Digital pet landscape in the UK shows shifting consumer trends

Herd’s latest report reveals how UK pet owners search, shop and adopt new digital platforms for pet care.

With a surge in the UK’s pet population, according to a report from the English marketing agency startup Herd, the country also registered a monthly average of 8.8 million pet-related organic Google searches between 2024 and 2025.

According to Jack Hendry, Senior Client Strategist at Herd, higher quality, sustainable and convenience purchases were the key trends identified across all sectors of the market. “As pet ownership moves into younger generations, attitudes toward their pets have changed. They’re truly a core part of families, and this is going to continue to be expressed in the products they seek out,” Hendry tells GlobalPETS.

Dog owners search accessories…

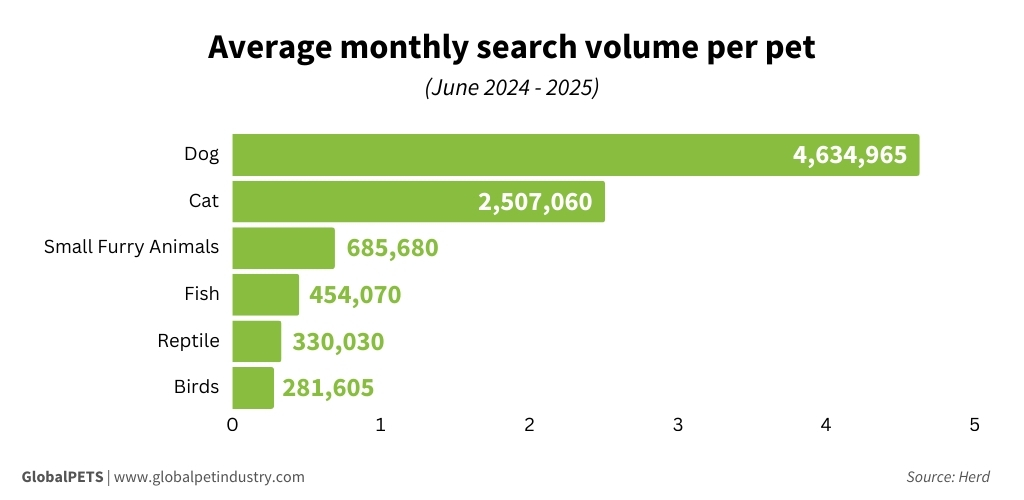

The general searches, including acquisition, food and accessories, were dominated by dog-related topics (4.6 million), followed by cats (2.5 million), small furry animals (700K), fish (450K), reptiles (300K) and birds (280K).

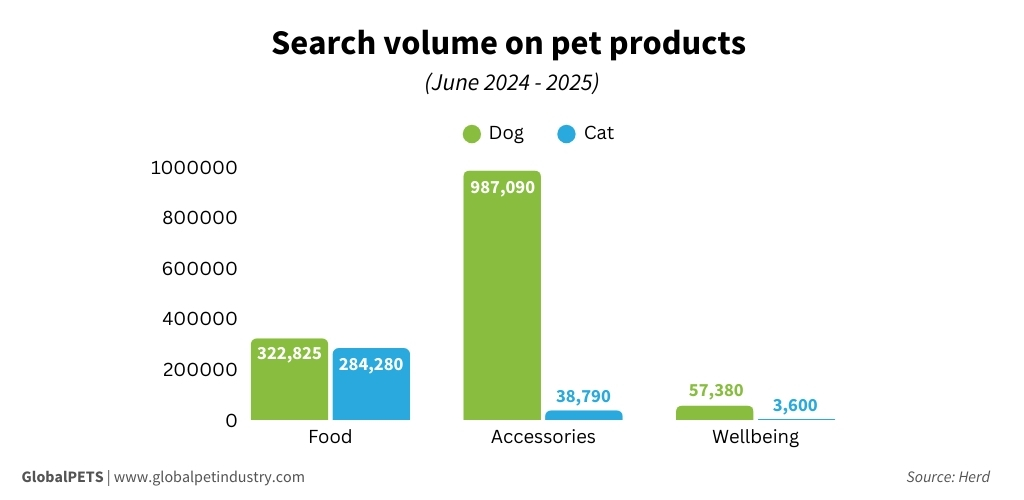

In the dog category, search volumes for accessories dominated, with nearly 1 million monthly searches, primarily driven by high interest in beds, crates, travel, coats and clothing, harnesses and toys.

The second most searched category was dog food, with an average of more than 320,000 searches per month. Here, pet owners in the UK were most interested in treats, raw and BARF, generic, dry and puppy. Meanwhile, emerging interests included joint care, coat and skin, meat-free, freeze-dried, frozen, hypoallergenic and subscription.

…And cat owners search food

The trend among cat owners was the opposite: the search for food dominated overwhelmingly, with 284.2K queries, versus 38.7K for accessories and only 3.6K for health and well-being.

According to Herd, it is driven by the interest in catnip, cat food and kitten food.

Market growth

When it comes to consumer preferences, the data revealed that the fastest growing categories were: subscription dog foods, and fresh and human grade (30%); personalized and breed specific (25%); raw and BARF, and sustainable (20%); health-focused (18%); and premium treats (15%).

In terms of pet products, Herd noted that smart pet accessories showed the highest growth (18%), followed by toys and eco-friendly accessories (12%), hygiene and grooming (9%) and training equipment (8%).

“Brands that have seen the largest surge in search demand typically offer subscription products combined with their higher-quality, fresh ingredients – a pairing that aligns with growing customer expectations,” the report states.

To Hendry, brands will profit from online search trends if they know how to balance attention between emerging categories and those with the highest current volumes. “Finding that balance between taking advantage of the short term whilst monitoring and adapting to the longer-term trends” is key, it says.

AI enters the game

Aside from Google, pet owners are also turning to generative AI platforms for their search needs. As of July 2025, ChatGPT generated about 2.95 million organic searches, much more than other platforms such as Google’s Gemini (591K), Microsoft Copilot (585K), Perplexity (305.7K) and Claude (217K).

“Generative AI and advanced automation are transforming how brands connect with audiences. While organic search still relies on keywords and rankings, it is increasingly shifting toward zero-click results, with users getting answers directly and even converting within AI engines,” says Gareth Allen, Managing Director of Herd.