Patent activity reveals healthy state of pet tech

Over the past decade, pet care has undergone a remarkable transformation, with a surge in innovative products for everyday use driven by a booming sector and digital advances.

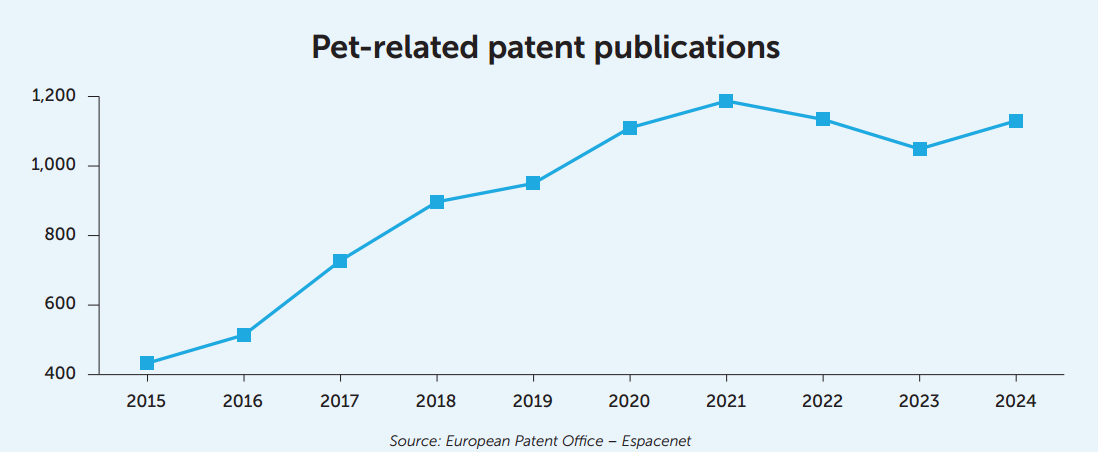

Data from the European Patent Office (EPO) covering 2015-2024 shows a sharp rise in activity. In those 10 years, publications in the sector nearly tripled. A new generation of advanced healthcare and welfare pet devices is emerging.

The nations making the running

Following global innovation trends in nutrition, health and technology, China and the US have emerged as clear leaders in patent filings. Close behind are the Asian competitors Japan and South Korea, plus major European markets such as Germany and the Netherlands.

The 2022 White Paper on China’s Pet Food Industry, published by Deloitte, forecasted the pet food market reaching ¥114 billion ($16.3B/€14B) by 2026. If current trends continue, China is poised to take the lead in patent innovation for pet products – if it has not already done so in several specialized subfields.

Regional trends to watch

South Korea has been distinguishing itself with its inventive product design, alternative proteins and innovative pet tech applications. The market is continuing to push boundaries, combining technology and nutrition in ways that cater to the country’s increasingly sophisticated pet owners.

Europe, shaped by sustainability and circular economy goals, remains focused on greener formulations, packaging and materials. Brands across the continent are therefore prioritizing environmental responsibility, from how they source ingredients to reducing waste in the production and distribution of their products.

Southeast Asian countries such as Vietnam and Thailand, although not yet major patent applicants, are expected to become increasingly active in the coming years. As global supply chains evolve, more manufacturing and R&D operations are being outsourced to these regions, positioning them as emerging hubs for innovation in the pet industry.

Digital tipping point

In the mid-2010s, the majority of pet care patents centered on mechanical solutions. Typical inventions included feeders with basic timing mechanisms, ergonomically improved cages or kennels, and exercise devices of modest technological sophistication. These innovations laid the groundwork for today’s industry.

The real acceleration in creativity has come in the past decade, with a growing number of patent applications that have introduced digital components such as sensors, embedded software and wireless connectivity into everyday products including feeding stations, collars and litter boxes.

This convergence of hardware and data marked a turning point, transforming the field of pet care from a largely mechanical craft into a connected, technology-driven ecosystem.

Sensors and stationary devices

The hallmark of this new wave of innovation is the use of multiple types of sensors. A lot of patent applications are now directed to wearable devices such as smart collars that integrate accelerometers, GPS modules, weight sensors and even miniature cameras.

At the same time, many patents are being filed for stationary devices – including feeding stations, litter boxes and exercise appliances – that come equipped with scales, motion detectors and even image recognition systems. The goal for all these innovative products is no longer just to provide a service, but to gather continuous streams of data on the pet’s activity, feeding habits, hygiene and overall health.

Automation as part of daily life

Automated feeding systems show how far we’ve come. The patent applications filed at the EPO are no longer limited to food being dispensed at fixed intervals, adjusted mechanically. Patents now protect devices that can adjust feeding to meet the individual pet’s needs. By linking weight measurements, activity patterns and even biometric indicators, they can tailor feeding plans in real time, ensuring healthier outcomes and preventing overfeeding.

Hygiene is also an area of significant activity in patenting. In recent years, patent filings have begun describing litter boxes equipped with monitoring capabilities, to track usage frequency or detect differences in waste characteristics.

These features do more than offer the convenience of knowing when to change the litter – they provide early diagnostic potential for owners and vets, flagging any unexpected activity right away.

For both training and behavioral management, there are more and more patent applications for interactive devices that provide instructions or stimuli to pets, often coordinated through mobile apps. This enables a more consistent, data-driven approach to training, benefiting both pets and their owners.

Cross-disciplinary applications

These examples illustrate the increasing sophistication of pet-related inventions. At the EPO and other patent offices, steady growth has been observed in classifications related to animal husbandry (A01K) and veterinary technology (A61D), mirroring broader trends in digitalization and health-related innovation.

The result is a growing complexity in filings involving connectivity, data governance and ownership, and even ethical considerations in the use of Al for pet health.

As cross-disciplinary applications become the norm – blending biotechnology, Al and data analytics with traditional pet care technologies – this brings new challenges and opportunities for the patent profession. So today’s examiners are multidisciplinary professionals who combine deep knowledge of these emerging technologies with a solid understanding of traditional pet care systems.

Assessing patentability

Examiners and practitioners must navigate issues once confined to other technical areas, such as the legal treatment of computer-implemented inventions or methods involving medical procedures on pets. And what was once focused on straightforward mechanical technologies now demands expertise across multiple domains, from materials to software and connectivity.

Regulations and examination guidelines dealing with ‘technical character’ and ‘technical contribution’ have therefore gained new relevance. In this emerging landscape, the question of what constitutes a ‘technical’ invention has become a central challenge in securing and defending patents in the pet technology domain.

As both established consumer goods companies and dynamic startups invest heavily in pet tech, patent portfolios are becoming strategic assets – not only for legal protection but also for market positioning and for attracting investors in a rapidly consolidating sector.

Patent activity is a reliable barometer of innovation, and the EPO’s data clearly shows that the world of pet technology is entering a distinctly digital era.

Wellbeing in a connected world

Beyond convenience, these inventions all aim to enhance pets’ wellbeing, encompassing advances such as Al-based health monitoring, connected feeding systems, biodegradable materials and precision nutrition. The trajectory points toward a future in which caring for pets is not only easier and more efficient, but also more deeply informed by science and technology.

In essence, the convergence of technology, welfare and consumer demand is transforming more than just the way we care for pets – it is redefining the very business of patents. So patent offices and professionals are now required to adapt to a market where digital innovation and data-driven design extend far beyond traditional boundaries, ultimately helping to create a healthier, more connected world for pets and their parents.

Innovations in allergy management

Cat allergies are the most common animal- origin allergy and affect about 10-20% of adults globally, according to the medical charity Allergy UK. Various patents are emerging to tackle cat allergies. One of these innovations adds antibodies to pet food to neutralize allergens in a cat’s mouth or environment.

Other patents focus on using virus-like particles (VLPs) to trigger immune responses in humans, potentially reducing allergic reactions. Essentially, these VLPs can act like vaccines, eliciting an immune response that helps prevent the body from experiencing allergic reactions.

When it comes to a pet’s own problems with allergies, there are several patents which address food allergies caused by specific proteins. These diets often use alternative proteins like duck, venison or fish and include fiber to support digestion and immunity.