US and Canada: a comparative data analysis

The pronounced impact of inflation has been felt across the US and Canada, with consumers grappling with higher prices for essential pet items.

The North American pet industry landscape has seen substantial changes in the past year, reflecting consumer behavior across essential and non-essential pet items. In many ways, developments in pricing, sales and preferences are similar in the whole region, but there are some interesting differences too.

Higher prices in the pet department

As of October 2023, US consumers were paying 32% more for packaged goods than they were in 2019, with people in Canada paying 22% more. Inflation is affecting all corners of the store, but the pet department in particular is seeing significantly higher prices. For example, there was a 6% increase in average unit price in the US in October 2023 compared with October 2022, and a 5% increase in Canada.

Regional differences

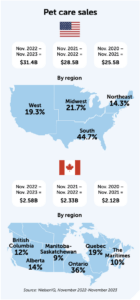

In the US, retail pet sales were over $31.4 billion (€28.7B) in value, +10% from a year earlier, and 5 billion in units, -3%. With spend increasing and consumption decreasing, average unit prices have also seen significant change, with the average in pet retail rising from $5.46 to $6.20, a 13.7% increase.

Looking at grocery, drug and mass retailers, the Western states had the highest average unit price in pet retail, at $6.67. This region also had the highest average unit price increase at 15% – followed by the Midwest ($6.50), South ($6.37) and Northeast ($4.98).

In Canada, sales in pet retail were $2.5 billion (€2.3B) for over 377 million units. This is an 11% increase in value and a 1% drop in unit sales compared with a year before. As seen in the US, sales value is increasing substantially while unit sales are flat or decreasing. Average unit prices in Canada are no different either, increasing from $6.03 to $6.79, a 13% increase. Alberta is the region with the highest average unit price – at $8.34 – followed by Manitoba- Saskatchewan ($8.10), Ontario ($6.66), the Maritimes ($6.34), Quebec ($6.33) and British Columbia ($6.32).

Essential purchases

There has been a great deal of movement around products that are considered essential for pet owners – including dog and cat food, and cat litter – not only in terms of pricing but also in consumer preference.

In the US, cat consumables overall stayed flat in unit sales (+1%) but saw an increase in sales value (+13.8%). In dog consumables, units increased slightly (+4.7%) and sales value increased more significantly (+11.8%). Unit sales in wet food and dry food for both cats and dogs remained flat. Supply chain disruptions and rising prices certainly contributed to unit sale decreases for wet food, and dry food stayed flat as consumers resorted to larger unit sizes in order to get more value for money and decrease their number of shopping trips.

In Canada, dog food and cat food overall stayed flat in terms of unit sales (+/-0% and -1%) but sales value increased for both (+15%). Canned cat and dog food saw a very small decrease in unit sales (-1%) while dry food increased by 2.6%. In terms of average unit prices, there was an 18.5% increase in canned cat food and a 10.9% increase in dry cat food. Canned dog food saw a 7% increase in average unit prices, with a 15% increase in dry dog food. The assumption is that Canadians have also resorted to purchasing larger package sizes in order to make their dollar go further.

Cutting back on non-essentials

Consumers have recently been cutting back on pet products they consider to be ‘non-essential’. Interestingly, those categories all saw decreasing unit sales and increasing sales value.

So it seems like consumers are re-evaluating what their pets really need and whether certain items are worth a hit to the wallet.

Pet beds (-18%) saw the biggest decrease in unit sales in the US, followed by pet toys (-10%) and grooming tools (-5%). In addition, unit sales decreased slightly in both cat and dog treat categories (-1% and -4% respectively).

In Canada, categories such as pet care (-2%) and accessories (-5%) saw unit sales decrease or stay flat compared with the same period last year. Additional non-essentials such as dog and cat treats also experienced a drop in unit sales, -1% and -2% respectively.

As a result of the consumer’s current need to save money, many categories of pet products considered to be non-essential are most likely to remain flat or decrease in the near future.

Ways to bring back customers

Promotions are becoming a more popular vehicle to encourage customers back to bricks-and-mortar stores for their shopping.

In US grocery, drug and mass merchandise stores, over $3 billion (€2.7B) of total pet retail was sold on promotion. That includes everything from price reductions, featured displays and ‘buy one, get one free’ deals to endcaps.

This is a 12% increase from the same period last year, and the highest promotion turnover the pet retail sector has seen in years.

Over 654 million unit sales were on promotion, which is a 15% increase from the previous period. Pet supplies represented the largest amount of unit sales on promotion (14%), followed by pet food (12%) and pet treatments (8%).

In Canada, $617 million (€564M) of total spend in pet retail was on promotion, about 23%. This is also a 23% increase compared with last year. In terms of units, 30% of units were sold on promotion (117 million out of 379 million), a 2% increase from the previous period. Cat litter and dog food saw the greatest increase in promotions (representing 20.7% and 18.6% of units sold respectively).

Boom in private labels

There has been a boom in private labels in recent years, with many consumers buying these products as a core cost-saving strategy.

About 17% of pet care dollars and unit sales in the US come from private label products, with national brands combined at 83%. Pet supplies had the largest private label sales – 42% of total unit sales and 36% of sales value. Both cat and dog consumables saw an increase in unit sales, 17% and a 6% respectively, with the average unit price of private labels for each about $2 lower.

Pricey private labels in Canada

In Canada, the situation is completely different to the US, with the average unit price of a private label pet product at $10.77 while for national brands this is $6.27. There was also a much larger increase in the average unit price of national brands than in private labels (+12% vs +8%). That said, private label cat and dog foods saw unit sales increase (+10% and +23%), even though they are both more expensive on average.

Finding the right balance

The state of consumerism in the pet retail sector reflects a delicate balance between evolving spending patterns, the impact of inflation and the strategic choices consumers make to ensure the well-being of their pets within budget constraints.