Country report: Brazilian pet market set for modest 3.5% rise in 2025

With revenue expected to hit over $13 billion, the sector continues to grow, though at its slowest pace since 2019. GlobalPETS has more.

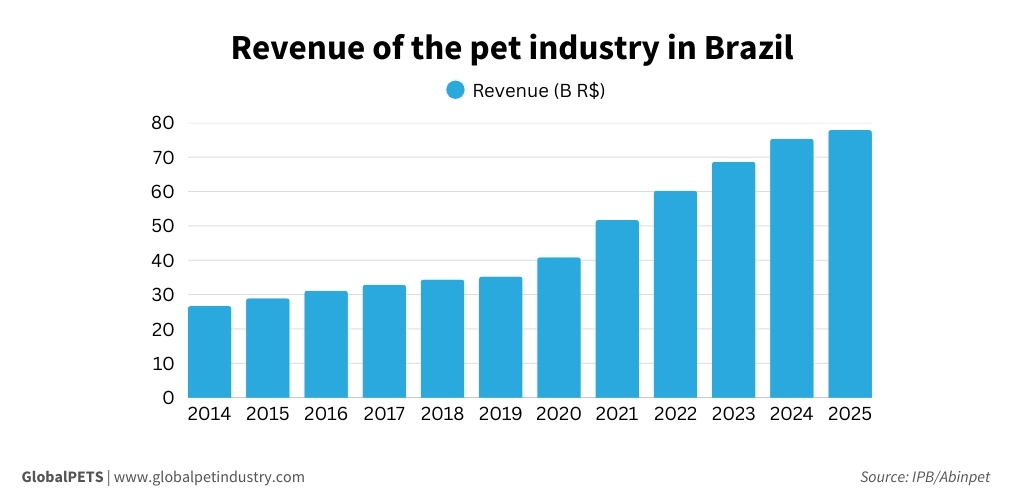

Industry associations Abinpet and the Instituto Pet Brasil (IPB) forecast that the Brazilian pet sector will reach R$78 billion ($13.3B/€12.3B) in revenue in 2025, reflecting a 3.5% year-on-year (YoY) increase from the R$75.4 billion ($12.8B/€11.83B) recorded in 2024.

Revenue for 2024 fell short of earlier projections, which had estimated it would surpass R$77 billion (approximately $14.1B/€13B).

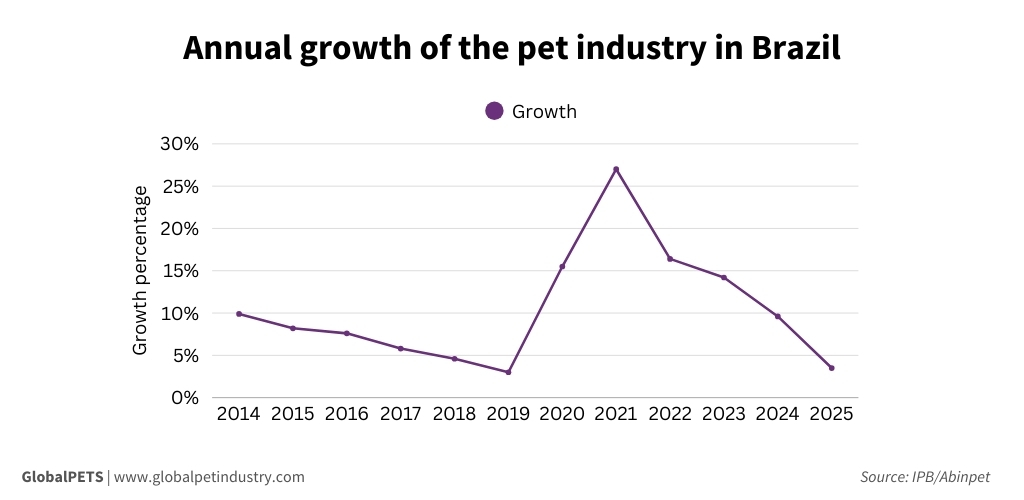

However, despite the growth this year, the projected increase marks a 6-year low, following a 15.5% YoY growth in 2020. The slowdown is attributed to rising inflation, volatile exchange rates and weaker consumer spending.

In particular, exchange rate fluctuations affect the cost of essential pet food ingredients, such as vegetable and animal flours, which are classified as commodities and priced in foreign currencies, making them sensitive to the value of the US dollar.

Competitiveness

“Our sector is robust, but the downward revision of the revenue projection and the drop in productivity in 2024 had already been a warning that we need a more competitive environment for companies and a more attractive market for the end consumer,” says José Edson Galvão de França, CEO of Abinpet.

De França also states that companies need “incentives such as reduced tax burdens” to improve productivity and remain competitive.

Although total revenue has steadily increased since 2013, the annual growth rate has been declining since it peaked at 27% in 2021, dropping to 16.4% in 2022, 14.2% in 2023, 9.6% in 2024 and 3.5% in 2025.

Revenue by sector

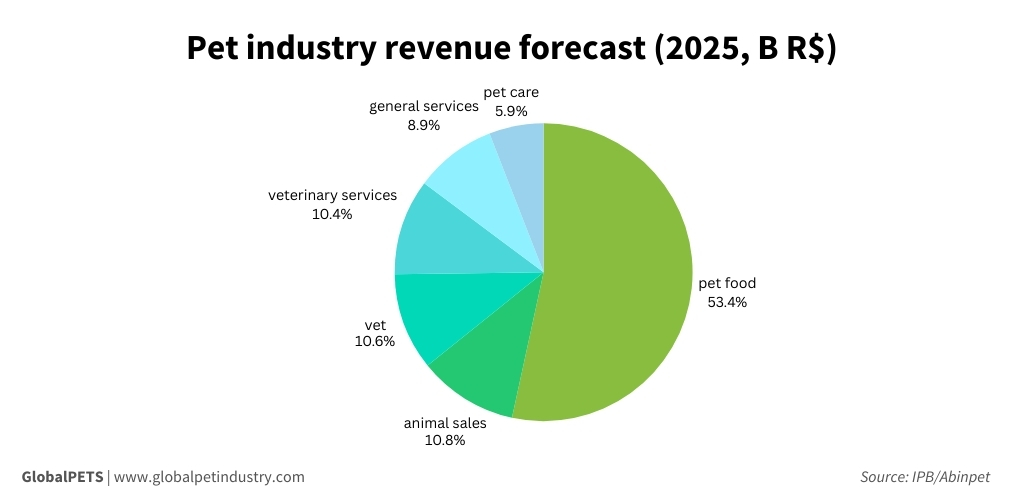

Abinpet and IPB forecast that pet food will remain the largest category in the pet industry, accounting for 53.3% of the market. Revenue is expected to reach R$41.6 billion ($7.65B/€7.05B), a 1.95% increase compared to 2024.

Animal sales are expected to follow with a market revenue of R$8.5 billion ($1.6B/€1.4B), up 1.96% YoY. This will account for 10.9% of the total pet industry.

Veterinary products are poised to become the third largest category, with R$8.2 billion ($1.5B/€1.4B) in revenue, a 5.01% increase from 2024.

Despite accounting for only 9% of total revenue, general services are expected to post the highest growth rate, rising 7.7% to R$7 billion ($1.3B/€1.2B).

Retail channels

According to IPB, small and medium-sized pet shops accounted for 48.5% of all retail sales in 2024, generating R$36.6 billion ($6.7B/€6.2B).

Veterinary clinics and hospitals followed with 18% of sales, totaling R$13.4 billion ($2.5B/€2.3B), while pet megastore chains held a 9.3% share, generating R$7 billion ($1.3B/€1.2B).

Within the e-commerce segment, specialized virtual pet shops led in revenue share, accounting for 40.6% at R$2.3 billion ($421M/€389M).

These were followed by the online stores of pet megastores, which generated 26.8% at R$1.5 billion ($275M/€254M), and the virtual stores of small and medium-sized pet shops at 21.5%, with R$1.2B ($220M/€203M).