What are the effects on the pet industry of inflation stabilization?

As inflation continues to level off from its historic 2022 high, PETS International takes a look at where and why prices are now changing in regard to the global pet sector.

Around the world, inflation has dropped significantly from its recent peak, when the impacts of pandemic-era disruptions coincided globally to cause a surge in prices.

Pet industry inflation – dubbed ‘petflation’ by some frustrated consumers – has come down in many areas, but not without leaving its mark on the industry.

Keeping afloat amid falling sales

The ongoing socio-economic and political consequences are manifold but, in the pet industry, the inflation wave struck unevenly across different sectors and is still causing headaches for consumers and companies, even as the outlook brightened in 2024.

“Inflation has driven a lot of pet businesses, whether it’s brands, service providers or bricks and mortars, to increase their prices just to stay open,” pet industry Marketing Consultant Jolanta Smulski, co-founder of the Pet Industry Network, says. “It’s not even about making a profit, necessarily, and it’s really affected the pockets of pet owners.”

The inflation wave that peaked in the US and Europe in 2022 drove lower sales for some companies, as consumers grew more cautious about spending on increasingly pricey pet goods.

In 2024, however, petflation cooled significantly – but only in some sectors of the industry and unevenly across markets.

Pet food inflation is declining more steeply than many other consumer goods categories. However, some unavoidable expenses like veterinary costs remain high.

US price change variations

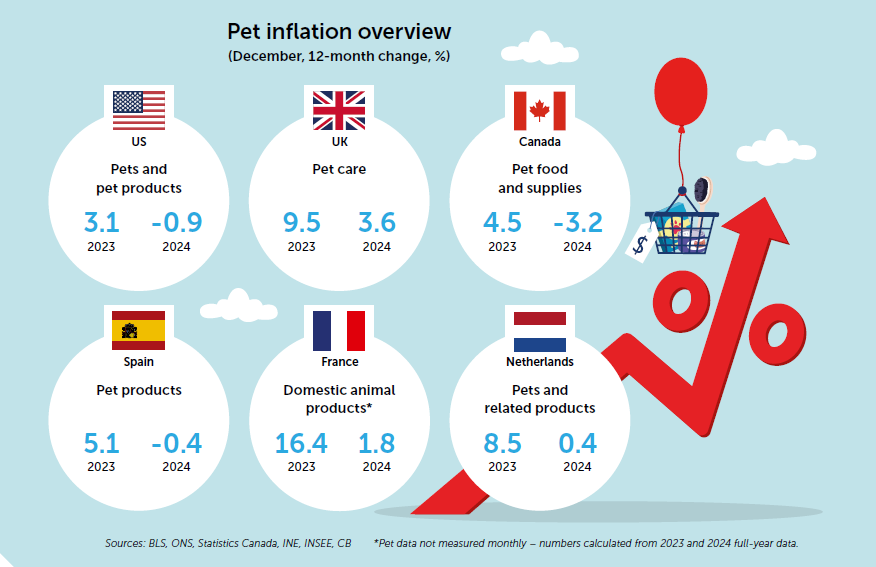

In the US, inflation on pets and pet product sales declined by 0.9% from December 2023 to December 2024, and by 0.4% in the final month of last year, according to the Bureau of Labor Statistics (BLS).

That’s down from a peak of 12% year-on-year (YoY) inflation in November 2022.

The decline was driven by pet food, which saw inflation drop by 1.7% last year. That put the sector into deflation territory for much of the year – prices dropped during 8 of the last 12 months.

Meanwhile, prices in other pet categories continued to rise in the US. The prices of pets, pet supplies and accessories increased 1.5% YoY, while veterinary and service prices rose 6.2% YoY.

Deflation poses a challenge

Lower food prices are a welcome relief for many consumers but could pose challenges for manufacturers and retailers.

Deflation can reduce profit margins for corporations relying heavily on pet food sales. If sustained, declining prices could force production cutbacks or layoffs.

No real universal trends

Pet food prices are returning closer to normal as the industry adjusts to the supply chain changes and increased wages that contributed to high costs over the past few years.

Similar consumer price numbers have been reported around the world. In Spain, pet products declined by 0.4% for the year, while veterinary service costs increased by 3.1%.

In Canada, pet food and supplies inflation declined by 3.2% from December 2023 to December 2024.

The trend is not universal though. In France, pet product prices increased by 1.8% in 2024, and in the Netherlands pet goods prices increased by 0.4%, though overall inflation remains high in the country at 4.1%.

In the UK, the Retail Price Index (RPI) for pet care dropped from a peak of 12% in 2023 to 3.6% in 2024, slightly above the overall RPI of 3.5%.

Comparing to other fast-moving goods

Barring veterinary costs, pet food and product costs have experienced more sharply declining inflation than many other similar consumer goods.

In the Netherlands, for example, many fast-moving consumer goods (FMCG) categories are experiencing higher inflation than pet goods, including the relevant meat and grocery markets, and in Canada pet food deflated more strongly than most other categories.

In the US, pet deflation of nearly 1% YoY in 2024 stands out among FMCG groups, though some categories like meats and some vegetables also saw sizeable declines. That may have contributed to deflation in pet food, as ingredient prices have declined or stabilized.

Pet goods prices are easing faster than most personal care products and groceries overall, which still faced slight price increases over the year.

Veterinary costs still going up

Despite the cooling inflation and an easing veterinarian shortage, vet costs were still rising by the end of the year.

Though few countries offer detailed consumer price information on veterinary services, those who do show costs rising above the overall rate of inflation.

Pet services in the US, including veterinary, increased by 6.2% last year, and in Spain – where overall pet product prices declined – vet costs rose by 3.1%.

In the Netherlands, vet inflation hit 7.4% YoY in December, down from a mid-year peak of 9.3%.

The high inflation is partly due to complex equipment plus medication that’s hard to produce or costly to develop.

However, experts have also pointed out other long-term trends in the vet industry that could be pushing up the prices.

Understanding high vet expenses

Pete Scott, President and CEO of the American Pet Products Association (APPA), says that while the rest of the industry adjusts to high wages and supply chain disruptions, the expense of getting into the veterinary sector is likely to drive up costs.

“When it takes somebody that’s an out-of-state student $300,000 (€288,000) to get through vet school, they’ve got a lot of debt,” he says. He also cites growing corporate ownership of vet clinics, which may be more profit-driven than independent local vets.

Firms like Shore Capital Partners, owners of the recently merged Southern Veterinary Partners and Mission Veterinary Partners, have snapped up hundreds of small clinics in the US, with an unclear impact on consumer prices.

A 2023 report by the Journal of the American Veterinary Medical Association found that vets working in corporate-owned practices reported “feeling more pressure than those in private practice to generate revenue and see more clients per shift”.

Prices are also generally reactive to how much consumers are willing to tolerate.

In an industry that can hold moral weight over consumers eager to take the best care of their pets, veterinary companies could perhaps raise prices to levels higher than shoppers in other sectors would be willing to pay.

This year and beyond

High inflation has caused belt tightening among consumers around the world. Whether or not that cautious spending continues remains unclear.

Tariffs and other possible political changes associated with the new Trump administration could spike prices, and the uncertainty surrounding the Republican President’s return to Washington has already contributed to weakening consumer confidence in the economy overall.

Other elections – and possible changes that come with them – could have similar impacts. But long-term trends in the pet industry, like humanization and premiumization, are likely to continue.

Despite the unclear economic future, Scott says things are generally looking up, as the world moves on from the post-pandemic inflation wave. “I don’t think it’s going to be a blockbuster year, but I think it’s going to be a better year,” he concludes.