Regional report Central and Eastern Europe: More alike than different

A look at pet care trends across Poland, Hungary, the Czech Republic and Slovakia – and how they stand in comparison with Western Europe.

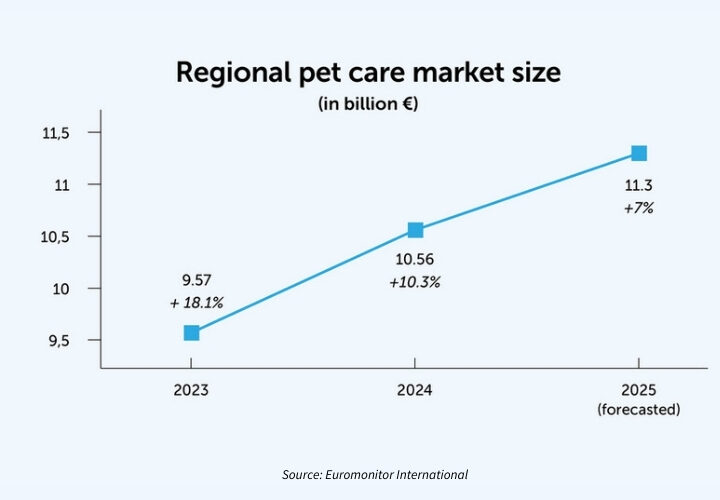

In 1989, as many countries in this region regained independence and began to align with Western Europe, a new era began for various market sectors. The pet industry was one of those that has since experienced significant growth, driven by increasing pet ownership, e-commerce adoption and economic factors.

Poland: constantly growing market

Thanks to its size, Poland stands out as a dominant player in the Central and Eastern European pet industry, mirroring trends in Western Europe. The market has seen substantial expansion, fueled by high pet ownership rates and a thriving export sector.

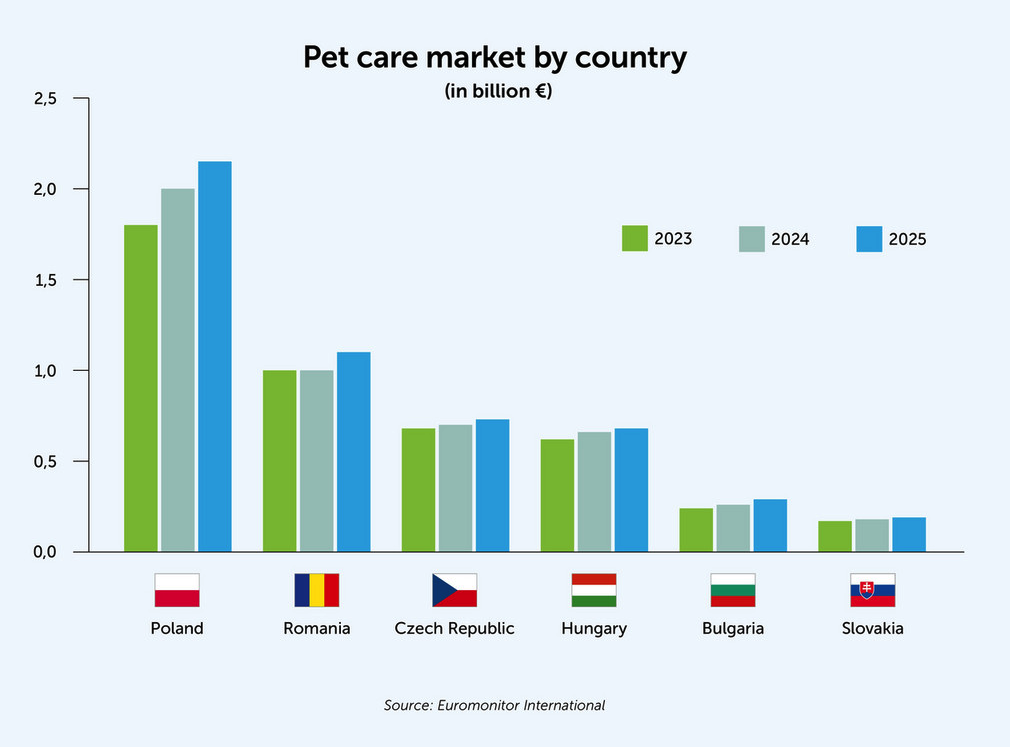

According to statistical data from European pet food industry association FEDIAF, the Polish pet food market is currently valued at approximately zł4.9 billion (€1.15B/$1.35B), with projections for annual growth of between 5%-7%.

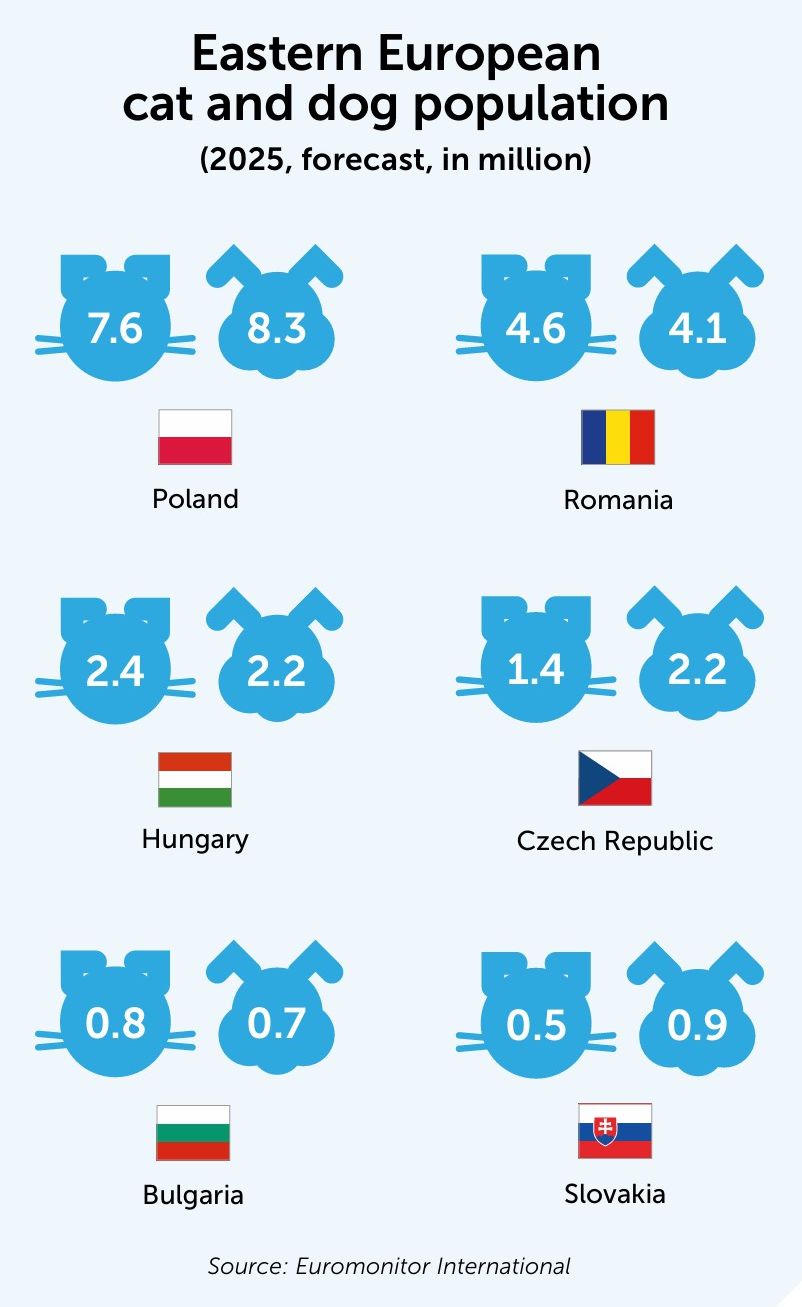

“It’s a constantly growing market,” says Maciej Przeździak, General Secretary of the Polish Pet Food Manufacturers’ Association (Polkarma). This growth is supported by a high level of household pet ownership, with 49% owning at least one dog and 40% owning cats.

The surge in e-commerce has been a key driver too, with more than 20% of pet care products sold online, according to Euromonitor data, making Poland a regional leader in digital sales.

Private label products in the pet category are gaining traction, with a 3.7% increase in volume and a 5.1% rise in market share, as consumers seek affordable options amid inflation. Export is also important for the Polish market, with local pet food manufacturers selling their products throughout the EU and to 63 other countries.

Local production facilities

“Thanks to the availability of raw materials and workers, relatively low production costs and our geographical location, many companies have their production facilities in Poland. We also have indications that new companies want to open their factories here, or that work has already begun on them,” says Przeździak.

Polkarma’s General Secretary also points out that, according to an audit conducted last year by the European Commission, Poland produces about 10% of the entire European pet food output.

The market is expected to reach €2.46 billion ($2.89B) by the end of the year, according to data from Mordor Intelligence, with a 7% annual growth rate, driven by demand for premium and sustainable products.

Online sales are also booming in the market. The turning point was the pandemic, according to Marcin Kukla, CEO of Zoona.pl, an online pet retailer based in the southern city of Katowice.

The company was founded in 2015 and has managed to establish itself as a benchmark in the sector. “Since COVID, the number of people buying products online has grown much faster than ever before,” he explains.

Online marketplaces move up

The presence of major online marketplaces in the country is also impacting the retail landscape. Allegro – a Polish-based e-commerce platform that is the biggest in the country – has been operating in the country since 1999, while Amazon entered the market in more recent years. “Marketplaces are good for the buyers, but bad for the sellers,” Kukla explains.

“For the shopping platform, it really doesn’t matter who sells the product. Most important is having the lowest price and trying to lure the client there, so that the marketplace itself earns its margin from each sale,” he says.

According to Kukla, the emergence of Chinese players such as Temu, AliExpress and Alibaba won’t substantially change things because Polish pet owners are looking for products from reliable sources, especially when it comes to their pet’s health.

Amazon, however, could take advantage of a dispute that has arisen between Allegro and InPost, leading companies in the locker box market, to gain a larger market share.

Hungary: high pet adoption

The second most important market in Central and Eastern Europe is Hungary, where 49% of the households own a dog – one of the highest figures in Europe and the highest in the region – while 35% own a cat.

This adoption rate has propelled the pet industry forward, making it a regional growth driver. A notable trend is the shift toward online purchasing, with Hungarian pet owners increasingly buying food and accessories via e-platforms.

This year, pet food market revenue is projected to reach ft35.12 billion (€88.72M/$103.62M), with an expected annual growth rate of 4.05% through 2030, according to Statista.

The market benefits from increased spending on veterinary services and wellness items, though findings from a survey conducted by financial services company Cofidis show that economic pressures have led to a 33% rise in pet care costs over the past 5 years.

Grooming and boarding services

According to Péter Gárdos, CEO and founder of Hungarian pet care company Dogmopolite, pets have started to become integral members of the family.

As elsewhere, this is reflected in a shift towards premiumization, with owners purchasing items like clothing and treats, which contributes to projected market growth in segments such as pet grooming and accessories.

“There are more and more single households, where pets play an increasingly important role. They are being given more attention and affection, and people are spending more money on them. It seems to be a business which is pretty recession-resistant,” he says.

Dogmopolite’s experience is indicative of the dynamism of the Hungarian market and its potential for growth. Gárdos explains how the company started: “We had just one employee, who provided dog walking and daycare services. After a while, we started to offer dog boarding services in an apartment in my grandmother’s villa in the Buda hills.”

In 2012, having outgrown this location and a subsequent one, Dogmopolite opened its first large boarding facility in Budapest, the biggest of its kind at the time.

Its first and second grooming locations followed, as well as another boarding facility. “Today, we operate 4 boarding and daycare facilities in and around Budapest, and in Debrecen in eastern Hungary, as well as 4 dog grooming salons, a veterinary clinic and a web shop.”

A distributor’s perspective

Another perspective comes from Péter Tamási, CEO of PetPartners Hungary, one of the country’s largest pet product distributors.

“For many years, the Central and Eastern European region was the main growth driver in Europe. The pet market in these countries was growing a lot more than in Western European countries. I think it’s true to say that Hungary was also a driving force in the growth of the European pet space.”

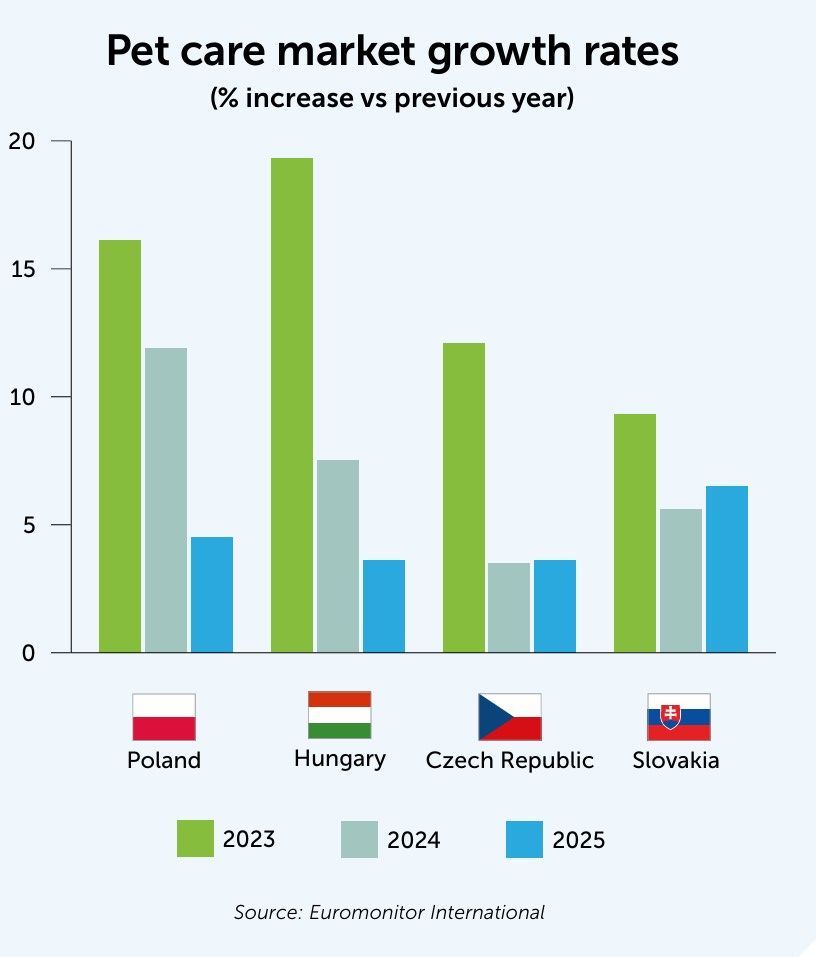

During COVID, there was double-digit growth in the whole Hungarian pet market. But this started to slow down when the war in Ukraine started.

“Right now, there’s not much growth in the market. In 2022-2023, the general inflation rate in Hungary was one of the highest in Europe, at around 25%. So it also had an effect on the pet food market, where the inflation rate was between 40% and 50%.”

According to Tamási, that had an impact on premiumization. He notes that there was a shift from more premium to less premium products.

People didn’t want to spend more money on their pet food, but they didn’t get the same quality for the same money as previously.

Czech Republic: positives and challenges

Compared with the growth of the Polish and Hungarian markets, the Czech Republic demonstrates steady progress, characterized by moderate growth and resilience despite economic fluctuations.

In 2025, the sector has witnessed stable value increases, supported by an improving economy and declining inflation.

Pet care sales have grown in both volume and value terms, with a marginal decline in unit prices allowing for broader accessibility.

Key trends include a rising demand for specialized products – such as premium dog food and grooming items – as pet owners increasingly see their pets as family members.

E-commerce and online channels are expanding, with private label products maintaining a market share of over 30%, according to NielsenIQ data.

Projections indicate continued expansion, with the market expected to grow at an annual rate of around 5%-6% through the decade, driven by urbanization and shifting consumer preferences toward natural and organic options.

Despite these positives, challenges such as high retail prices and lower adoption rates in some segments could temper growth. The market stability of the Czech Republic positions it as a mature player in the region, balancing tradition with modern trends.

Slovakia: natural and organic

Slovakia’s pet care market is on an upward trajectory, driven by increasing urbanization and a cultural shift toward treating pets as family members.

In 2025, the market is valued at approximately $40.34 million (€34.53M), with projections of a 1.31% annual growth rate through 2029, according to Statista.

Pet food sales, particularly for dogs, are a major segment, influenced by the demand for natural and organic products. Household ownership rates – while slightly lower than in neighboring countries – are rising, with a focus on dogs and cats.

Customized communication

Euromonitor data shows that e-commerce and retail channels are key growth factors, with consumers seeking customized options such as sustainably sourced food.

COVID had a favorable effect on the popularity of e-commerce, says Ladislav Kobolka, CEO of COBBYS PET, a Slovakian pet store chain. Alongside its physical stores, the company has also had an e-shop for some years now.

Kobolka explains: “It’s a great help for our business partners that they can order goods when it suits them. They have constant access to new products as well as our promotions. We use our e-shop as an additional communication channel for both our wholesale partners and our consumers. A good website also helps store sales, as customers look at the assortment and current promotions before visiting the store.”

Kobolka warns that for e-shops, owning warehouses and stock is crucial. Overspending on advertising without a sustainable revenue model can lead to failure.

While e-shops compete with traditional stores, customers still value the in-store experience for certain purchases, preferring the opportunity to touch and feel – and to talk to staff.

Cross-border cultures

The story of COBBYS PET tells us something else about the market in the region. In 1989, Kobolka’s father opened a shop selling aquariums, where he started working. In 2001 he opened his own company, which grew and diversified to target all kind of pets.

Today, COBBYS PET has 6 shops, employs more than 30 people, has a range of over 500 own products and operates in Slovakia, the Czech Republic and Hungary.

In this regard, Kobolka says: “The mentality of all 3 nations is very similar. Cultural and ethical habits are the same and since I can look at it from a distance, I can say that it’s a homogeneous part of Europe. People are nice, willing to help, hospitable. We are much more alike than we think.”

His biggest difficulty is operating under different regimes pertaining to value-added tax (VAT). In the Czech Republic VAT is 12%, in Slovakia 23% and in Hungary 27%.

“The difference in VAT between the lowest and highest rates is an incredible 15% and this distorts the markets. Overall, the 3 markets are very close to each other in terms of purchasing tendencies and brand perception.”