Joint health tops dog supplement demand in the US

Kibble and flea and tick products have declined since 2018, while allergy medication usage has doubled, according to a new industry survey.

The American Pet Products Association’s (APPA) 2025 Dog & Cat Report revealed a significant increase in overall supplement use among dog owners, with 53% giving supplements in 2024, up from 34% the previous year.

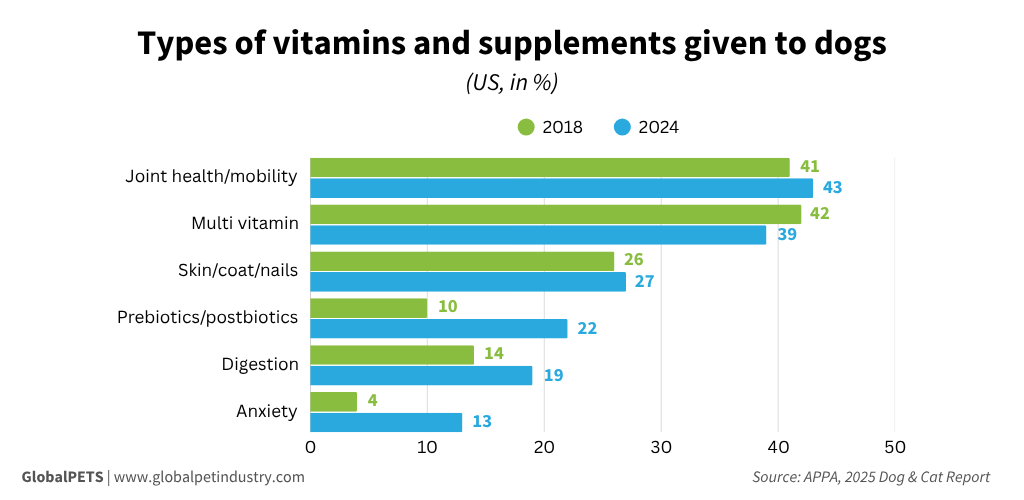

According to the data, joint health and mobility supplements were the most popular among dog owners in the US, increasing to 43% in 2024 from approximately 40% the previous year. Since 2018, demand for joint health supplements has remained relatively steady.

Multivitamins showed stable demand, rising to 39% in 2024 from 35% in 2023, following several years of consistent usage at around 40-41%. Pre- and probiotics registered an upward trend, growing from 10% in 2018 to 22% in 2024.

Digestion supplements were used by 19% of American dog owners in 2024, reflecting steady demand. Immune boosters followed at 17%, maintaining moderate usage. The allergy supplement category, introduced in 2023, held steady at 17% in its second year.

In contrast, anxiety/calming supplements declined to 13% in 2024 from 16% in 2023, and are now significantly lower than 2018 levels. Skin, coat and nail supplements held steady at 27%, maintaining their position as the third most used supplement type.

Pet food

When it comes to diet, dry food remains the most commonly fed, though it is gradually losing ground.

In 2024, 65% of dog owners in the US reported feeding dry food most often, down from 74% in 2018.

Fresh food has steadily gained traction, with usage doubling from 4% in 2018 to 8% in 2024. Canned food remained steady at 9%, while semi-moist and raw food options stayed niche, used by 5% and 3% of owners, respectively.

Flea and tick

Flea and tick medication use dropped to 62% in 2024, down from a recent high of 65% in 2023. Tablets remained the most popular flea and tick treatment, with more than 4 out of 10 (44%) owners giving these products to their pets.

Interest in all-natural or chemical-free flea and tick products also continued to rise, increasing to 21% in 2024 from 16% in 2018.

Other product types held relatively stable. In 2024, 24% of dog owners used collars (down from 27% in 2018), 23% used shampoos (down from 30%) and 20% applied topical skin solutions (down from 27%). Use of yard treatment products declined more noticeably, from 17% in 2018 to 13% in 2024.

Medications

While usage of some preventive medications declined, others saw moderate growth. Antibiotic use rose to 12% in 2024, up from 5% in 2018.

Allergy medications also increased to 12%, up from 4% over the same period. Ear treatments reached 13%, while pain relievers were given by 10% of owners, both reflecting gradual increases in chronic care and symptom management.

Heartworm medication usage experienced a sharper decline, dropping to 27% in 2024 from 33% in 2018, indicating a significant year-over-year decrease.