Selected highlights from Packaged Facts’ U.S. Pet Market Outlook, 2018-2019

Internet/E-commerce Upending Longstanding Retail Dynamics

The acceleration of e-commerce is transforming many norms in the U.S. pet industry, including the longstanding retail paradigm. And it’s not simply that pet product shoppers are migrating online at a rapid pace, spiking Internet sales and putting brick-and-mortar- based retailers on the defensive. With its virtual marketplace, e-commerce is also pounding away at the already toppling wall between pet specialty and mass channels.

Mass Premiumization Accelerating

Signs of the crumbling divide between pet specialty and mass retailers are the entry ofmajor specialty brands (Nature’s Recipe, Blue Buffalo, Nutro) into the mass market and the acquisition of Blue Buffalo by General Mills, which Packaged Facts predicts will rapidly escalate mass premiumization. The success (and price points) of mass-market based premium brands such as Rachel Ray Nutrish similarly challenge any hard distinction between mass vs. specialty.

Private Label and Exclusive Brands Taking on New Importance

Private label has long been a huge part of the pet market. Private-label sales of pet food and supplies combined for nearly $3 billion in sales in 2017, with pet food comprising about three-fifths of the total. Private label is also strong in pet specialty big boxes and independents, as well as non-traditional channels looking to capitalize on the higher margins and product exclusivity.

E-commerce Going Gangbusters

For several years Packaged Facts has touted the Internet as the pet market channel to watch, and the e-commerce stars now appear to be fully aligning. The market is at a stage where no serious marketer can afford not to be well-represented online, whether through a proprietary direct-selling website, a third-party seller, or a combination of the two. “Click- and-collect” at the store is another key piece of the puzzle

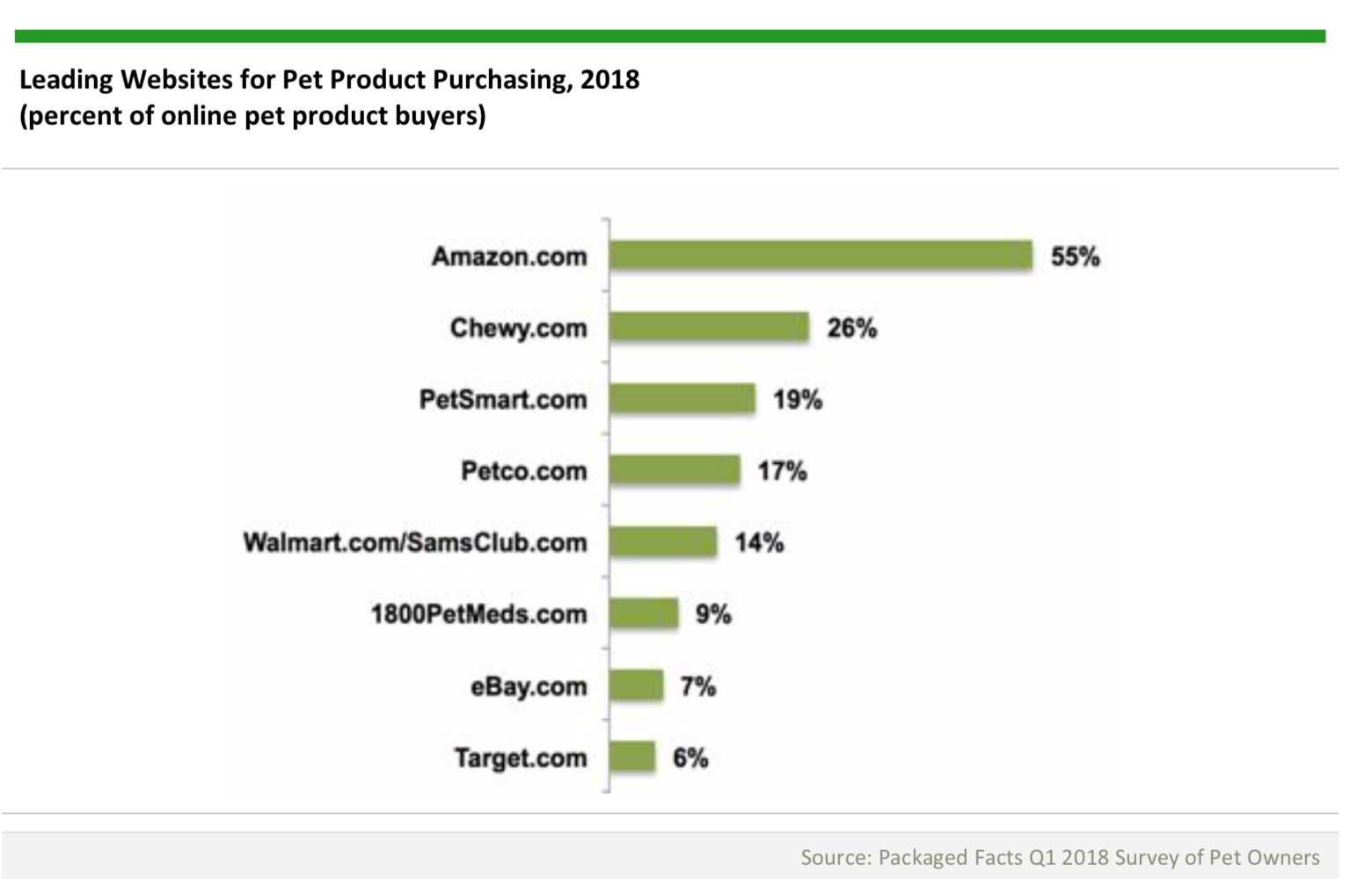

Amazon Is Frontrunning Pet E-tailer

Due to its size, scope, resources, online expertise, brick-and-mortar expansion, and drive to dominate across consumer packaged goods categories, Amazon poses a singular threat to pet market players of all stripes. Amazon remains the frontrunner in online sales of pet products, although with its acquisition of Chewy.com PetSmart made a huge jump. Packaged Facts’ pet owner survey in Q1 2018 shows that Amazon attracts 55% of those who purchase pet products online, followed by Chewy at 26%, PetSmart at 19%, Petco at17%, and Walmart/Sam’s at 14%. When considering the percentage of pet owners whohave ordered online in the last three months, the gap between Amazon and its online challengers widens further, driven in part by Amazon’s strength in pet supplies categoriesother than pet food.

Pet Specialty Big Boxes and Walmart Playing Catch-Up

The online surge in pet product purchasing is both a driver and a function of the increased involvement of brick-and-mortar-based retailers. In the past few years, PetSmart, Petco, and Walmart have all been playing catch-up to online-based players, partly through acquisitions.

Reading the e-commerce writing on the wall, Petco and PetSmart are further diversifying from products into petcare services—one area in which (for the time being at least) Internet-based players including Amazon cannot compete.

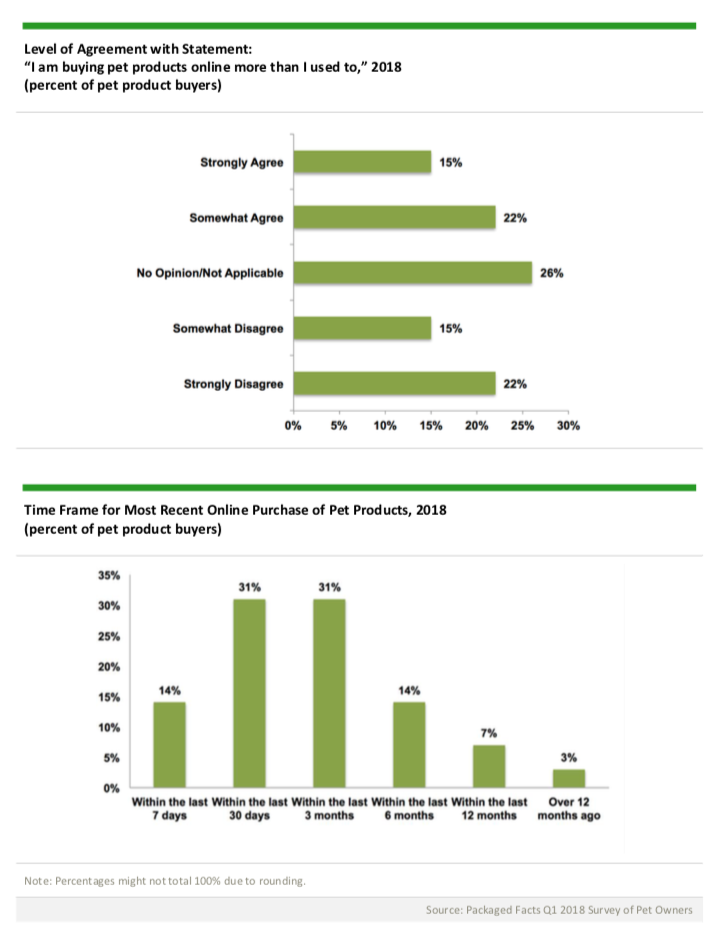

Frequency of Online Shopping for Pet Products

In addition to shopping online in greater numbers, pet owners are doing so frequently.Packaged Facts’ Q1 2018 online survey of U.S. pet owners shows that 14% of online pet product shoppers have made a purchase within the last seven days, and another 31% have done so in the last 30 days. In addition, 37% of online pet product shoppers agree that “I am buying pet products online more than I used to.”

The avidity with which pet shoppers are buying online is not surprising given the vast and growing assortment of products available in the virtual marketplace. As importantly, retailers have figured out how to sell bulky pet items online while avoiding (or avoiding explicitly) charging high shipping costs, and to encourage customer loyalty via subscription and auto-replenishment programs.

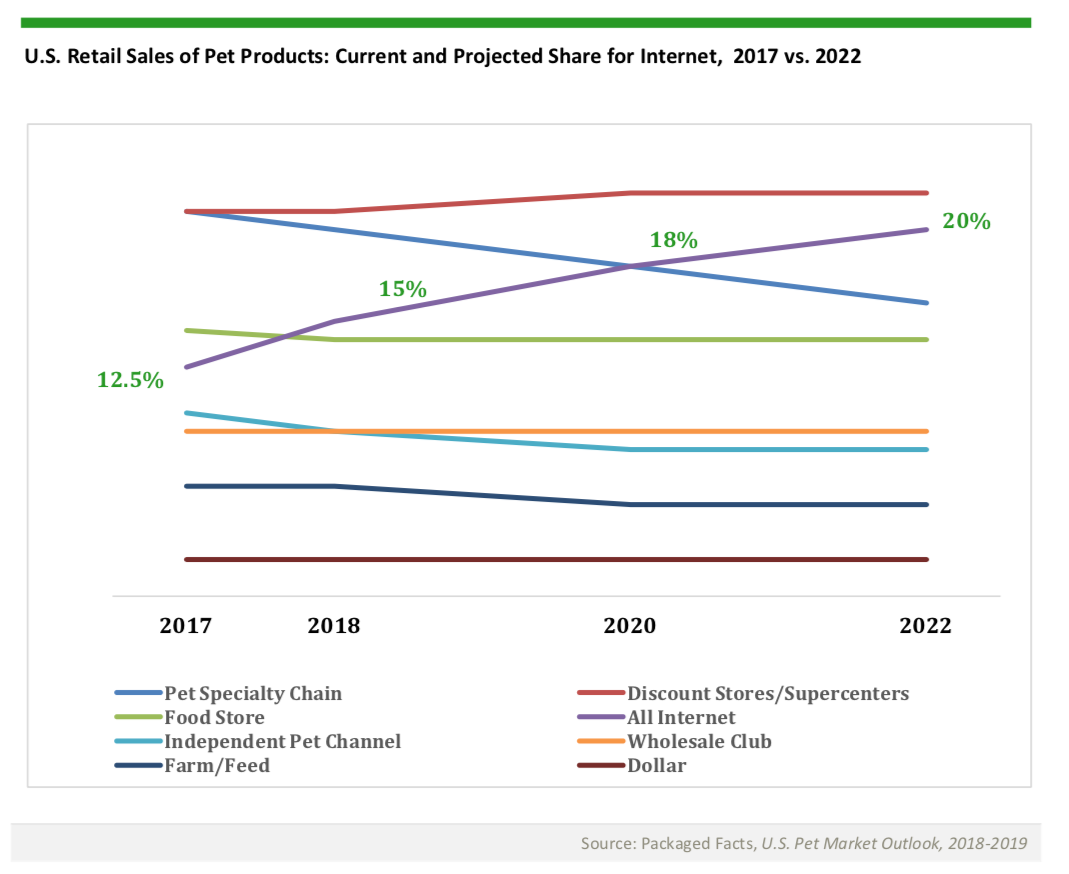

Projected Online Share of Sales

Although the Internet is not simply robbing Peter to pay Paul, in terms of pet product sales,it’s certainly recasting channel shares. E-commerce made enormous strides between 2014 and 2017, reaching a 12.5% market share in that year, and Packaged facts projects it to grow to 20% of the market by 2022, surpassing pet specialty chains (excluding their online sales) and food stores in the process, and nipping at the heels of discount stores/superstores.

Online dollar growth will benefit from:

growing role of e-commerce/home delivery in consumer shopping overall

heavy Internet shoppers in/aging into prime pet ownership years

strength of Amazon and Chewy

omni-channel strategies of brick-and-click retailers and specialty brand marketers

“endless shelf” brand & SKU selections in age of product customization

unlimited company/brand and product information in age of “clean label” and “transparency”

convenience and loyalty retention from home delivery & auto-ship

Online dollar growth will be moderated by price pressures due to easy price shopping for consumers and easy tracking of competitor prices/special offers by marketers, as well as by the mass premiumization trend.

For information on Packaged Facts pet market research, see:https://www.packagedfacts.com/pet-products-services-c124/

For information on Packaged Facts’ U.S. Pet Market Outlook, 2018-2019:https://www.packagedfacts.com/Pet-Outlook-11270807/

The latest articles

American investment firm launches pet fund

Vetted Capital aims to bridge a funding gap that has hindered growth within the pet care sector. GlobalPETS learns more.

Freshpet raises yearly guidance following strong performance

The New Jersey-based pet business has raised its forecast for the second consecutive quarter, projecting a 27% increase in net sales.

From South Africa to Europe: Maltento expands footprint

The South African insect company is leveraging its strategic location and aims to triple its revenue by 2026.

Weekly newsletter to stay up-to-date

Discover what’s happening in the pet industry. Get the must-read stories and insights in your inbox.