Leading pet retail in the Nordics: Insights from Musti’s Chief Commercial Officer

After recently becoming part of multinational business group Sonae, the leading Nordic pet retailer is laying out ambitious plans for its future.

Leading regional pet care group Musti currently has 351 stores in the Nordic countries, and that number is growing.

At 138 stores, Finland is its largest market, while it has 132 locations in Sweden and 81 in Norway.

As Musti ends its 36 years as an independent company, CCO Ellinor Persdotter Nilsson talks about the company’s achievements as well as Musti’s current and future strategies under the Sonae umbrella – and she envisages plenty of fresh opportunities for the business.

You’ve been with Musti since 2018. How has this 6-year journey been for you?

I must say that it’s been very exciting. Working with a really passionate consumer group makes it such a fun experience. We genuinely feel like we are making a big difference for pets and their parents every single day.

It’s also exciting because, as a company, we’ve grown nearly doubled the number of stores we operate.

We’ve built our operation in Norway from a start-up to the current market leader, and we are continuing to open more stores there. Now we’re embarking on a new adventure with new ownership.

Where does Musti fit into the pet retail ecosystem in the Nordic countries?

We are the market leader in the pet space in the Nordics, particularly in pet specialties. I think we’re front runners in the whole sector, which comes with a lot of responsibility but also a lot of excitement.

We have this unique position where we operate under a dual-banner strategy. In every market, we have both an omnichannel banner and a pure-play banner.

In Finland, for example, we have Musti ja Mirri – both a store concept and an online channel – as well as a pure-play channel, which operates mostly online with 6 physical stores.

This allows us to cover many aspects of the market and serve a broad range significantly since I started. We’ve doubled in size and of customers.

How is this dual-banner approach working for you and your customers?

We’ve seen that the concept works really well because we’re serving different customer groups.

With Musti ja Mirri, we say that our selection starts where grocery ends. It’s a true pet specialty concept.

The assortment is carefully selected by our pet experts, and we have a high share of our own products. We also offer many services, including digital and physical training.

In Sweden, we have a veterinary clinic chain under the Arken Zoo brand, which is the equivalent of Musti ja Mirri in Finland.

On the other hand, our pure-play channels, which are primarily online, have a wider assortment which includes some grocery brands. They are more focused on fast deliveries. It’s a different kind of offering that caters to a different consumer group.

How does your traditional retail compare to your online offering in regard to stock keeping units (SKUs)?

Our SKU count doesn’t differ significantly between online and offline. However, most of our omnichannel sales come from physical stores, and our average store size is around 350 sq m. So, naturally, the SKU count in-store is more limited compared to the wider assortment offered in our pure-play online channel.

We have between 13,000 and 14,000 SKUs available online, although that’s obviously nowhere near the case in our traditional retail stores. In an average 350-400 sq m physical store, we would usually carry between 3,500 and 4,000 SKUs.

Are there any differences in product demand across the different countries where you operate?

The reason our concept works so well across the Nordics is that there are very few product selections that wouldn’t work across all regions.

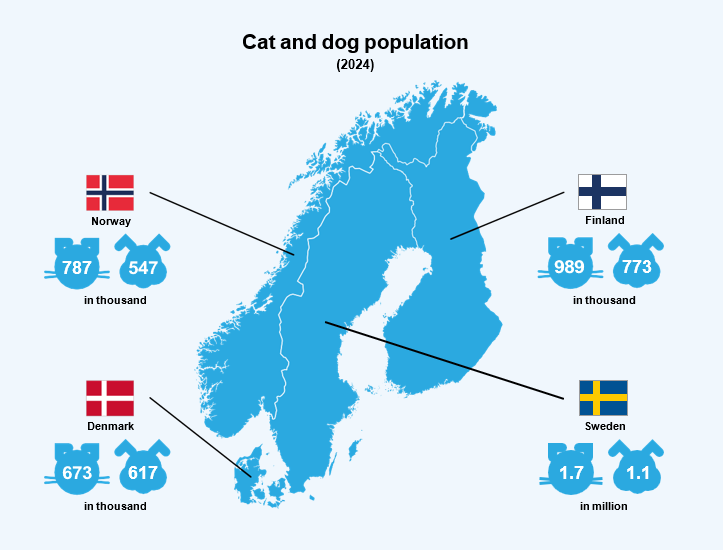

Pet parents in the Nordic countries are quite similar, so what they buy is too. Since there are more cats in Sweden, those types of products are more popular.

Items for outdoor activities – like trekking with your dog – are more popular in Norway than in Sweden and Finland.

Can you describe the average journey of the Musti customer?

Our loyalty program is central to the customer journey, with almost 1.6 million customers across the Nordics. Many customers have multiple pets, but our loyalty program tracks the pet owners.

We actively work with breeders, as they are an important customer group. And our Puppy and Kitten Club, launched in 2020, is key to attracting new pet parents.

A typical customer journey begins when someone gets a new pet, and they may interact with us for the first time through our stores.

But our top-tier customers tend to use both our physical stores and our online services, including training and grooming. We offer physical as well as digital dog training, and have 125 grooming salons located in or near our stores.

As the market leader, how do you operate alongside competitors in the Nordic region, including online?

We are market leaders in all 3 countries, but our share of the market varies: in Finland, it’s just over 30%; in Sweden, around 25–26%; in Norway, about 15–17%.

In Norway, we have not yet consolidated our position in the market, which is even more fragmented than Sweden and Finland, where we have been active for longer.

What is your plan for growing Musti’s footprint in Norway?

When I started 6 years ago, we had around 15–16 stores in Norway, and now we have over 80. We still see room for growth, through new store openings and by ramping up existing stores.

Our goal is to engage customers, both in physical stores and online, and grow their share of wallet. The real magic happens when customers meet store staff – they trust our experts.

Tell us about your average store…

Our store network is very diverse, so it’s difficult to define an average size – with stores ranging from 100 to 1,000 sq m.

Locations include retail parks, city stores and larger stores. It’s important for us to be where the consumer is, so we adjust our assortment and the services we offer to the location.

In areas where we have multiple stores, we tailor the offerings for each one.

Where do you want to be present as a brand?

We have a presence in both big cities and smaller towns. It is key that we’re right there where our customers are. Retail parks work well for us, as they offer ample parking and allow us to welcome pets into our stores.

We have various types of locations, but it’s important to ensure good customer flow and convenience for pet owners.

How is current low consumer confidence impacting Musti’s business?

We’ve seen softer trading in some categories, particularly accessories, but 75% of what we sell is food and consumables, which remain frequent purchases.

It’s essential that we continue to refine our product offering, focusing on both high-end innovative products and more budget-friendly options.

We’ve noticed more consumers looking for promotions and discounts, and offers we’ve had for years are now resonating even more due to inflation and rising prices.

Given the shift in consumer behavior, are you also expanding your private label offering to meet the increased demand for value products?

At Musti, we don’t use the term ‘private label’. We talk about ‘own brands’, which are developed to fit into our ‘good, better, best’ structure.

While all our products are of high quality, this approach helps us cater to a range of price points.

In the more budget-friendly ‘good’ category, we’re filling more gaps than before by developing new products, textures and packaging.

Over 50% of our sales come from our own exclusive ranges, and we’re constantly expanding these to remain relevant, especially in the current economic climate.

Musti was recently acquired by Sonae for $1 billion (€0.92B). How is this going to impact your business in the short term?

The new situation presents numerous opportunities for inspiration and benchmarking in retail innovation. We’re looking into possible synergies with Sonae’s own pet specialty chain, which has 60 stores.

Our strong brand offering also has the potential to expand beyond the Musti universe, so brand export is an area we’re exploring. International expansion is also part of our growth journey, and this investment indicates confidence in our potential.

With such a significant investment, how do you plan to maintain Musti’s identity and focus in the Nordics?

The investment reflects the trust in our expertise as pet specialists. It’s crucial for us to maintain our identity and continue serving pet parents and their pets in the Nordics. We still see room to grow market share, especially in Norway and Sweden.

Our new owners want us to focus on this, while also exploring new avenues for growth, such as collaboration with other retail chains and market expansion.

You recently announced the acquisition of Baltic pet retailer Pet City for €18 million ($19.5M)…

While recent investment has been primarily in Finland, our acquisition of Pet City is in the Baltics, which shows our interest in geographical expansion.

With 46 Pet City stores and 16 veterinary clinics in the region, we see significant potential for sharing best practices. The pet parenting trends in the Baltics are quite similar to those in Finland, so we believe there’s a natural synergy that can be leveraged.

Is expanding the Pet City footprint in the Baltics part of your future plans?

We always aim to grow, but our immediate focus will be on sharing best practices and collaborating effectively. Once we have established ourselves there, and laid all the groundwork, we can go on to explore further expansion opportunities.