Taiwan’s pet food industry nears $1 billion mark

A new study suggests that this growth is driven by rising pet ownership and increased spending on supplements.

The latest data from the Taiwan Institute of Economic Research (TIER) reveals that the country’s pet food industry is currently worth NT$30.8 billion ($965.2M/€869M).

Pet food supplements are believed to contribute NT$5.1 billion ($159.8M/€144M), a category growing faster than general pet food.

Data shows that pet parents allocate half of their pet-related spending to food. This figure was estimated to be around 41% earlier this year.

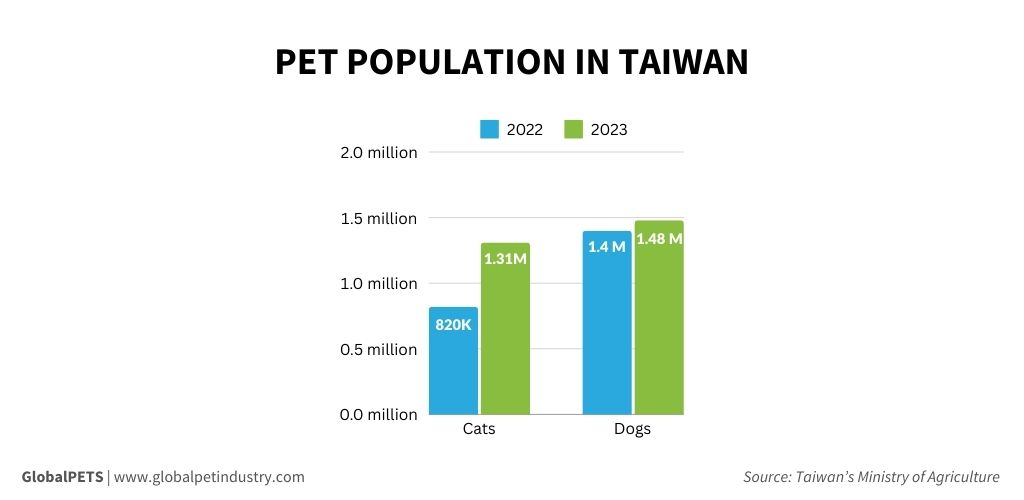

Pet population

In 2023, the pet population increased to 1.48 million dogs and 1.31 million cats. This is up from 1.4 million dogs and 820,000 cats in 2022.

Taiwan’s Ministry of Agriculture says that this figure has gone up by 19% and 50% respectively since 2021.

According to TIER, the number of pets in the country could now exceed the number of children under 15.

Following the trend, pet population in China is expected to surpass children aged 0-4 by 2024 and could nearly double by 2030, as per market analysis firm Goldman Sachs.

The country is expected to see a 4.2% year-on-year decrease in new births from 2022 to 2030, largely due to a decline in the number of women aged 20-35 and a decreased willingness among younger generations to have kids.

Market by pet food category

Market research firm Euromonitor projected dog food retail sales in Taiwan to reach $544.6 million (€491M) in 2023, with dry food accounting for $397.7 million (€358.6M), wet food for $118.1 million (€106.4M) and treats and mixers for $28.7 million (€25.8M).

Meanwhile, retail sales of cat food were expected to total $403.8 million (€363.3M), with dry food valued at $262.8 million (€236.9M), wet food at $107.2 million (€96.6M) and treats and mixers at $33.8 million (€30.4M).

Pet food imports

Euromonitor also reports that Taiwan imported C$352.6 million ($259.5M/€234M) worth of dog and cat food in 2022.

That year, Thailand was the largest supplier, contributing C$131.2 million ($96.5M/€87M) in pet food imports.

In 2022, Taiwan also sourced C$64.9 million ($47.7M/€43M) in pet food from the U.S., C$31.4 million ($23.1M/€20.8M) from Canada, C$28 million ($20.5M/€18.5M) from South Korea and C$23.8 million from Japan ($17.6M/€15.7M).