A European approach to pet-food private labels

The private-label pet food category is performing better in Europe than in the US. What are the reasons behind this difference?

Private labels in the European pet food market have seen a notable year, crossing the $6 billion (€5.5B) mark and regaining ground in terms of market share.

A well-established category

With a significant share of the market (55% in volume and 34% in value), private label is a well-established category within the fast-moving consumer goods (FMCG) sector in Europe. The market share in North America is considerably lower in comparison (38% in volume and 17% in value).

There are a few reasons to explain this difference:

- European retailers have been more aggressive than their US counterparts in promoting their private label brands

- European consumers are more willing to try new products and have less brand loyalty than American consumers

- European retailers have succeeded in building a more premium image for their private label brands, which has helped them to differentiate themselves from manufacturers’ brands

- European retailers tend to work in a more centralized manner than US retailers. This gives them greater control over their supply chains, which makes it easier for them to develop and promote their own private label brands.

Evolution of pet-food private labels

The dominance of the private label category is slightly less pronounced in the European pet food segment, with a 47% volume share and a 31% value share. The comparatively lower prevalence of private labels in pet food has historically been attributed to consumer preferences. When it comes to caring for others, consumers tend to focus more strongly on quality and therefore choose manufacturers’ brands over private labels. This trend can be seen in segments such as baby care as well as pet care.

Over the last few years, more sophisticated and premium ranges of private-label pet food products have been developed. However, these have struggled to secure a foothold in the market dominated by manufacturers’ brands, with both the volume share and value share declining by around 1 percentage point.

Nevertheless, there are signs of a shift driven by the recent increase in inflation rates and the erosion of consumer spending power. The purchase of private label products has now become a primary strategy for people looking to manage their household expenses. This is having a positive impact on the share of the private label category, both in the broader FMCG sector and within the pet food segment.

Cost-of-living crisis

Another coping behavior to navigate the cost-of-living crisis is the increased willingness of consumers to shop at discounter stores. This is also benefiting the private label category, since the share of private labels is bigger in the discounter channel.

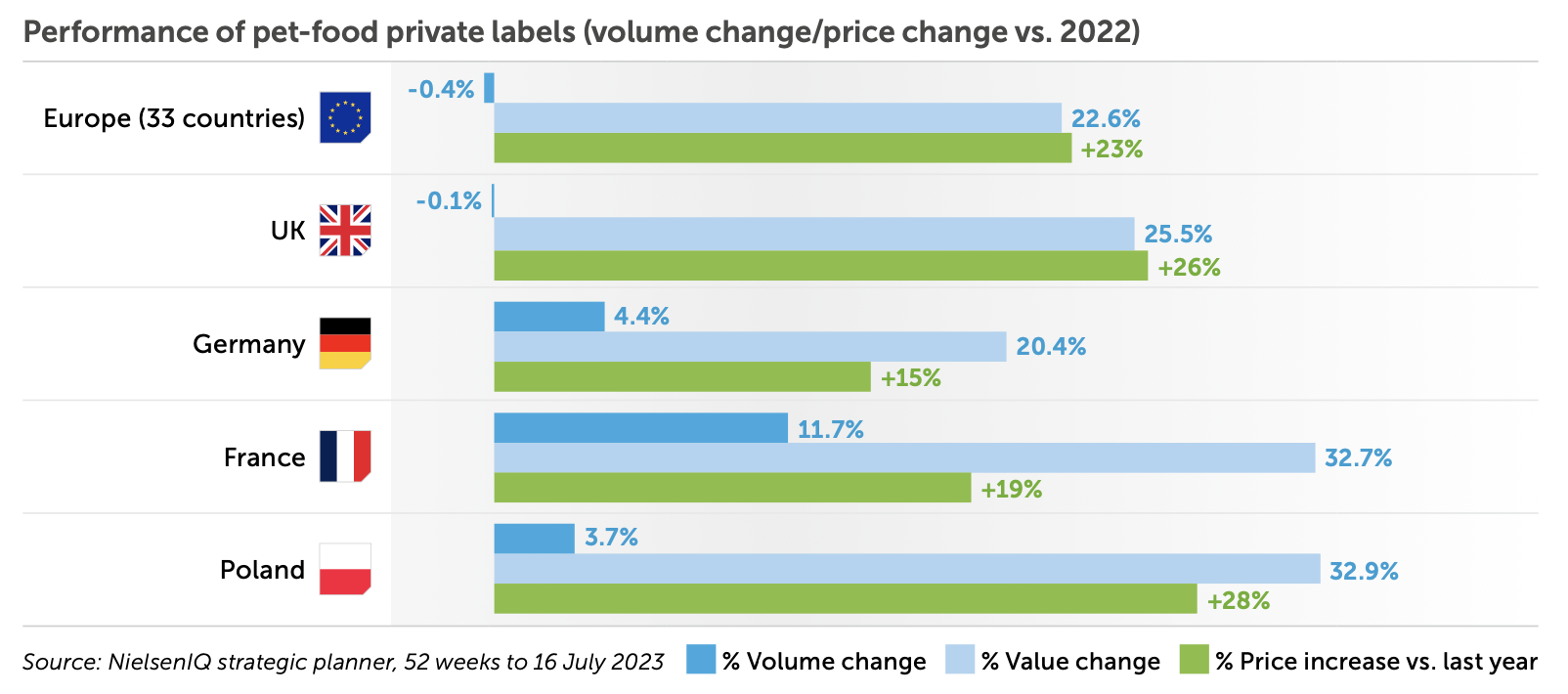

This increased interest in private label has not yet triggered substantial volume growth in the European region. Nevertheless, the category has shown resilience amid the ongoing volume decline affecting both the FMCG and pet food sectors. Private labels have not been entirely immune to this downward trend, but their overall decline has been less steep compared to manufacturers’ brands (year-on-year volume change of -0.4% versus -2.5%), resulting in an increased market share by volume (rising from 46.4% to 47.3%).

Countries to watch

Pet-food private labels have achieved volume growth in a number of European countries, specifically France (11.7%), Germany (4.4%) and Poland (3.7%). These growth figures are accompanied by notable increases in volume shares, with Poland witnessing a 5.1% increase, while Germany and France each saw a 4% increase. These gains surpass those achieved by private labels in the broader FMCG category.

Interestingly, the United Kingdom deviates from this trend, with the nation experiencing relatively stagnant volume growth. This can be attributed to a significant reduction in the product assortment, which happened to a lesser extent in the other 3 major countries.

Slightly less price-competitive

The prices of pet-food private label products have been raised a little more aggressively than branded products: by 23%, compared to 19% for manufacturers’ brands. This equates to a 1.3 percentage points increase in the value share, from 29.6% to 30.9%.

As a result, private labels in the European region have experienced a slight reduction in their price competitiveness. Based on the price index for the pet food category, private labels are 34.1% cheaper than the category baseline in 2023, whereas they were 35.9% cheaper last year.

Upon closer examination of this trend, the United Kingdom stands out once again, with relative prices rising by 3.9 percentage points this year.

Conversely, the index shows that the price competitiveness of pet-food private labels in the other 3 major countries has improved slightly. For instance, in Germany, where the relative price difference is the smallest at around 25%, private labels became 0.5 percentage points cheaper than the baseline this year. For comparative purposes, the relative price difference in North America has remained steady at 26%.

What will the future bring?

So the next big question is: Will private labels in the pet food sector continue to do well in the future? The answer seems to be yes, for 2 main reasons.

First, pressure on people’s wallets will persist for the foreseeable future. This will encourage them to stick with their money-saving strategies, which often involve choosing private labels. Secondly, as more shoppers trial the category, the acceptance is likely to increase further. 35% of consumers already say that some store-brand products are just as good as – or even better than – manufacturers’ brands.

Given the likely sustained interest and growth in private labels, it is key for branded manufacturers to pursue strategies that will enable them to either maintain or grow their market share. Obvious strategies include offering their own value-for-money products, implementing effective pack/price architecture or having a portfolio of brands that can play in different price tiers.

Besides these strategies, some manufacturers have successfully managed to offer points of differentiation or added perceived benefits versus private label products. Examples include initiatives related to sustainably sourced ingredients or recyclable packaging. These are areas that the majority of mainstream retailers are unlikely to pursue with their private label ranges in the short term.