An investor perspective on the pet industry

Pets remain a sector of interest for corporate and financial sponsors. But what asset-specific attributes are investors looking for? Sam Farnfield of PwC shares his views.

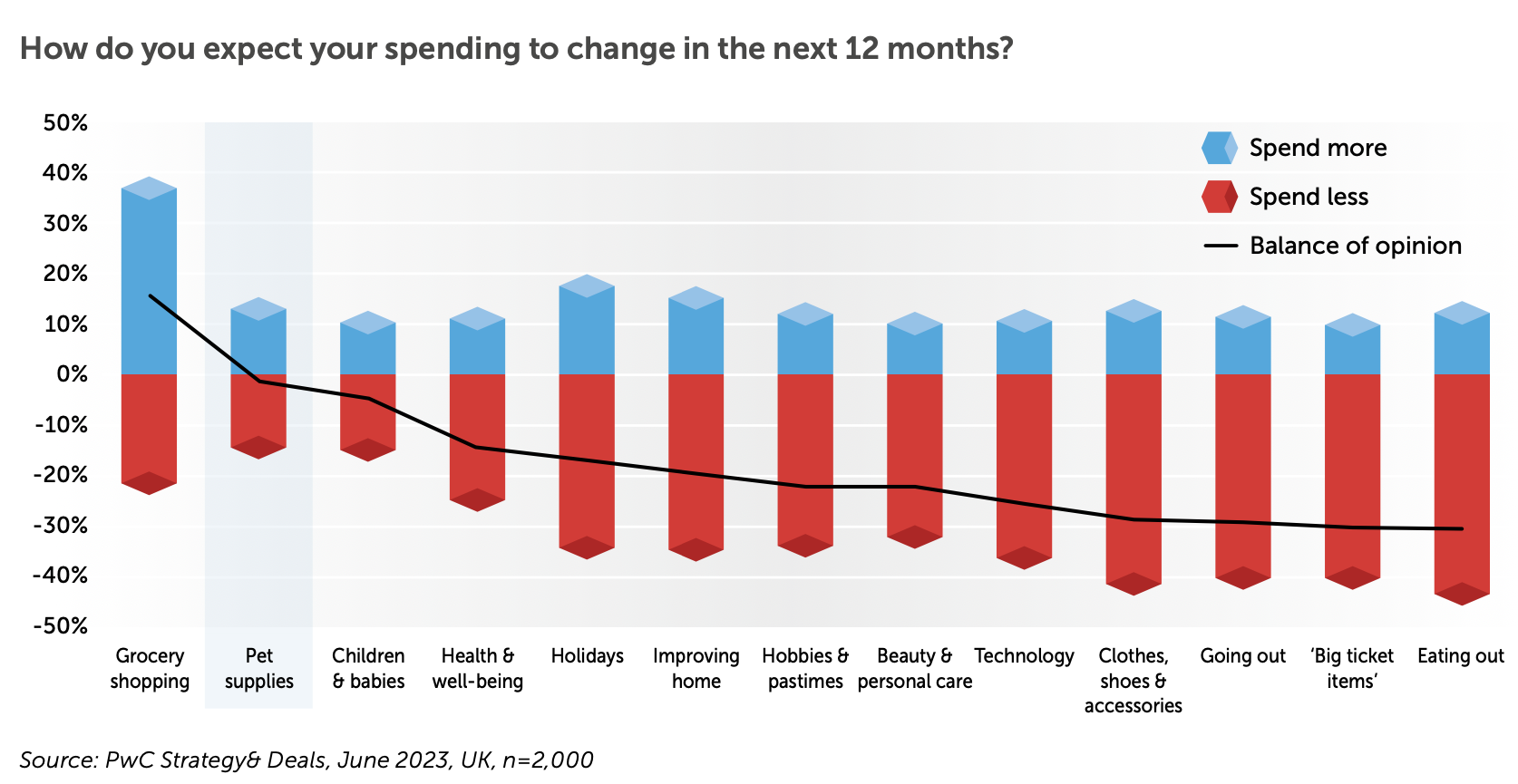

‘Pets’ is a category that we like; along with many of the investors we work with. Pet care markets across Europe – and indeed more widely – have been resilient in times of economic turmoil. Pet care grew at approximately 5% per year in the global financial crisis and also during COVID-19. The current period of volatility and uncertainty is no different, with our latest consumer insights even suggesting that UK consumers are prioritizing their pets ahead of their children.

Favorable demand drivers

Going forward, the 5% growth in the European pet sector is underpinned by favorable demand drivers, including the humanization of pets, as evidenced by: accelerating adoption of human dietary trends (e.g. supplements), increased focus on pet food quality and ingredients, and growth/premiumization of services (e.g. pet hotels, end of life care). On the supply side, we are seeing increasing tech-enabled innovation and medical sophistication.

As a result of these attractive demand and supply drivers, we have historically seen significant interest in the pet space from investors. This extends beyond nutrition to accessories, health, services and wider retail. As a team, we’ve worked on many of these processes across Europe.

5 investable themes

Our discussions with private equity and corporate investors suggest sustained interest in the sector, underpinned by 5 key investable themes:

• Premium (e.g. super premium pet food, pet ‘hotels’) • Health (e.g. specialty nutrition, supplements)

• Connected (e.g. connected pet products, pet wearables)

• Convenience (e.g. subscriptions, online platforms, virtual services)

• Life quality extension (e.g. advanced veterinary technology, biotech)

Investors are, however, often looking harder and/or longer for businesses that correspond to these themes. While global pet transaction volumes recovered quickly post-COVID, the average capital invested per publicly reported transaction has declined by almost 50% since 2014.

This has partly been driven by a more limited number of accessible, sizable assets not already owned by a private equity investor, particularly in the UK. More recently, a number of assets have started to come to market across both the UK and Europe more broadly. Given this renewed focus on dealmaking in pets, how do we – and our investor clients – diligence what ‘good’ looks like in the pet space? What questions might you prioritize if you are currently assessing pet assets?

Key questions

This is a simplified version of the key questions we typically consider for diligence and value creation:

• Attractive market fundamentals: Is the business positioned in an attractive market segment?

• Distinctive model: Is this a strong and resilient model?

• Sustainability: Is performance sustainable based on underlying drivers, including consumer and customer relationships?

• Manageability of risks: How does the business reduce market and execution risks?

• Scalability: What is the headroom for growth in core and adjacent product categories?

• Exportability: What is the headroom for growth in existing and new international territories?

We adopt a mix of quantitative and qualitative methodologies and different data sources (internal, proprietary, third party) to help investors answer these questions.

When seeking investment

Perhaps you are a business that is seeking investment? Here are a few of my personal learnings from the pet deals I’ve led over the last 15 years:

• Get aligned on the story of historical trading and the investment thesis

• Evidence your story using multiple sources, both quantitative and qualitative

• Pre-empt and address key investor concerns (internal and external)

• Demonstrate the resilience of the market/business model, particularly given the current climate

• Establish a single version of the ‘truth’ across all advisors (corporate finance collateral and diligence reports)

In the deals space, we are hugely excited about pets and what’s to come. We expect it to be a priority area for our investor clients in the medium to long term.