Interview with CEO of Pet Lovers Centre: “Our website and marketplaces will be our main means of growth”

The largest pet retailer in Southeast Asia wants to continue growing its footprint with new stores, but also to expand its customer reach by partnering with e-commerce giants and supermarkets.

The solid operations in its homeland Singapore as well as Malaysia, Thailand, Vietnam, Brunei and the Philippines are testimony to the ability of Pet Lovers Centre to align with customers’ needs. Whereas a few years ago, before COVID, e-commerce represented just 5% of its total sales, nowadays it accounts for nearly 18%.

Furthermore, orders representing more than 22% of sales are delivered directly to pet owners’ homes. At a time when consumers in the Asian region are changing the way they shop, David Ng Whye Tye shares how the retailer is adapting to the new trends. He also outlines the challenges of operating across several countries.

How has the retail market changed since your company started 5 decades ago?

My father started the company in 1973 and I came into the business in 2003. When we started, there were very few pet stores in Asia, and those that did exist were terrible. Pets were not something that people looked at. But this has changed over the years and we’ve grown from just 7 stores to 170 across Asia. There are now 200 pet stores in Singapore alone, of which close to 70 are owned by us. We are a major player in Malaysia as well, and we will probably soon be the largest pet retailer in Thailand.

Which markets still offer opportunities?

We have tremendous room for improvement in Malaysia, Thailand, Vietnam and the Philippines. The multi-billion-dollar pet industry in Thailand allows us to tap into the huge market, with growing stores to support it.

And what about challenges?

We find it extremely challenging to enter many malls, especially in Thailand. We tend to first start with the malls in cities like Bangkok, as opposed to stores in small towns – simply because our target audience is not there. We need slightly higher-income customers and they usually go shopping in malls.

Thailand also continues to be a very difficult market to grow in, especially for bringing international brands into the country. Unlike in Singapore or Malaysia, where we import goods from all over the world, we only manage to get a small percentage of the brands into Thailand. One of the main reasons for this is that Thailand is a huge producer of pet food, making it much easier to build brands within the country itself.

How are you managing all this from a logistics point of view?

When it comes to food, we need to get the products into the warehouses of the specific country. Non- consumable products are significantly easier because they do not require veterinary certificates and additional paperwork. However, we only ship non consumables from our central warehouse in Singapore if the country is small. When we hit a certain volume, everything is shipped to and from the country of origin.

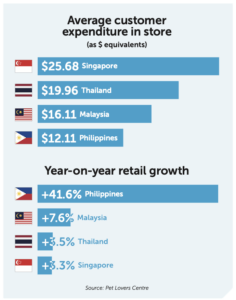

How do you match prices in the different markets where you operate?

The cost of importing dog food into Singapore and Malaysia is the same. Maybe it gets a little bit more expensive in Malaysia, simply because it is a larger country and the cost of distribution is higher. However, the buying power of Malaysians is significantly lower than that of Singaporeans. This means that the price of goods you sell cannot be matched to the selling price in Singapore. Generally speaking, in Malaysia you can buy goods and services at 30% below the selling price in Singapore.

What’s your store target?

Our overall 5-year plan is to hit well over 400 stores. In Thailand, we will probably hit about 130 new store openings, followed by Malaysia (126), Indonesia (108) and the Philippines (71). We are certain that we will continue to grow our store network, but our website and marketplaces will be our main means of growth.

Why the strong focus on your website and marketplaces?

In Singapore, more than 80% of our clients are offline customers. But before the pandemic, online customers represented between 4% and 5%, whereas now the figure is as high as 18%. For companies to be successful, you have to join the bandwagon. We can no longer say no to online players. We should be on all marketplaces, on our website and also in as many bricks-and-mortar stores as possible to align with the spending behavior of the majority of Asians. And ideally, all these channels need to be holistically integrated.

Our shop is already integrated into online platforms including Amazon, Lazada, Shopee, GrabMart and Pandamart. We are one of the few companies that is poised to grow in whatever way the customer wants to shop.

You are also present in supermarkets…

We are currently working with the government- run cooperative supermarket NTUC FairPrice in Singapore. We have a small area within the supermarket where we sell some of our products. We started this concept in 2019 and we now have 6 stores.

Do you have plans to further expand this concept?

Expansions depend on the right opportunity and timing, and negotiations between the supermarkets and us. If you would ask me if we plan to expand in this way, my answer would be ‘why not?’. But it’s also a question of whether supermarkets are willing to give us this visibility. We have to sell ourselves well to make sure that we are ‘sexy’ to them.

Any plans to expand the business to new countries?

We will continue focusing on Southeast Asia for now because of the region’s potential and because our footprint here is still small.