A recession-proof industry you can count on: pet care

That’s right: America is pet obsessed. Pet ownership is up. Spending on pets is up. In fact, we actually spend more on our pets during a recession. We’ll dig into the details in a moment and look at three companies in a niche of this recession-proof industry that can bolster your portfolio. But first: Around 85 million U.S. families own a pet, according to the National Pet Owners Survey. That’s 68% of U.S. households. This figure has increased around two percentage points annually since 2011. But spending on those pets has increased almost 7% annually.

That’s right: America is pet obsessed. Pet ownership is up. Spending on pets is up. In fact, we actually spend more on our pets during a recession. We’ll dig into the details in a moment and look at three companies in a niche of this recession-proof industry that can bolster your portfolio. But first: Around 85 million U.S. families own a pet, according to the National Pet Owners Survey. That’s 68% of U.S. households. This figure has increased around two percentage points annually since 2011. But spending on those pets has increased almost 7% annually.

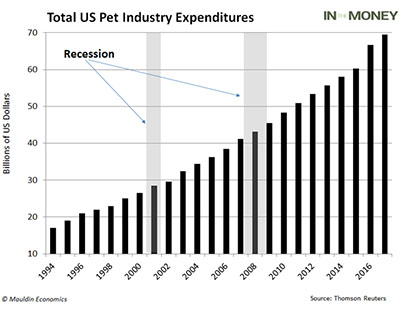

Meanwhile, spending on veterinary care is growing especially fast. From 1991 to 2015, it shot from $4.9 billion to $35 billion. For perspective, that’s three times faster than U.S. gross domestic product grew over the same period. Pet-care spending even grew during the past two recessions: 29% during the 2001 recession and 17% during the 2008-09 recession.

You can see it in this chart.

This all points to a solid, recession-proof industry. It means pet-care companies enjoy predictable cash flows and sales growth, even during a recession. (And I’m predicting a recession in the coming months.)

It also means stable share prices for stockholders when they’re looking for that the most. One of my favorite pet-health companies is PetMed Express Inc. PETS, -1.27% . PetMed is a leading, nationwide pet pharmacy. The company markets over 3,000 prescription and nonprescription medications for dogs and cats directly to consumers.

PetMed boasts a hefty 6.7% dividend yield. It also has a low payout ratio, which is critical to dividend stocks. Shares have struggled a bit this year, but that also means they’re attractively priced right now — and a good way to take advantage of the growing pet-health market.

The ‘dog mom’ generation

There are demographic reasons behind the jump in pet ownership and pet spending.

To start, U.S. household formation is near all-time lows, according to Yardeni Research. The main reason for this, says the Institute for Family Studies, is that millennials — born between 1980 and 2000 — are marrying later. And they’re turning to pets for companionship till they do marry.

Millennials make up 25% of the U.S. population. But they own 35% of all pets, making them the largest pet-owning cohort in the country.

Aging baby boomers and empty nesters are also big pet fans.

In 2007, only 34% of adults over the age of 70 owned pets. But by 2016, the year boomers started turning 70, that figure had jumped to 41%. As I write, fewer than half of the country’s 75 million baby boomers have reached their 70s. So the “dog mom” generation still has plenty of room to grow. And these folks are spending a lot on their pets.

The fastest-growing area in pet care

Dog owners spend over $1,000 a year on Fido, on average. So companies that cater to these dog ”parents” should continue to thrive.

Overall, spending on pets in the U.S. has gone up every year since 1994. And it’s grown 4.6% annually over the past 10 years, or three times faster than overall consumer spending.

This is good news for pet-care companies. And it makes sense that they’ve done well, even during the past two recessions.

Pets are considered part of the family now. Their owners skimp on other things before downgrading to cheaper pet food or cutting back on supplies. This is especially true for the $15 billion pet-medication industry. Sure, you might skip your regular dog-grooming appointment during a recession, but you’re not going skip your pet’s medication.

The booming pet-medication market is proof positive of that. Pet-medication sales are growing twice as fast as overall pet spending.

The pet-medication market will be the highest growth area of the pet-care industry for the next decade, reports market research firm Packaged Facts. It expects new products for flea and tick prevention as well as itch relief to drive sales.

To tap into this market, look into Zoetis Inc. ZTS, -1.01% . Zoetis used to be the animal-health unit of Pfizer PFE, -1.08% . The company is the largest manufacturer of anti-infectives, vaccines and other animal-health products in the world.

It offers a small 0.6% dividend yield, but, with a 19% payout ratio, there’s plenty of room for dividend hikes

Also consider Pets at Home Group PLC PAHGF, +4.39% . The company operates a network of stores, pet services and veterinary services in the United Kingdom.

Its dividend yield is 4.2%. At 125%, the payout ratio is higher than I would like. But the company has very low debt and strong free cash flow. So it isn’t likely to cut the dividend, despite the high payout ratio.