Christmas shopping trends: UK reports growth in pet gifts, with decline expected in the US

British supermarket chain Waitrose is seeing a holiday bump, but US and German data suggest sluggish sales. GlobalPETS learns more.

While the Christmas shopping season is still in full swing, early indications show mixed results.

In the UK, retailers Waitrose and John Lewis have released data on consumer trends showing spikes in pet purchasing.

Waitrose, a high-end supermarket chain, reported 964% growth in its Christmas pet lines year-on-year (YoY). Shoppers have been gifting their pets higher-quality food this season, according to Nicki Hobbs, Pet Food and Petcare Buyer at Waitrose.

“We have definitely seen our customers looking to trade up into more premium seasonal products for their pets this year,” she tells GlobalPETS. In particular, a trend of buying premium Christmas dinners for pets has been boosting sales.

Hobbs cited Forthglade lamb and chicken platters as an example – sales of the natural-branded product are up 343% YoY.

According to data from Go.Compare Pet Insurance and MyVoucherCodes, the average UK pet owner will spend £68.20 ($86.60/€82.50) on their furry companions for Christmas.

US

In the US, the pet industry may stagnate in this season’s holiday shopping despite apparent growth in overall consumer confidence. With the pandemic largely in the rear-view mirror and shoppers getting used to higher prices, it’s likely to be a good year for retail. However, the pet industry is not reaping the benefits as strongly as other sectors.

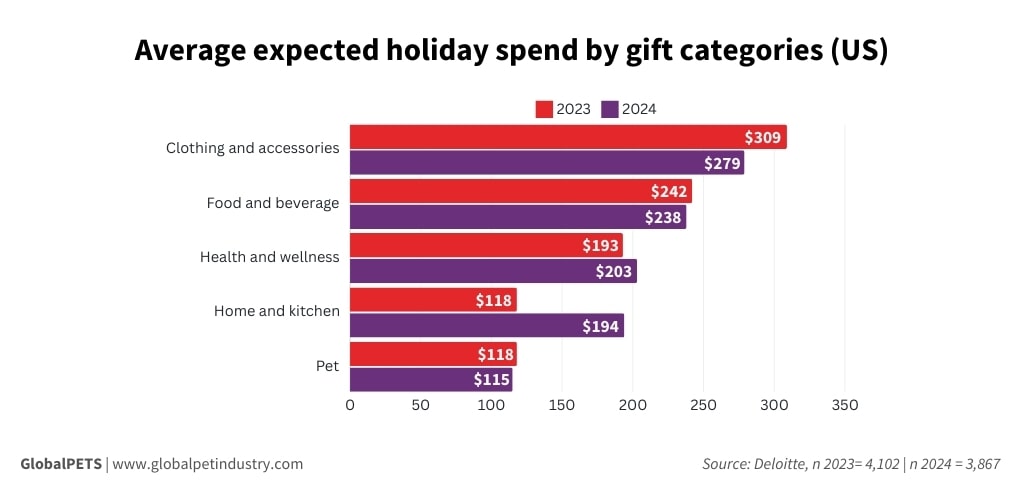

A survey published by Deloitte in October found that 39% of households planned to spend their holiday dollars on their pets. That’s down 4 percentage points from the same period in 2023.

They expect to spend an average of $115 (€110), also down slightly. In the same survey last year, shoppers anticipated spending an average of $118 (€113) on their pets.

It’s a bad sign for the pet industry’s penetration of holiday shopping as consumers get ready to increase their spending after years of belt-tightening. The same report found that optimism is expected to drive sales up by 8% across industries, following a historic 14% increase in spending during last year’s holiday season.

Germany

In Germany, the opposite trend can be seen. Data from the German E-commerce and Distance Selling Trade Association (bevh) found small increases in online pet sales despite a disappointing season for online retailers.

According to their research, pet supplies saw a 1.6% growth YoY in online sales in Germany. However, these figures were not adjusted for inflation, which has hovered around 2% in the country over the past year.

A fuller analysis of the industry’s successes and failures cannot be completed until after the holiday shopping season ends.