Pet services survey looks into pet owners’ preferences and spending habits

How popular are pet services? Which ones are used most often and how much do pet owners spend on them every month? What are key decision-making factors when choosing a service provider?

Read the results of a recent research project conducted by PETS International in collaboration with Yummypets.

Pet retailers across the world continue to make significant investments in adding more pet services to their offerings. Whereas it’s clear there is a growing demand for such services, we were interested to find out which services are most in demand in which countries.

Our survey was held amongst 1,572 pet owners in Canada, France, the UK and the US. The vast majority of respondents (62.8%) are pet owners that use pet services.

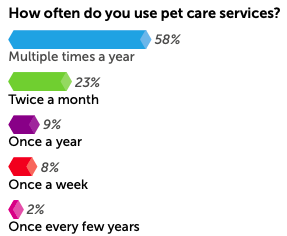

Of those that use pet care services, most (58%) do so multiple times per year. One in four (23%) require services twice per month and 8% once a week. The remainder (11%) go to a pet care service provider once a year or less.*

*To provide the best overview of the preferences and habits of consumers of pet services, respondents who don’t pay for pet services have been excluded from the results in the rest of the article.

Most popular services

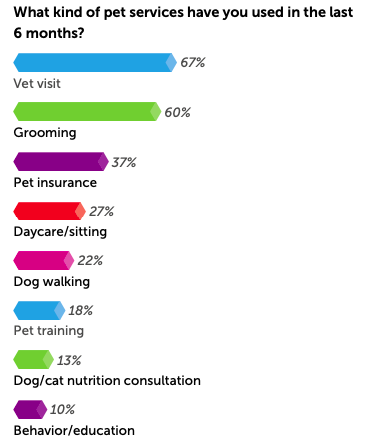

Paying a visit to the vet is one of the most popular pet care services: 67% of pet owners take their pet to a vet. Interestingly, 78% of French pet owners visit vets, whereas in the US only 56% of pet owners do so.

Grooming services come in a close second, at 60%, without any real differences between countries or pet owner age groups.

Another popular service is that offered for taking care of pets during holidays or when owners are at work. One-fifth of respondents (22%) indicate they’ve used a dog walking service in the past 6 months. As for pet daycare or pet sitting services, 27% of respondents used such services.

US pet owners are less likely to pay for dog walking and daycare/pet sitting services than owners in other countries. The survey also showed that pet owners between 25 to 39 years of age are more likely to use pet care services. What’s more, UK pet owners (37%) pay for dog walking services.

With pet health top of mind for most pet parents, it’s interesting to see that 13% of pet owners indicate they’ve visited a dog or cat nutrition consultant in the past 6 months.

Acupuncture for pets and pet taxis are the least popular services.

Budget

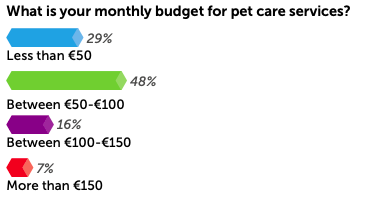

We also asked pet owners how much they spend on pet care services on a monthly basis. Almost half of the pet owners (48%) spend somewhere between €50 and €100 per month. The second largest group (29%) spends less than €50 per month. A small group (7%) are the biggest spenders, with a budget of over €150 per month.

Despite current inflationary pressures, the majority of respondents (69%) think they will continue to spend the same amount on pet services as they’re currently spending. Only 13% expect to spend more, while 17% believe they will spend less.

Buying criteria

With an abundance of pet care service providers around, deciding on which provider to use can be a challenge. That’s why we asked pet parents what factors their decisions are based on.

Cost appears to be the most important decision-making factor. A convincing 53% of respondents mention that high prices are the main concern around pet services.

Pet owners also value the opinion of others when picking a service provider. In fact, positive reviews are the second most important consideration for 51% of pet owners. Discounts are at the bottom of the criteria list.

Finding service providers

The natural first step for pet owners to find a service provider seems to get recommendations from friends, family and other pet owners. No less than 49% of respondents have found their current provider in this way.

Using the internet is the second most popular option. 26% indicate they’ve consulted reviews on the internet before making a final decision. A quarter of respondents base their decision on recommendations made by their vet.

When it’s actually time to book an appointment, the majority of pet owners (62%) do so by phone, whereas 29% make their appointment online.

Opportunities for service providers

Surprisingly, survey results show that there is a lack of service providers. 23% of respondents indicate that they have difficulty finding providers and making appointments. In the same vein, around 16% of respondents also complain about a lack of providers in their neighborhood.

Customer satisfaction

Most pet owners (70%) are happy with their current providers. Very few (2%) are not satisfied or looking to change providers. The remaining group (28%) is okay with their service providers, but feels there certainly is room for improvement.

When it comes to trust, the majority of respondents (80%) indicate they trust the know-how and skills of their pet care provider. Yet, 18% remain somewhat skeptical.

Pet insurance

In the September issue of PETS International, we discussed the growing popularity of pet insurance. This survey shows that 45% of pet owners have pet insurance; 15% of pet owners indicate that their pets aren’t currently covered by insurance, but that they’re planning on taking one out.

UK pet owners (81%) are most likely to have pet insurance. US and Canadian pet owners are less likely to have insurance.

When comparing different age groups, 25 to 39-year- olds are most likely to have pet insurance, whereas older respondents are less likely to have one for their pet.

Pets on holiday?

Because of the pet adoption boom during COVID, many places have a shortage of pet boarding providers. One in five respondents (21%) indicate that they were forced to change or cancel their holiday plans because of a lack of pet care solutions in the last 2 years.

Uniform demand for pet services

In previous surveys that we conducted together with Yummypets, there were always clear distinctions between pet owners from different age groups or countries. Although this survey does reveal some differences in these categories, they are much less significant. We can therefore conclude that pet owners across countries and age groups more or less share the same preferences and behaviors when it comes to pet services.