Is it Latin America’s time to shine?

Changing consumer behavior, increased local pet food production, retail mergers, new e-commerce offerings – there’s a lot going on south of the US.

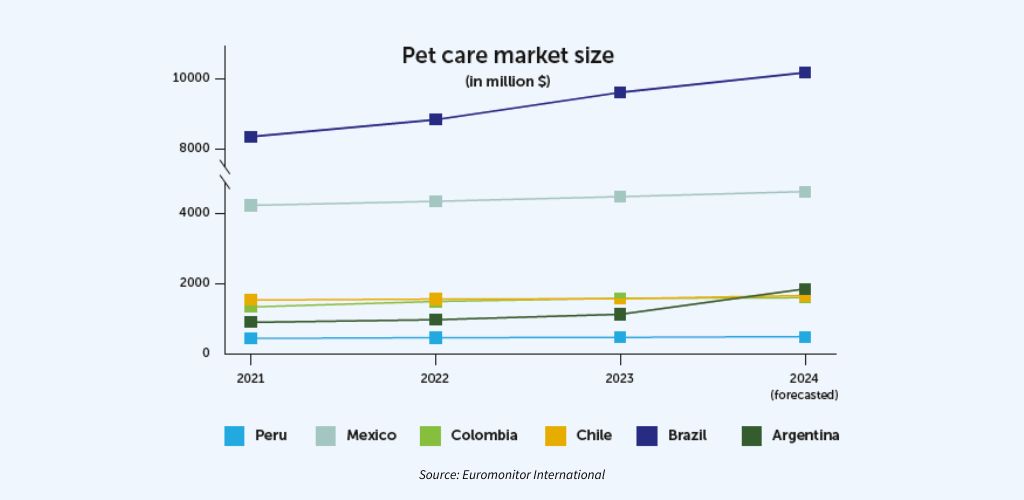

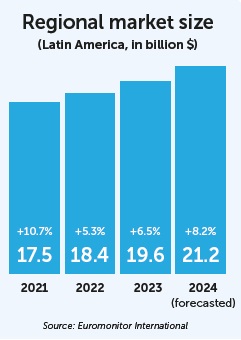

In recent years, new brands and companies have been strengthening the Latin American pet market. Industry experts have no doubts: the region offers the best growth opportunities in the near future, compared with more structured markets such as Europe and the US.

From scraps to premium products

According to marketing data analytics company Kantar, 6 out of 10 households in Central America still feed their pets with table scraps. But this trend is decreasing as pet owners are now increasingly aware of the need to replace human food with other balanced and healthy options.

Although there are differences among the more than 30 countries that make up Latin America, education has generated a premiumization movement overall.

A Euromonitor survey shows that 74% of owners see their pets as their children. This explains the rise in spending on pets, and the focus on better food, healthcare and quality recreation time. The post-pandemic period has been crucial in accelerating a change in consumer behavior, with increasing demand for products that offer pet health benefits.

According to Kantar, 94% of pet owners in Argentina are willing to spend money to keep their pets happy and healthy. In Mexico, data from government agency Condusef shows that Mexican families spend about 20% of their monthly budget on pets. The World Bank forecasts a 1.6% increase in the regional economy this year, followed by further increases of 2.7% in 2025 and 2.6% in 2026.

Regional pet food production up

Pet food manufacturing has shown steady growth in the region in the past decade. According to Feedlatina, a body representing pet food players in Latin America and the Caribbean, production of pet food in the region reached 7.3 million tons last year. That’s 3.8% more than in 2022.

Brazil leads this growth in production, due to its logistics and infrastructure advantages, as well as its capacity to supply essential raw materials like corn and soybean meal. Mexico, Colombia, Chile and Argentina also stand out in the market.

Pablo Azpiroz, Executive Director of Feedlatina, tells PETS International that Latin America is “very well-prepared”, with its large production capacity and extremely competitive costs.

“We have taken advantage of this period of uncertainties and rising production costs, especially in Europe. Here, the scenario is completely the opposite: we have less inflationary pressure and readily available raw materials to drive the growth,” he says.

Costa Rica goes local

Only 30% of Costa Rican pet owners give home-made food to their furry friends. And over the last decade, the local market has shifted from imported brands to national options – experts say from just 2 to 50 local brands.

“In smaller markets like Costa Rica, you have to educate your consumer and make them understand that the quality of your product is important for a better life for their pet. It’s also about earning the trust of veterinarians, who initially preferred imported foods, and showing them that more natural options produced here can be superior,” says Marco Guzmán, founder of pet food manufacturer Technovet.

The company, set up in 2012, has a portfolio of 16 different dog and cat food brands. Last year it increased its annual growth by 15% and it is forecasting a 25% jump for 2024, after expanding to Guatemala and planning further expansion to El Salvador and Panama.

High taxation affects Brazil

In a region full of contrasts, Latin America is home to the third largest pet market in the world: Brazil. It has a 5.54% share of global revenue, amounting to R$68 billion in 2023 ($12.1B/€11.1B) and projected to reach R$76.3 billion ($13.6B/€12.5B) in 2024, according to a survey by the Instituto Pet Brasil (IPB).

The Brazilian market is currently undergoing a period of readjustment after the growth boom during the COVID pandemic. Despite controlled price inflation, the retail sector in the country has struggled with high tax burdens and tight profit margins on sales.

“About 50% of the price of pet food is due to taxes, because the government classifies pet food as a luxury item – the same classification as alcoholic beverages and cigarettes,” explains Caio Vilella, Executive President of IPB. The main goal of the trade association is to achieve tax reductions in the sector, so that Brazilian companies can be more competitive and boost sales growth.

A new Brazilian pet giant

Major pet retailers Petz and Cobasi have announced that they are merging to become a national pet platform offering a unique value proposition for Brazilian pet parents. The new entity, with 494 stores in 140 Brazilian cities, is expected to generate R$6.9 billion ($1.3B/€1.2B) in net revenue.

“The main goal of the merger is to bring down costs, so that consumers can have access to better prices than those we can give them today. We are very complementary companies, and this union will make us even stronger,” Petz CEO Sergio Zimerman tells PETS International.

The transaction still needs the green light from the companies’ shareholders at general meetings and the Administrative Council for Economic Defense (CADE), Brazil’s competition regulator.

Data from JP Morgan indicates that 22% of Petz retail units are located less than 1 km from a Cobasi store, and some 60% of Petz stores are within 3 km. This suggests that authorities may require the closing or selling of some stores in order to approve the merger.

Meanwhile, a competitor in Brazil is also expanding its footprint in the market: Petland has been investing in its franchise system. The retailer already has 108 stores nationwide and plans to add 15 more by the end of the year.

Adding bricks-and-mortar to online

Petlove, the third largest Brazilian retailer, has been the country’s biggest online brand for many years. It now aims to develop an omnichannel model to get closer to its customers. The company plans to open 20 new locations this year and have 100 stores in 2025.

This new sales channel is expected to have an impact on its revenues. While last year the company turnover was R$1.3 billion ($0.23B/€0.21B), it aims to reach R$1.8 billion ($0.32B/€0.29B) this year.

“We know that the physical operation will allow us to create touchpoints, promote unique experiences, and foster brand recall – extremely relevant criteria within our business plan,” CEO Talita Lacerda says.

In a similar move in Colombia, where it is believed that 7 out of 10 people still prefer to shop in physical stores, online pet supplies platform Laika is planning to open up to 12 outlets by the end of 2024 in cities like Bogotá, Medellín and Cali. With this expansion, the company estimates it will grow from 300,000 to 500,000 users by the end of the year.

Rapid e-commerce growth in Paraguay

Last year, 4Pets started up as an online platform in Paraguay for selling pet food as well as veterinary, dog walking and pet boarding services.

The company is primarily focused on the capital Asunción but aims to expand its 24-hour service nationwide. Its goal: $140,000 (€129,000) in revenue and $35,000 (€32,000) in net profit by the end of the year.

“In just 1 year of operation, we already have a base of 3,000 monthly customers. Growth can be very rapid when you have a market like ours which is lacking in options. Expansion opportunities become infinite,” CEO Tomás Salas explains to PETS International.

Despite the growth of e-commerce, 4Pets recognizes the need to also pay attention to offline services and plans to open physical stores to serve Paraguayan customers. The company understands that there is still a connectivity and cultural gap that requires closer proximity.

“We are still lagging behind in a technological respect. It’s hard not to use the word education, but online shopping does require that. You need to train your customer. And today they are asking us for a physical store to see the products up close,” says Salas. “We want to aim for a hybrid model – an omnichannel approach that is sustainable in the long run.”

Investments in the region

US pet retailer Petco already owns more than 1,550 physical stores in the US, Mexico and Puerto Rico, and has decided to expand its operations in the region. Grupo Gigante, which operates in Mexico with 111 physical stores and e-commerce, has invested $2 million (€1.8M) to open branches in Chile.

In June 2023, it opened its first 2 stores in the capital, Santiago, and also offers home delivery through online marketplaces.

Nestlé Purina has announced significant investments in the region too. In Chile, the brand completed the $140 million (€129M) Teno project – around 170 km south of the capital – earlier this year, with a new production line and the expansion of the distribution center, generating 100 new jobs. Its goal is to produce super-premium products that the country previously imported.

Mexico is Purina’s main market in Latin America. The company announced in May that it will be opening its third and fourth production lines for wet and dry food in Silao, Guanajuato, a state in the center of the country.

Entrepreneurs and the future

Recent research conducted by Sebrae, a non-profit body that promotes the sustainable and competitive development of small businesses, shows that small and large entrepreneurs in Latin America are increasingly willing to invest in the sector.

The pet industry is the second most interesting sector for those looking to invest in the region, coming in just after health and wellness, but before online businesses and digital marketing.

“In Brazil alone we had 18,000 businesses focused on the pet market in 2023. It is a versatile sector that always creates demand due to the growing humanization of pets,” researcher Flávio Barros explains. With increasingly dynamic markets, many experts say that the next decade will be crucial for Latin America.

“It is a combination of urbanization, changing family patterns and the appreciation of pets, but also the quality of local products and businesses that are showing us a very promising scenario for the entire continent,” says IPB’s Vilella.

“There is no region in the world with more growth potential than Latin America – in terms of manufacturing and services. The global pet market needs to pay more attention to what is happening here in the global south,” concludes Feedlatina’s Azpiroz.