Survey finds smart water fountains the favorite tech device among pet parents

A PETS International and Yummypets research concluded that nearly 5 out of 10 respondents find this product useful for their animals.

The pet tech sector is seeing an increasing demand for smart devices. According to Global Market Insights, the segment’s size was valued at $5 billion (€4.65B) in 2021, and it is expected to grow at 20% per year until 2028.

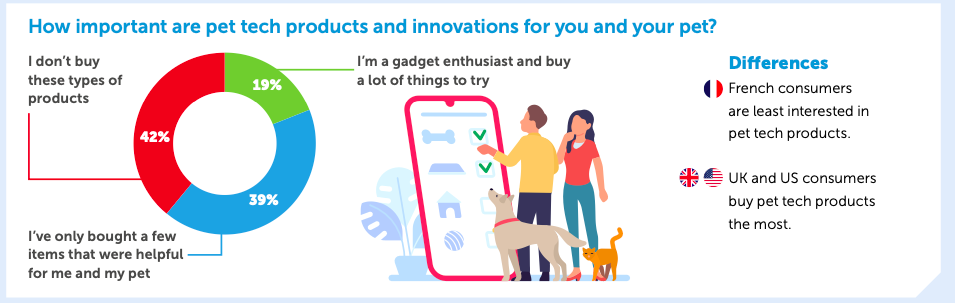

A survey conducted by PETS International and Yummypets to 762 pet parents in Canada, France, the UK, and the US concluded that 42% don’t purchase smart devices for their pets as they do not consider them vital for the animal.

Nearly 4 out of 10 said they bought tech devices for their animals, and 19% said they purchased various products to try them out.

French pet parents are less likely to invest in smart devices for their pets, with 60% admitting they had never purchased one. They are followed by Canadians (40%), British (33%), and Americans (32%).

On the other hand, Americans (24%), British (21%), and Canadians (18%) buy tech gadgets for their pets more frequently.

A question of preferences

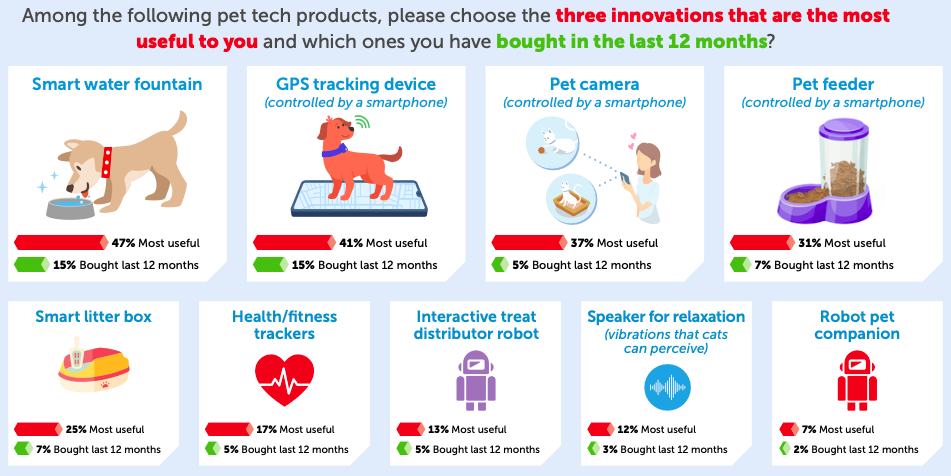

Nearly 2 out of 10 pet parents admitted they had not purchased a smart device for their pet in the past 12 months. The rest bought pet tech items for their animals, with smart water fountains (15%) and pet cameras (15%) being the most purchased items.

Water fountains are the preferred smart device choice for Americans (56%) and Canadians (49%), while the pet camera is the most useful to the British (42%).

The survey concludes that 60% of pet parents who bought water dispensers for their animals were very satisfied with the product, and 32% were somewhat pleased. Americans were the most satisfied with their purchases (73%), followed by the French (59%), Canadians (58%), and British (43%).

Useful products

Smart water fountains are the favorite pet tech device among pet parents, with 47% of respondents admitting it is a useful product.

Some brands, such as Xiaomi, DogCare, and Uahpet, have introduced such products in the market featuring wireless designs, longer battery life, large tanks, deep filtration and purification, and remote access controls.

Smartphone-controlled GPS tracking devices (41%) were chosen as the second most purchased products, followed by pet cameras (37%) with smartphone-enabled remote access controls. Other choices included smart litter boxes (31%), app-controlled smart feeders (25%), health and fitness trackers (17%), and microchip pet doors (15%).

Robot pet companions (7%), relaxation speakers (12%), and interactive treat distributor robots (13%) were the least liked products for pets.

Data companies predict that the wearable pet segment will be worth between $2.4 billion (€2.2B) and $3.5B (€3.2B) in the coming years, with an annual increase ranging between 13.5% and 25% by 2025.