Canadian pet food industry responds to local legislation and global market shifts

From the impact of federal regulations on plastic to adapting to changes at international level, the pet food sector in Canada demonstrates resilience in the face of its many challenges.

Within Canada, pet food manufacturers face the prospect of upcoming plastic-reducing initiatives, as well as a push to classify all plastic as toxic. In addition, the industry has been lining up with labeling legislation in the US and responding to changing trade relations with China.

Targeting plastic

Recent moves aimed at reducing the use of plastics have been spearheaded by Environment and Climate Change Canada (ECCC), the Canadian government’s department for strategic action on environmental issues.

One of the proposed regulations involves mandating recycled content in plastic packaging. The food and pet food sectors were initially exempt from this rule, primarily due to the complexities involved in recycling their specific packaging types and integrating recycled content.

Another facet of the proposed regulation is focusing on recyclability labels. Echoing initiatives in the European Union, the Canadian government intends for companies to label their products to indicate whether they are recyclable or non-recyclable.

Toxic classification

This plan, initially scheduled to enter into draft phase in late fall, now faces some headwinds. A recent court case has challenged the government’s approach to classifying plastic packaging under the Canadian Environmental Protection Act (CEPA).

The government attempted to list plastics as a category on the CEPA’s toxic substance list, a move that was contested in court. Opponents argued that not all plastics are inherently toxic and that a blanket categorization is an overreach.

The Pet Food Association of Canada (PFAC) believes that classifying all plastics as toxic would make it even harder for the industry and more costly for consumers.

Shortly after, the Canadian government tried to include food and pet food packaging by targeting the grocery retail sector, which is dominated by 4 to 5 major players in Canada. It listed several targets and objectives that the retail sector has to meet to be able to reduce plastic use or increase reusable plastics in some way.

“Both of those things got a lot of feedback and backlash from the industry because they weren’t really based on reality. They are putting the cart before the horse, and they didn’t give a whole lot of time for consultation with the industry either,” admits Chris Nash, Executive Director at the PFAC.

US regulation

Any legislation in Canada’s neighboring country of the US has a huge impact on Canadian pet food manufacturers. One example is the Model Regulations for Pet Food and Specialty Pet Food, which set new labeling standards for all producers and distributors of pet food in the US.

The impact on Canadian companies is expected to be relevant as over half of the pet food sold in Canada originates from the US.

“PFAC is currently updating the Canadian pet food labeling and advertising guide, which was last updated in 2001, in line with the US changes in order to have a North American best practice for pet food labeling,” points out Nash.

Canadian firms shipping to China via the US

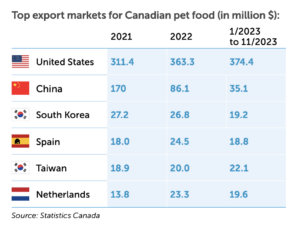

Exports are another subject that the local pet food industry is following very closely. The export of Canadian pet food to China halved in just 2 years due to the countries’ rocky relationship. At the end of 2021, exports to China were $170 million (€156M). By the end of 2022, this figure had plummeted to $86.1 million (€79.3M).

Now Ottawa and Beijing are speaking about business again. “For the first time in 2 years, we are seeing a little bit of progress in that our government and their government are talking again,” says Nash.

The United States Department of Agriculture (USDA) claims the reason for the decline in Canadian pet food exports to China in 2022 was the avian influenza epidemic.

However, the Canadian pet food industry sees no scientific justification for this. It claims that despite facing similar avian influenza conditions, the US did not experience such trade restrictions and continued to receive new facility approvals in China.

The reality is that most Canadian exports were taken over by its southern neighbor. Most Canadian pet companies exporting to China moved their production to the US to continue shipping. “A big portion of the increase in the US exports to China is from Canadian companies, which is unfortunate because that doesn’t really help our economy that much,” admits Nash.

“There’s still a demand for Canadian pet food in China. Our brands are selling, just shipped from different countries.”

Looking to new markets

Curiously, despite the significant loss in exports to China between 2021 and 2022, the PFAC calculates that the overall loss for local pet food companies was limited to about $38 million (€35M).

This was largely due to these companies successfully expanding into other global markets. While exports to Russia ceased completely in 2022 – they represented $18.5 million (€17M) in 2021 – an increase in trade with Europe and Taiwan helped offset these losses. The industry’s global export performance in 2022 remained comparable to 2021 levels.