The pet industry in Belgium

An overview of the Belgium pet market in 2024, including the most recent statistics and trends.

With a higher percentage of households in Belgium owning a pet compared to the European average (58% vs. 46%), Belgium is clearly a pet-loving country.

But how is the industry really doing here? Let’s find out.

Pet demographics

In 2024, 58% of Belgian households own at least one pet, which is a slight decline from 2023’s nearly 60%.

Cats lead in popularity, with 32% of households owning cat, while 31% own a dog.

According to a recent report from the central database DogID, there are almost 1.3 million dogs and 517.000 cats registered in the Flemish part of Belgium in January 2024.

Besides the dominated pets like cats and dogs, there has been a decrease in the ownership of smaller pets, especially fish, possibly due to shifting preferences towards larger, more interactive companions like dogs and cats.

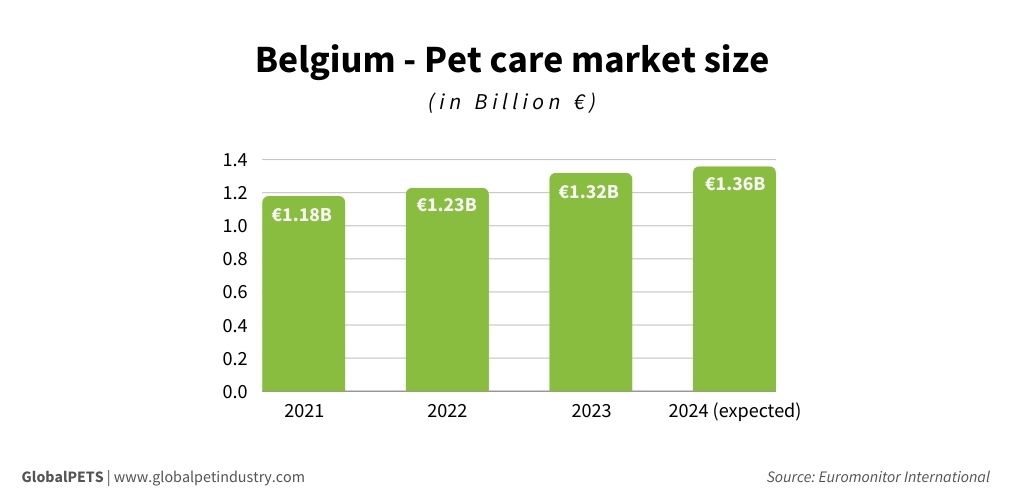

Industry size

In 2022, Belgian trade association Comeos estimated the size of the Belgian pet industry at nearly €3.5 billion.

Consumer attitudes

In fact, Belgian pet parents are becoming more discerning, with health-conscious choices, eco-friendly products, and even alternative diets like raw and BARF diets gaining traction.

Here are some interesting stats:

- In Belgium, 68% of dog owners prefer dry kibble

- 56% of pet owners feed their dogs twice daily

- Quality and nutritional value are primary factors influencing their choices.

Belgian pet owners are at the forefront of sustainability trends, with natural ingredients becoming essential criteria in purchasing decisions. This reflects a broader global shift toward more ethical and environmentally-conscious consumer choices.

In parallel, the AI-driven pet tech market is seeing innovation, particularly in pet health monitoring.

Retail landscape and sales channels

The Belgian retail market is competitive, with several key players dominating. Tom&Co remains a leader in the brick-and-mortar space, but online retailers like Zooplus are quickly catching up, offering a wide range of pet products with convenient home delivery.

E-commerce is increasingly shaping Belgium’s pet market, with a growing number of consumers choosing the convenience of online shopping for pet supplies.

Retailers like Tom&Co are expanding their digital offerings while also planning to grow their physical store presence.

Additionally, supermarket chains such as Delhaize are enhancing their pet product lines to cater to rising demand, reflecting a comprehensive approach to meet consumer needs across both online and offline channels.

M&A

The Belgian pet market has also seen significant M&A activity in 2024. One of the most notable recent deals was General Mills’ acquisition of Edgard & Cooper, a Belgian pet food company known for its commitment to sustainable practices.

This acquisition highlights the growing importance of natural and premium pet foods in the European market, with large corporations aiming to capture this burgeoning segment.

Inflation and future outlook

Belgium, like many other countries, has faced rising inflation, which significantly impacts pet owners. This has led to discussions about implementing lower VAT rates to ease the burden on consumers. The Belgian government is evaluating options to address these price hikes without stifling growth in the pet sector.