Fresh intel on the UK pet market

UK pet owners remain largely brand-loyal, are increasingly buying fresh and raw pet food, and are becoming more open to subscription models.

Consumer research conducted by PwC Strategy& among 1,000 pet parents in the UK in 2023 reveals some interesting insights into the market. The key findings are highlighted below.

The rise (and rise?) of fresh and raw

Fresh and raw pet food continues to gain traction in the UK, with 16% of dog owners and 12% of cat owners in the survey having bought fresh food (i.e. food stored in the fridge/freezer) for their pets. Purchases of raw food are slightly lower (13% and 8%, respectively), although Google Trends data, which shows search volumes for specific keywords, suggests sustained interest in the category. This is also reflected in some retailers’ investment in the space.

What’s driving this growth? According to the survey’s respondents, the main drivers of purchase are, unsurprisingly, all about their pet. 21% of responses highlighted the pet’s preference for the taste and 17% said: “It’s better for my pet’s health”. Accounting for 16% of the responses, high-quality ingredients were also a key driver of purchases. Conversely, price is the primary barrier to buying into the category according to 22% of respondents, while the secondary obstacle relates to storage space at home (12%).

So, what’s next for the category? Raw/fresh penetration in the UK lags behind some other European markets, so there still seems to be significant potential in this area. The ultimate ceiling will be determined by capacity on both the supply side (most notably the mainstream grocery retailers) and the demand side (storage space in consumers’ fridges/freezers).

The age of subscriptions is dawning

Subscription models are gaining popularity in some segments of the pet market, as evidenced by the ongoing increase in online traffic to leading players’ websites since COVID. The research indicates that dog owners are more likely to use subscription services than cat owners (17% vs 13%). This is partly due to the bulkier nature of dry dog food, which broadly drives higher online penetration.

Subscription pet food shoppers tend to be relatively younger (28% of 18 to 34-year-olds have used a subscription pet food service against 7% of those aged 55 to 74) and more affluent (most earn an annual salary of over £50,000 [€58,000/$64,000]). The key drivers of subscription usage are convenience (11%), quality (11%) and taste (10%). Price is a key barrier according to 22% of non users.

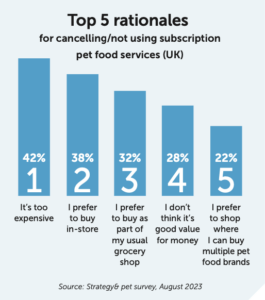

According to the data, 15% of dog owners and 12% of cat owners tried subscription services but then cancelled. The price, a preference to buy in store and the lack of value for money were the top rationales for not continuing with subscription services.

Brand loyalty and bulk buying

Analysis of the data reveals that UK pet owners are buying from an average of 6 pet food brands in any given year – and cat owners specifically buy from closer to 10 different brands.

Even during the cost-of-living crisis, pet food shoppers have generally remained loyal to brands, with the most common behavior change being ‘stocking up’ or buying bigger pack sizes to take advantage of price deals. Similarly, some consumers have switched to private label alternatives, resulting in around a 3 ppt value share gain against branded food in the grocery channel since 2021.

Cat owners are less likely than dog owners to change their buying habits. Owners attribute this to their cats’ more ‘picky’ (or should that be ‘refined’?!) palates.