U.S. Pet Market Growth in Pandemic Era

The impact of COVID-19 on the U.S. pet industry (products and services) was nothing like what seemed unavoidable during the early months of the pandemic. Instead, 2020 turned out to be a banner year for the pet industry, with overall sales growth of 9.3%, well above the 2014-2019 compound annual growth rate of 5.4%

Sales growth brought total U.S. pet industry sales to $107.3 billion in 2020, confirming the pet industry’s reputation for being recession resistance.

The market’s performance was, nonetheless, uneven between the retail product and service sectors, with the former up 15.8% in 2020 to $67 billion and the latter essentially flat at $40 billion, compared with the 4%-7% annual growth rates of previous years. These market size figures equate to average spending per pet-owning household of $1,460. By animal type, dog-owning households spent $1,274, while cat-owning households spent $942.

Brick-and-mortar pet product sales held up better than expected during 2020, growing 6.3%, thanks in part a significant assist from curbside or in-store pickup of products ordered online. But the big story is of course e-commerce. Already advancing rapidly even pre-pandemic, internet sales of pet products surged 46% in 2020 to reach $20.3 billion. E-commerce accounted for 30% of total pet product sales in 2020, up from only 8% in 2015.

E-commerce is the most prominent part of a larger “digital” pet care sphere. At its core, digital pet care is the virtual exchange of pet health-related data and dollars, and the market prospects of digital pet care are stellar:

- E-commerce: Arguably the most comprehensive and accessible source of pet care information, from brand comparisons to ingredient lists to consumer reviews, the internet continues to rapidly gain share of pet product sales.

- Veterinary telemedicine: With veterinarians the foremost source of pet care information, the advance into telemedicine was a natural even before COVID-19. Currently, about 30% of companion animal veterinary practices in the U.S. use telemedicine to some degree.

- “Smart” products: IT increasingly permeates the non-food pet supplies sector. Sales of “smart” pet products—those using Bluetooth, GPS, or RFID, and those able to connect to Wi-Fi or home networks—rose 26% in 2020.

Throughout the pandemic, a spike in new pet acquisition helped grow market sales despite the COVID-19 economic downdraft. Packaged Facts estimates that the pet-owning household base in the U.S. grew over 4% in 2020 to 56.4% of households. Moreover, COVID-related increases in multiple-pet ownership—owning several pets of one type and/or several types of pets—meant that the growth in pet population was more dramatic.

Packaged Facts estimates that in 2020 over 10 million dogs and over 2 million cats were added to the U.S. base of household pets.

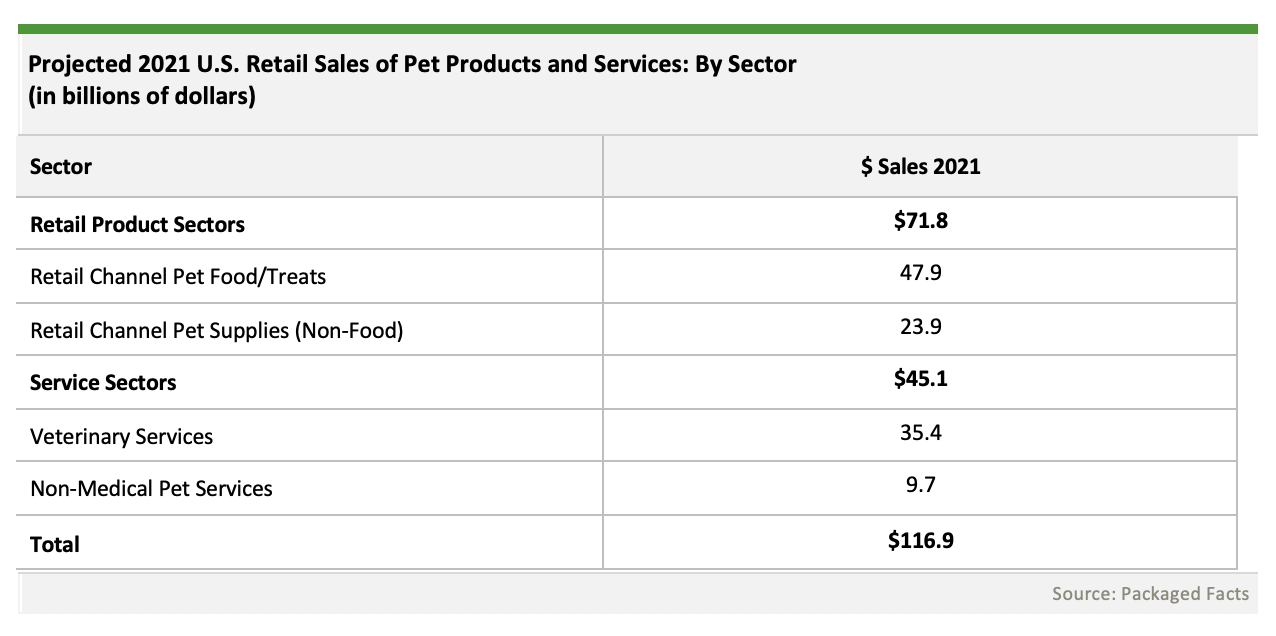

This pet population surge, coupled with a vigorous rebound for non-medical pet services, should yield very robust overall pet industry growth in 2021, on par with that of 2020, with overall pet industry sales projected to grow 8.9% to reach $117 billion.