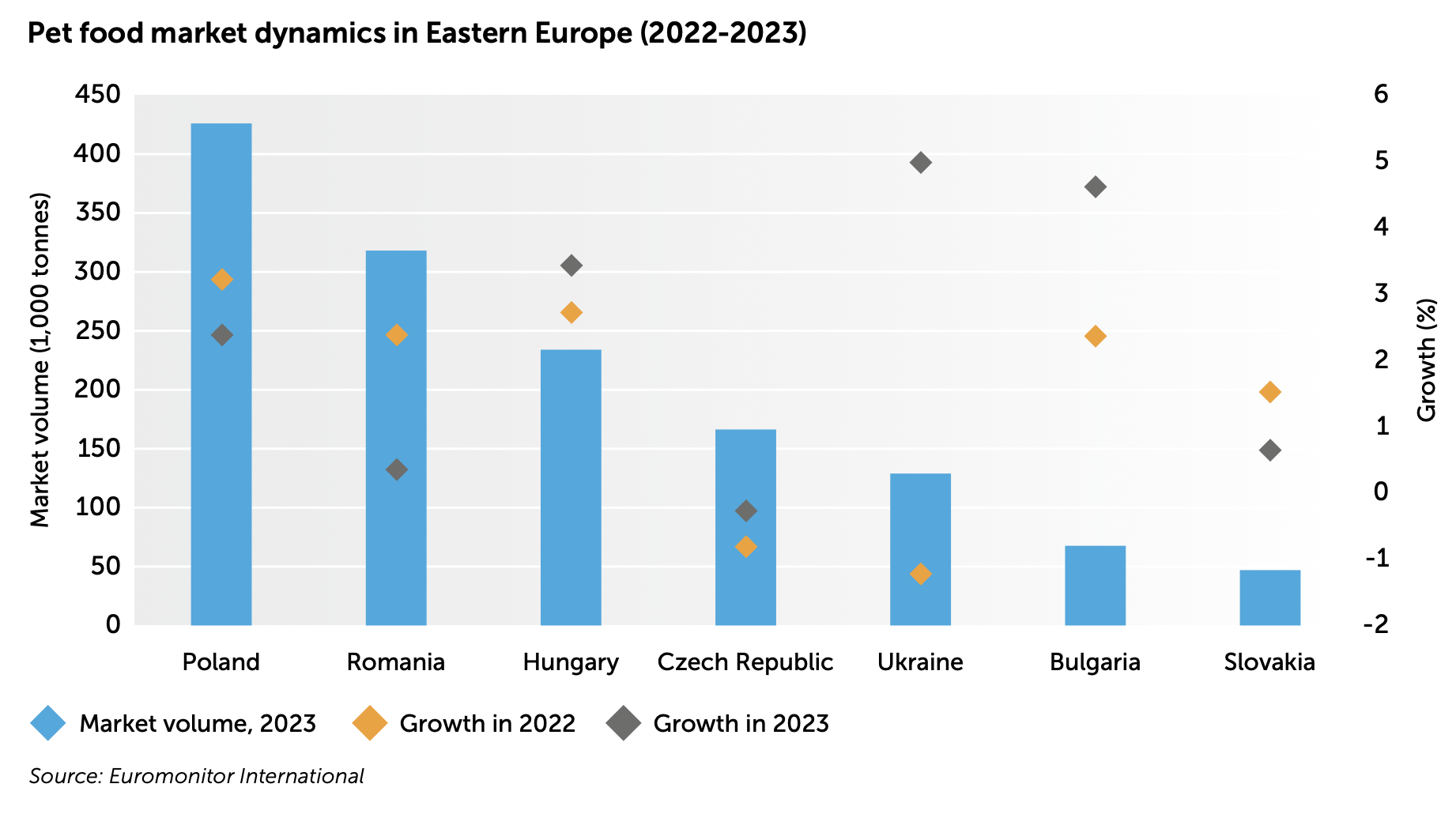

All pet food markets in Eastern Europe recorded lower growth rates in 2022 in comparison to previous years. The negative dynamics in the Czech Republic were also impacted by the inflationary pressure that caused increasing polarization between lower-priced options and higher-end varieties. And this greatly affected mid- priced alternatives.

In 2023, price increases have slowed down, with 10% growth in Eastern Europe (excluding Russia and Ukraine). It has led to partial market recovery in Hungary, the Czech Republic and Bulgaria, which recorded a higher growth rate in volume this year in comparison to 2022.

Meanwhile, in Poland, Romania and Slovakia pet care prices are still high, with price growth rates almost at the level of 2022. Inflation keeps putting pressure on these markets, which are witnessing a continuous slowdown. According to Euromonitor’s Voice of the Consumer: Lifestyle survey, in 2023, 39% of the respondents in Romania and 29% in Poland are going to put money into savings for next year.

Development of e-commerce

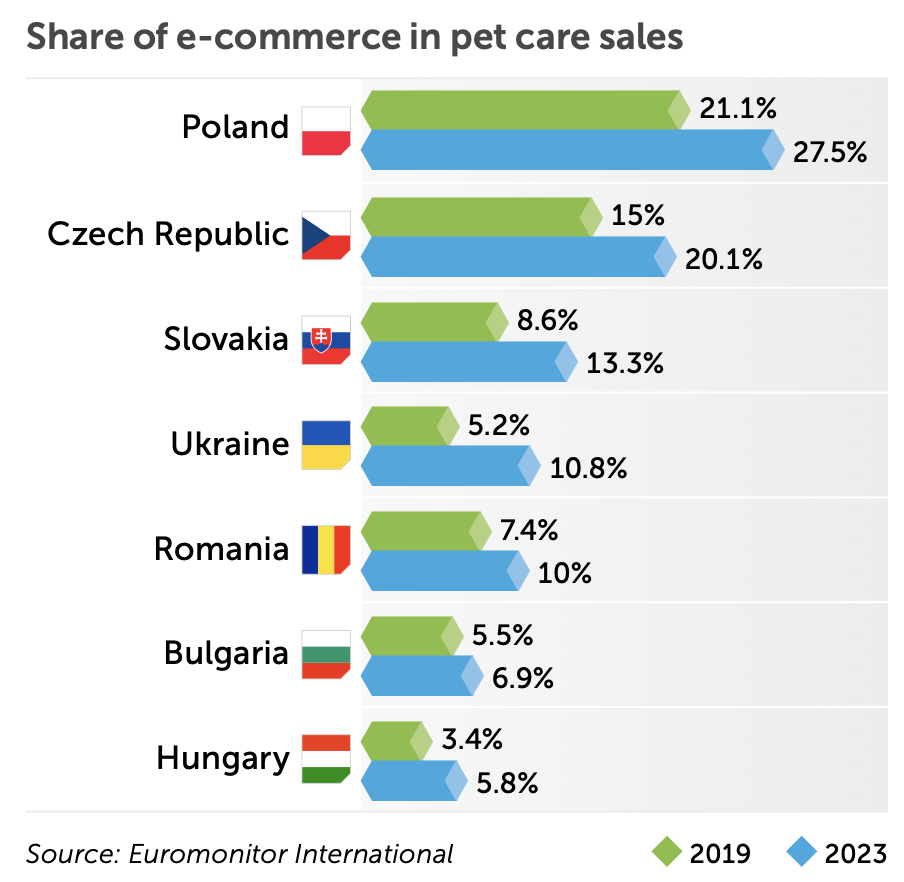

The rise of e-commerce is also shaping the pet care market in the region. Online platforms offer convenience and a wide range of products, allowing pet owners to access a variety of options for their pets. After the e-commerce boom in 2020, when online sales in pet care in Eastern Europe grew by 50%, the channel continues to grow – though at a much slower pace.

Across the Eastern European countries, Poland has the highest share of e-commerce in pet care sales, with more than 1 in 5 products for pets sold online. As the market is already quite mature, its share is expected to remain stable in the future, with no significant growth. On the other hand, Bulgaria and Hungary have a very low share of e-commerce sales in pet care. Online in these countries is, in general, not a common channel for groceries.

Despite the fast development of e-commerce, offline remains the main sales channel in Eastern Europe. After the pandemic, consumers have started to come back to physical stores. Omnichannel is increasingly gaining ground, combining the advantages of e-commerce and offline channels. Further omnichannel adoption by companies in the pet care sector is increasingly providing a seamless shopping experience for pet owners.

Humanization drives the premium segment

In 2023, in value terms, the pet care market in Eastern Europe is expected to grow by 15% to reach €11 billion ($11.6B) and cover 6% of global sales. In the coming years, the markets are expected to experience a gradual recovery, benefiting from easing inflationary pressure and the growing trend of pet humanization, which is driving demand for premium options in this region too.

During 2022, the premium sector recorded relative resistance during the difficult economic times, benefiting from high brand loyalty and higher price elasticity of demand from consumers in higher income groups. Declining disposable income led to a decrease in the mid-price sector, as consumers switched to cheaper options. In volume terms, economy pet food was the fastest growing segment in 2022 in Eastern Europe, but the premium segment has almost reached the same pace in 2023 and is expected to regain leadership in the rate of development in 2024.

Markets to watch

Over the next 5 years, Bulgaria is expected to show the fastest development in Eastern Europe, both in volume and value terms – thanks to increasing demand for premium pet food plus treats and mixers. The Romanian market is another area with growth potential in Eastern Europe, driven by the demand for premium cat food, as well as cat treats and mixers. Cats are increasingly popular in the country, as they are an easier and cheaper type of pet to keep in a small apartment.

Healthy and functional food

With consumers looking to improve their pet’s nutrition, health claims are becoming one of the main driving forces of the premium segment. According to Euromonitor Claims and Positioning data, every 5th pet product in Eastern Europe has a ‘high protein’ claim on its packaging. ‘Good source of vitamins’, ‘natural’ and ‘no artificial preservatives’ are also among the top claims of pet care products.

Healthy food and functional ingredients are gaining greater importance among pet owners and are expected to drive the future of the pet care market. As pet care products increasingly mirror trends in the human market, due to the growing humanization of pets, these factors are likely to play a significant role in shaping the industry in Eastern Europe.