Black Friday 2025: pet retailers bet on big deals ahead of the holiday season

Musti, Super Zoo, IskayPet, Petstop, and Dogman share with GlobalPETS how they drive sales during this week’s shopping event.

Black Friday has emerged as a key moment for the retail sector. According to consulting firm Bain & Company, retail sales in November and December 2025 are expected to climb 4% year-over-year (YoY) in the US, surpassing $975 billion (€846.4B).

The shopping event is also gaining popularity in Europe. A recent survey from e-commerce platform Klaviyo found that nearly 2 in 5 European consumers plan their holiday shopping around Black Friday and Cyber Monday.

GlobalPETS speaks with Musti (Finland) Super zoo (Czech Republic), IskayPet (Spain), Petstop (Ireland) and Dogman (Sweden) to learn how they are approaching one of the biggest sales events of the year.

Is it the most wonderful time of the year?

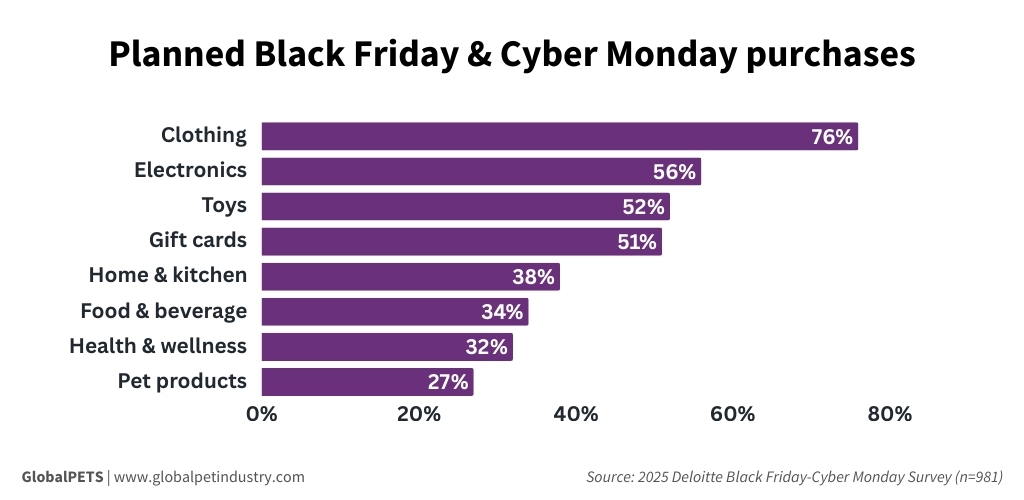

Despite an overall scale-back in spending, the pet products segment is holding relatively steady ahead of the holiday shopping season. According to Deloitte, 27% of consumers plan to purchase pet products during Black Friday and Cyber Monday, compared with 29% in 2024.

For Spanish pet retailer IskayPet, Black Friday is one of the key commercial moments of the year. This year, both of its banners, Kiwoko and Tiendanimal, implemented a three-phase structure to celebrate the occasion: Pre-Black Friday, Black Friday, and Cyber Monday.

The Pre-Black Friday period started on 18 November, with promotions up to 15% off food and accessories, with more discounts added after 26 November. “Throughout the campaign, we offer fixed discounts across categories and coupon rewards for purchases over €39 ($44.9),” explains Caroline Arrú de Caveda, Chief Marketing & Chief Customer Officer at Grupo IskayPet.

Musti has also been running Black Friday promotions over the previous week. “We run Black Week and Cyber Monday with some pre-offering, but we do not aim to extend the offer longer,” says Ellinor Persdotter Nilsson, the company’s Chief Commercial Officer.

The main reason is the so-called Omnibus Campaign Law, which requires retailers to display the lowest price at which a product was sold in the 30 days prior to a discount. According to Nilsson, this has made the process more complex, though she notes they put considerable effort into getting it right.

Discount strategies

Deciding how many and which products to discount is a key consideration for pet retailers when shaping their Black Friday strategies.

The approach of the Irish pet store chain Petstop has shifted this year. “Last year pushed a very wide range of offers. It worked, but it also stretched stock and made it harder for customers to spot the best deals,” says Owner and Managing Director Anthony Gallagher.

This year, the focus has shifted to the more profitable and popular ranges, with bigger discounts applied to fewer products. They also started planning earlier so the 14 stores the chain has across Ireland could build displays and avoid last-minute pressure.

Some other pet retailers, like Czech player Super zoo from Plaček Group, prefer consistency across their entire portfolio.

“We offer discounts on our whole assortment. This helps all customers find a good deal, including dog owners, cat owners, small pet owners and people interested in aquariums or terrariums,” says Executive Director Luboš Rejchrt.

Optimistic outlook

Early signs from the first few days of the promotion are positive, especially on their e-commerce platform. “We expect demand to increase as Black Friday approaches,” adds Rejchrt.

Dogman, which operates 48 stores across Sweden, Norway, Finland and Spain, also has high expectations for Black Friday. CEO Anton Andersson says that this year’s campaign is performing 5% better after a “tough year.”

“My expectation is that Black Friday will do 10-20% better in the Nordics,” he states. The Swedish pet retailer has increased the days with Black Friday offers from 7 to 10, including 2 weekends.

Some other players are showing a bit more caution, as many consumers wait until the last minute to make purchases. “Pre-Black Friday sales are slower than last year, but it’s clear customers are holding off and waiting for the main event,” notes Gallagher from Petstop.

The owner of the Irish pet retail chain says Irish pet owners are watching prices more closely yet still seek the same premium products.

Consumer needs

Pet retailers’ strategies for this global shopping event are primarily driven by consumer behaviour.

At Petstop, they designed their Black Friday campaign based on past sales patterns and what they know drives the highest returns.

“Customers want quick decisions, so we built the campaign around simple choices and strong value. This helps staff manage the rush and helps customers feel confident they’re getting the best prices without having to hunt for them,” states Gallagher.

Similarly, IskayPet based the discounts on their customers’ behaviour and preferences.

“Compared to last year, our strategy has evolved in a way that places even greater emphasis on understanding our customers. We study their behaviour, their preferences and the way they interact with our brands across channels, which allows us to design promotions and experiences that truly respond to what they value most,” adds Caroline Arrú de Caveda.

Discount levels also vary: Dogman offers up to 70%, while other retailers such as Super zoo and IskayPet cap theirs at around 50% and 33%, respectively.

Top performers

Premium pet products are taking the spotlight this Black Friday, as pet owners can purchase high-quality items at attractive prices.

At Super zoo, there has been a noticeable spike in interest for pet strollers. “Technology products are also growing in popularity, including automatic food dispensers, fountains and automatic litter boxes for cats. More customers are also buying super-premium food,” says Luboš Rejchrt.

In Spain, IskayPet noticed a “strong demand” for accessories in the days leading up to Black Friday, while Dogman in the Nordics highlights that non-edible items are performing particularly well in online sales.

In addition to food and cat litter, Musti expects strong performance in higher-priced accessory categories like grooming and pet tech, as well as in the Christmas and outdoor winter assortments.

“Toys, beds, and seasonal products also receive steady discounts, as we see a trend of customers starting their Christmas shopping early,” adds Gallagher from Petstop.

Private label and bundles

The Irish pet store chain also put more focus on its own brand ranges and marked down a few older lines further to clear space for new stock coming in for December and the new year.

Bundles are also attractive to pet parents. “We understand that bulk buying plays a bigger role this year, with savings increasing when customers pick up larger bags or multi-packs,” adds Gallagher.

The Nordics show a similar pattern. Dogman notes that shoppers are increasingly drawn to bundle deals, while Musti highlights a split between bargain hunters and those going for premium products and special promotions.

While each retailer approaches Black Friday with its own strategy, understanding the customer is key to succeeding in a highly competitive landscape.