The future of the global pet sector

How is the market shaping up to perform over the next 5 years? A recent report helps to identify the key trends to look out for.

According to Bloomberg Intelligence’s (BI) Global Pet Economy 2024 report, strengthening smaller markets and a growing healthcare segment may increase the global pet economy by 5-6% to over $380 billion (€352B) in 2025.

A bigger pet population and continued humanization could push this up to over $500 billion (€463B) by 2030.

US and Europe snapshot

The US remains the biggest region in the global pet economy, with 40% of industry sales. It is projected to reach over $150 billion (€139B) in 2025 and closer to $200 billion (€185B) by 2030. The growth may not be equally distributed, as economic challenges have made some pet owners cautious about spending.

Europe will continue to be the second largest region through 2030, making up a third of the market and reaching $131.3 billion (€121.6B) by 2025 and $164.7 billion (€152.5B) by 2030. These numbers will likely be driven by global trends, although the population mix (cats vs dogs) may differ.

In 2025, BI estimates that 54% of the European pet population will be cats, compared to 49% in the US. Having a pet in Europe is cheaper than in the US, with the annual cost of owning a dog calculated at €739 ($798) and owning a cat at €500 ($540).

Across the Atlantic, this is estimated to be over $1,700 (€1,574) and $1,000 (€926) respectively.

China and other regions

The pet market in China is on course to increase by 6.6% to $37.4 billion (€34.6B) in 2025. The country will remain at about 10% of the total global market through to 2030, growing an average of 6% annually to reach $49 billion (€45B). This is almost double the country’s GDP forecast.

Like other emerging markets, it is rising pet ownership in China, along with shifting demographics – as well as the many different offerings of pet food, products and services – that will be key catalysts for the industry.

Cats will likely be favored over dogs, as authorities continue to tighten the regulations on dog ownership and breeding.

The pet industry in Latin America, Asia and Africa could reach $98 billion (€91B) in 2025, representing a 7% annual increase, and grow at a compounded average rate of high-single digits to $137.8 billion (€127.6B) by the next decade.

Global pet food segment

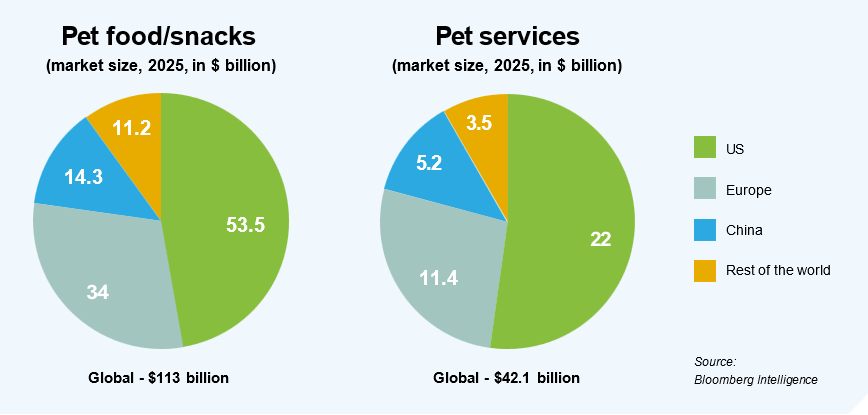

Food is set to remain the biggest pet expense. Despite economic sluggishness, the segment is projected to reach over $110 billion (€102B) globally in 2025 and $146 billion (€135B) by 2030.

This is due to a larger pet population – particularly since the pandemic – and continuing humanization, plus the limited elasticity that has allowed food producers to pass along increases in labor and commodity costs in the past couple of years.

Big food companies such as Nestlé, Mars, Post Holdings and General Mills will remain leaders in the pet space, with limited opportunity for transformative M&A in 2025, although smaller purchases to complement portfolios might not be completely off the table.

Health-focused food

Premium products will outpace the overall pet food market in 2025, as ingredients that have dominated human food in the past 10 years make their way into the industry.

Heightened awareness of the health benefits of using better quality food to extend a pet’s life and delay expensive healthcare treatments down the road, is another success factor.

Sales in the premium food sub-segment in the US may rise to as much as $3.5 billion (€3.2B) by 2030 – a 20-25% annual growth projection. This is despite some capacity constraints, as manufacturing expansion has slowed to improve profitability.

Conversely, snacks are unlikely to follow the same pattern as food overall, given that they’re perceived to have limited nutritional value so cannot really be used to replace meals.

As such, BI expects that snack sales in the US will remain at a quarter of all pet food revenue, up 36% to $15.5 billion (€14.4B) by 2030, while food for main meals will increase by 52%.

Rewards of healthcare innovation

Healthcare may be the largest contributor to growth in the market. Pet pharmaceuticals will potentially top $24 billion (€22B) globally by 2030, as improvements in nutrition lead to longevity, and aging pets – like older humans – require greater care.

At the same time, complex and expensive therapies seeking to extend life are becoming more common.

Longer lifespans, as well as an increased willingness by owners to spend on the pets they consider to be part of their family, may fuel pet pharmaceutical innovation in more complex and expensive therapeutic areas such as cancer, osteoarthritis, cardiology and renal disease.

BI believes these specific markets could produce over $5 billion (€4.6B) in revenue by 2030. With cancer as the leading cause of death in both dogs and cats, at 47% and 32% respectively, pet oncology in particular could generate close to $800 million (€741M) by the end of the decade.

Large parasite protection category

E-commerce rising to nearly 30% of total pet consumer sales, and the ease of free auto-ship subscriptions, has driven increases in parasiticide compliance.

Parasite protection is currently the largest pet health category by revenue.

The global market for parasiticide products may well expand by more than $700 million (€648M) to over $7 billion (€6.5B) in 2025, potentially boosting sales for Zoetis’, Elanco’s and Boehringer Ingelheim’s oral anti-flea/tick/worm combinations.

Huge potential for diagnostics

Another BI projection is that longer pet life expectancies will boost the use of diagnostics. Analysis suggests that this could expand to an addressable global market of more than $35 billion (€32B) by 2030, rising from $25 billion (€23B) this year.

Increases in diagnostics are likely to flow back to increased pharmaceutical use based on earlier diagnosis of pet diseases.

E-commerce in the US

Greater investment by pure-play retailers such as Chewy and Amazon, aimed at eliminating friction in the sales process and expanding pet consumer spending beyond merchandise, may enable US e-commerce sales to reach $37.8 billion (€35B) in 2025. This is a 36% gain compared to 4 years ago and could comprise a quarter of overall pet industry sales.

Price competitiveness remains pivotal for the pure-play format to further develop, although Chewy is targeting a greater share of consumer wallets by expanding into compound medication, insurance and veterinary services.

After 2025, the industry could gain in the high-single digits annually to reach $58.4 billion (€54.1B) by 2030, on its way to becoming a third of all pet consumer spending.

Online purchase drivers

Promoting benefits such as better price and free shipping could allow for greater e-commerce penetration.

In a BI survey among US pet owners conducted by consumer research platform Attest earlier this year, over 60% of respondents noted that free shipping and discounts were the main reason to do more of their purchasing online.

Convenience remains a key factor driving consumer preference for pet retail platforms.

Specialty stores such as Petco and PetSmart leverage their ability to provide an array of services – grooming, healthcare and training – under one roof, allowing them to expand their share.

In the BI survey, 27.2% of respondents said they use specialty retailers for their pet supplies. This is up from 23.3% last year and tops the 26.9% for mass merchants, which is down from 27.5% in 2023.