Gut health gains ground as a priority for pet food buyers

The interest in ingredients that promote digestive balance is shaping both purchasing behavior and innovation across the world of pet nutrition.

Today’s focus on gut health in cat and dog food reflects a wider shift in consumer priorities. As people pay more attention to enhancing their own health and wellbeing, they look for products that offer similar benefits for their pets.

A factor in pet wellbeing

Digestive health is becoming especially important as it’s frequently linked to a pet’s immune system and overall health. Stronger emotional connections between pets and owners play a key role in this shift.

According to Innova’s Pet Owners Survey 2025 of 5,000 respondents in the UK, Germany, Brazil, the US and China, around 45% of pet owners consider their pets to be family members, so they always take their pet’s health into consideration.

Currently, gut health is one of the top worries for pet owners. Among cat owners, 16% consider it a health concern – second only to weight management. For dog owners, digestive health ranks third, following weight and joint issues, with 17% of respondents expressing concern.

Interest in gut health is particularly strong among younger generations, such as millennials and Gen Z, an indication that demand is likely to increase further in the coming years.

For example, while only 1 in 10 baby boomers is concerned about their cat’s gut health, among Gen Z owners that number rises to nearly 20%.

Making greater claims

It appears that digestive health is having a significant influence on brand loyalty. More than 70% of pet owners say they are likely to switch products or brands if their pet experiences digestive discomfort.

This puts pressure on manufacturers to address gut health proactively through formulation and positioning.

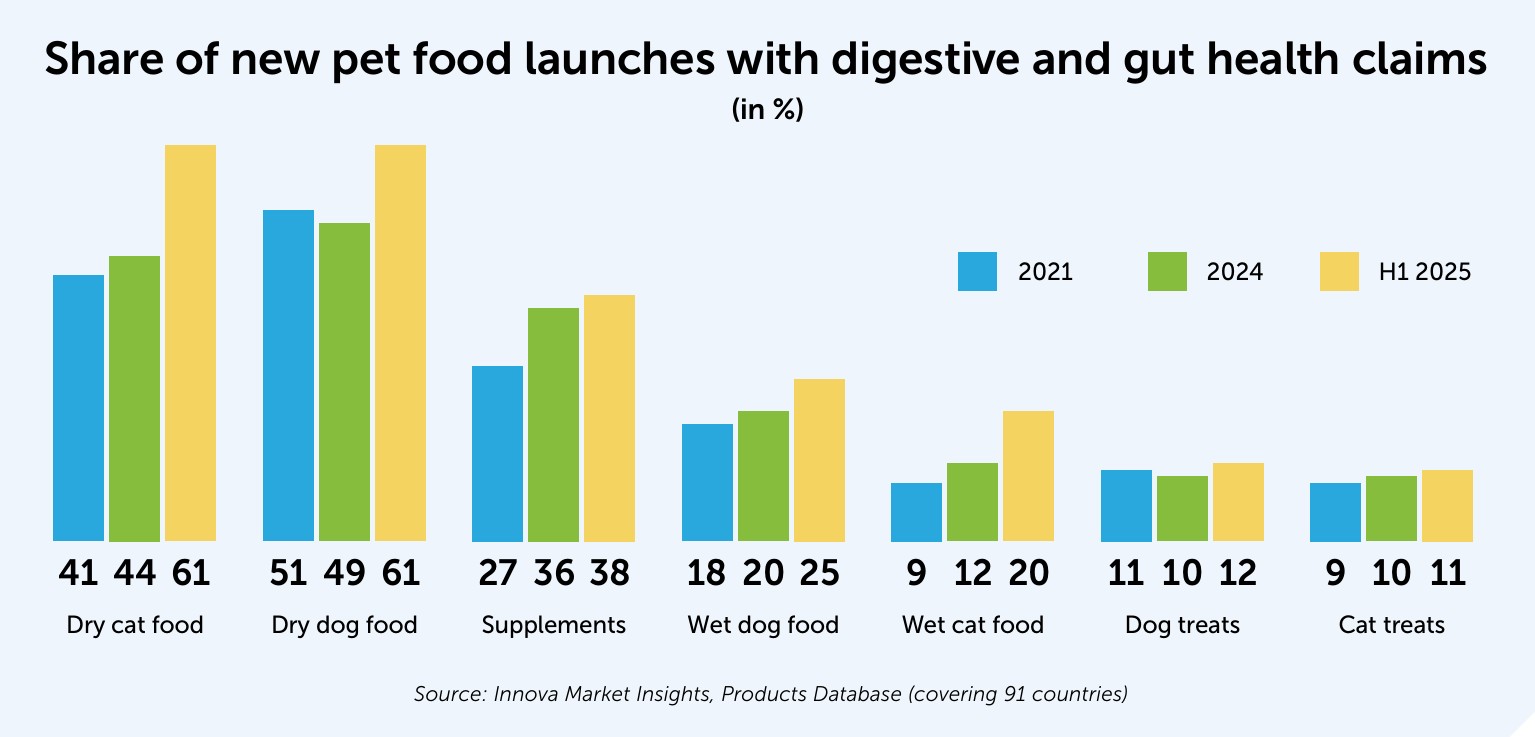

Reflecting this consumer concern, the number of pet food launches with digestive health claims has increased steadily over the last 5 years.

These claims are especially prominent in dry food formats, where over 60% of new innovations – in both dry cat and dry dog food – in 91 countries worldwide are positioned to support gut health. Claims like these have been gaining ground in wet food formats as well, especially in cat food.

Gut claims in both dry and wet subcategories have shown even stronger growth in 2025. Digestive health benefits are also common in pet supplement innovations, which peaked in 2024 and have continued to see modest growth this year.

Studying the ingredients

Ingredient transparency is becoming more important to consumers. According to Innova’s consumer survey, more than a half of pet owners always look at the ingredient lists of products that they buy, especially millennials.

This focus is particularly strong in markets like China, but in Brazil, Germany, the UK and the US, the ingredient list is also the packaging information that pet owners pay the most attention to.

Gut health claims are often supported by the inclusion of functional ingredients, particularly prebiotics and fiber.

These components are widely associated with digestive benefits and are increasingly highlighted on packs, reflecting consumer interest – around 60% of pet owners say they would like to add fiber to their pet’s diet.

Higher fiber content

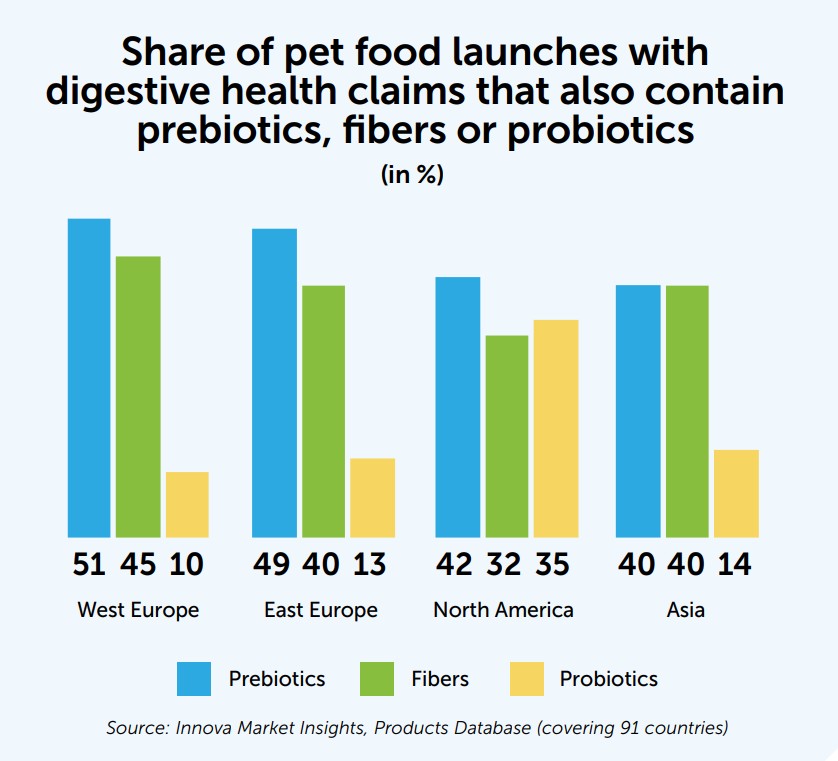

In 2025, 51% of new pet food launches with digestive health claims also featured prebiotics, and more than a third highlighted a high fiber content.

These figures have steadily grown. Back in 2021, less than a third of food products with digestive health claims also claimed prebiotic content. The share of products highlighting fiber has also visibly increased since 2021.

The UK and the US are leading globally in terms of pet food innovations with digestive claims combined with prebiotics and fibers.

Besides health benefits, this growth is attributed to the compatibility of these nutrients with multiple formats, such as dry and wet food, treats and supplements. Nevertheless, the most innovations with prebiotic and fiber claims are still tracked in dry dog and cat food.

Popular prebiotic sources

To provide a more complete picture, Innova complements its claims analysis with ingredient data from new product launches. Prebiotics commonly used in pet food innovations include oligofructose, inulin, mannan oligosaccharide and chicory root.

At the same time, chicory fiber and galacto-oligosaccharide are emerging almost from nowhere in Taiwan and Japan.

Regional profiles vary. In North America, inulin and chicory root are the leading prebiotics, while in Europe, oligofructose and mannan oligosaccharide are driving growth.

When it comes to fiber, fast-growing sources include beta-glucans and vegetable fiber, in addition to more established ones like oligofructose and inulin.

It is important to note that many products include functional ingredients without clearly claiming their digestive benefits on the label.

Only 45% of pet food products with prebiotics or fibers launched since 2021 made a digestive or gut health claim. This gap suggests an opportunity for brands to better communicate ingredient functionality and strengthen consumer trust.

Postbiotics vie with probiotics

Unlike prebiotics, probiotics are facing more challenges in pet food applications. Their sensitivity to heat, moisture and oxygen makes them harder to include in standard manufacturing processes, especially for shelf-stable products.

In the first half of 2025, only 13% of gut-health-focused product launches included probiotic claims – down from 20% in 2021. Probiotics are used more frequently in North America, while adoption in Europe and Asia remains much lower.

Probiotics are notably more prevalent in pet supplement innovations, appearing in 1 out of 5 new product launches over the past 5 years. This is largely driven by strong consumer interest, with 40% of the pet owners who give supplements to their pets choosing probiotics.

Emerging solutions such as postbiotics offer a promising path forward. These ingredients are more resistant to manufacturing conditions and can help deliver gut health benefits in formats such as dry food, which have traditionally been difficult environments for probiotics.

However, they remain niche ingredients – in 2025, less than 5% of new pet food launches with digestive health claims have featured postbiotics, which were first used in 2021 (when they represented 0.3%).

Brands vs private label

As much as 97% of pet food products with gut health benefits launched over the past 5 years have come from branded companies. These brands are increasingly featuring digestive health benefits in their innovations. The share of new launches with claims like these has increased from 23% to 30% since 2021.

By contrast, private labels have shown limited engagement with this trend, and their interest has remained relatively unchanged over the past few years.

Only 1 out of 10 new pet food launches by a private label in the first half of 2025 had a digestive health claim. During the past 5 years, digestive health did not break into the top 10 claims among new pet food launches by private labels.

This reflects the higher complexity and cost of developing products that promise digestive benefits. Branded companies often have better R&D, sourcing and marketing capacities – advantages that private labels may lack.

As a result, digestive health remains a more accessible innovation path for established players with premium positioning, while private labels continue to focus on core needs and value-driven products.

Spotting opportunities

Digestive health remains a key innovation area in pet food, driven by pet humanization and growing consumer awareness of the link between gut health and overall wellbeing.

As pet owners become more ingredient-conscious, they are seeking products with clear digestive benefits.

Brands might consider targeting younger generations – millennials and Gen Z – who are driving demand for benefit-led products with transparent labeling and added value.

While dry food leads in gut health claims, wet formats remain underused and present a strong opportunity for differentiation. Brands can also move beyond general claims by highlighting functional ingredients such as fibers and biotics.

Many of these ingredients are already used but not clearly linked to digestive benefits on packaging – where there is an opportunity to build trust and clarity.

To gain consumer trust and loyalty, brands could explore vet supported positioning that gives digestive claims more credibility, especially for those pets with special needs or health problems.

The supplements segment also offers additional space for featuring functional ingredients.

Digestive health is set to remain a central focus in pet food innovation and future growth is likely to be driven by more tailored benefits and functional ingredients that meet the specific needs of pets and their owners.