Is cultivated meat the future of pet food?

Following regulatory approval in the UK last year, several companies are poised to launch products featuring alternative meat proteins in the near future.

The environmental benefits of cultured meat-based food are becoming ever clearer and now that legislative obstacles are being overcome, producers will want to use the momentum to gain a substantial share of this novel market.

Leader of the pack

In July 2024, Meatly became the first company to receive authorization from the UK government to sell its cultivated chicken nationwide.

CEO Owen Ensor tells PETS International that this was the “first key step” in commercializing the product.

“The UK is enviable as a nation that sets trends, particularly when it comes to alternative proteins. Since achieving regulatory approval, we’ve seen a lot of excitement about cultivated meat for pets,” he says.

Less than a year after the UK’s Animal and Plant Health Agency gave the green light, Meatly has launched the world’s first cultured meat dog treat in a partnership with plant-based pet food brand THE PACK. The snack is called Chick Bites.

The product is being sold for around £5 (€6/$6) as part of a test project at a Pets at Home store in New Malden, in south-west London.

This UK pet retailer invested £3.6 million (€4.3B/$4.4B) in Meatly in 2023, with the aim of providing strategic assistance in bringing cultured meat to the market.

The path to more markets

In recent trials that Meatly has conducted in the UK, 75% of owners reported their pets enjoying the cultivated meat more than their regular diets. Despite the UK being the main focus for the London-based company, it is eager to expand its product offering to more markets.

“Regulatory approval here means that we are more likely to achieve similar approval for projects in other key markets, like North America,” says Ensor, who considers the region a “key geography” due to high pet ownership and openness to new food types.

Meatly is also working on the regulatory process in Europe. “The Netherlands and Germany have shown strong support for cultivated meat and alternative proteins and would likely be the best markets to enter first in the EU,” says the CEO.

Golden opportunity in the US

On the other side of the pond, the market could soon be seeing some new cultivated meat products for pets.

San Francisco pet food startup Friends & Family Pet Food Company (FnF) recently partnered with biotechnology firm Novel Farms to bring a “new class” of cultured meat-based pet food products to the US market this year.

The product will be launched in California first. “Since cultivated ingredients will inevitably sell at a premium, at least at the onset, you really can’t get much better than right here in the Golden State,” says FnF CEO Joshua Errett.

The company aims to show pet parents the nutritional advantage of its cultured offerings, rather than creating an alternative to what’s commercially available.

“To do that, we need to do some foundational work in the lab, to create something that is 10x what’s currently out there,” he says.

Caution reigns across Asia

Asia is also looking more closely at cultivated meat applications for pet food, but the official approach is a bit more conservative there.

“Regulatory bodies are cautious by nature and are naturally looking to understand more about our approach to cell cultivation before rendering any formal judgement,” says Mihir Pershad, founder and CEO of cultivated fish manufacturer Umami Bioworks.

According to Pershad, authorities in Singapore and South Korea have published frameworks to aid companies in preparing their dossiers for review.

“The South Korea process currently includes a request for data from an animal feeding study which Singapore does not require,” he explains. In 2024, the company partnered with FnF to develop a cultivated fish brand to be launched this year.

Meeting consumer price expectation

One of the biggest challenges that companies in the cultured meat sector are facing is price parity with traditional meat. Ensor says that Meatly’s main objective is to bring this difference down as soon as possible.

“If we can match our price with traditional meat, then it’s an easy choice for consumers to switch to our meat, which has the same nutritional and health profile without the associated environmental impacts.”

According to FnF’s Errett, the situation is crystal clear: “If a consumer sees one chicken-based pet food for one price and a cultivated chicken-based pet food for twice that price, and there is no difference other than sustainability claims, cultivated has no future.”

Finding the funding

Investment is another challenge for companies operating in the new space. Errett says this is mainly due to public sentiment in the US toward cultured meat and fish.

“In my time in the category, I’ve been through boom-and-bust cycles of cultivated meat. I don’t think anyone would disagree [when I say that] we are coming through a very low point for funding and general excitement around the technology,” he concludes.

How potential investors will respond to the legal path for using cultured meat in pet food remains to be seen. In the meantime, Meatly in the UK is planning to launch a new fundraising round in the first quarter of the year so that it can scale up commercial production.

How sustainable is cultivated meat?

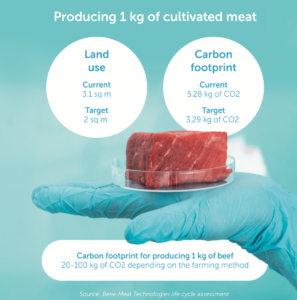

The Czech biotech firm Bene Meat Technologies (BMT) has conducted a life cycle assessment study with the Czech Technical University in Prague to evaluate the environmental footprint of cultured meat production.

The research found that 3.1 sq m of land is required to produce 1 kg of cultivated meat, compared to significantly higher requirements for traditional livestock. Cultured meat totals 5.28 kg of CO2 equivalent emissions per kg.

This is significantly less than beef farming, which is estimated at 20-100 kg of CO2 equivalent emissions per kg of meat.

“We believe that this study marks a key milestone in understanding the environmental impacts of cultivated meat and confirms its potential as a sustainable source of protein,” says Tomáš Kubeš, Head of Strategic Projects at BMT.