The pet industry in Spain

An overview of the Spanish pet industry in 2024, including the most recent statistics and trends.

Spain is known for its love of pets, and the country has seen a remarkable increase in pet ownership in the past couple of years.

According to recent data from the National Association of Pet Food Manufacturers (ANFAAC), more households in Spain have pets than children under the age of 15.

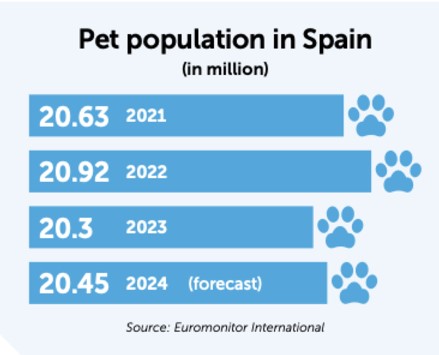

This highlights the growing significance of pets in Spanish homes, with the pet population now expected to exceed 20,45 million in 2024.

Spending habits of Spanish pet owners

Nearly half of people in Spain share their homes with a pet, according to a survey of 700 respondents by AEDPAC. Moreover, 8 in 10 pet owners consider their pets part of the family.

This insight points to an estimated 39% of Spanish households that nurture pets as if they were kids. Dogs and cats remain the most popular pets, contributing to increased demand for pet services and supplies. In many cases premium, or even custom-made.

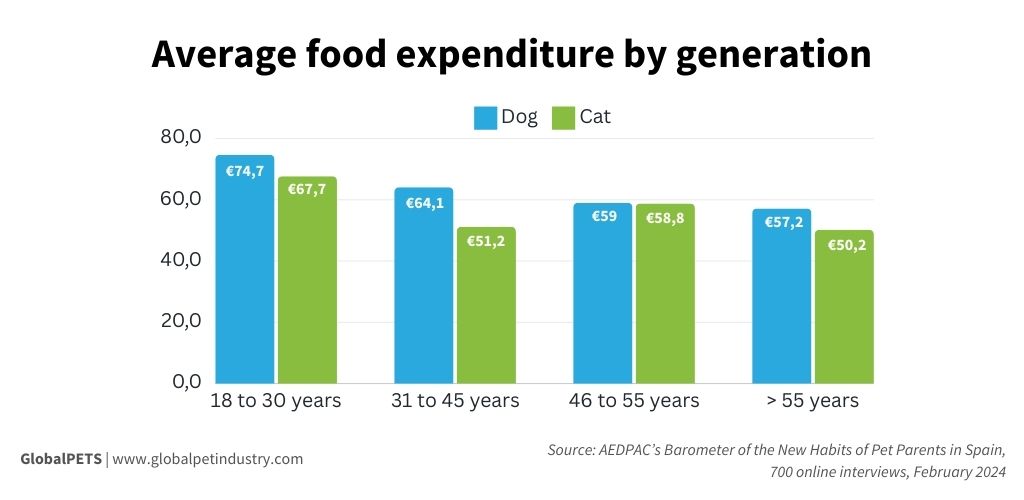

A study from the Spanish pet association, AEDPAC, also shows how much different generations in Spain spend on their pets on average:

Where do Spanish pet parents shop?

A recent study on Spain’s pet owners showed that more than half of them mostly shop in brick-and-mortar pet stores, however, there are some differences in this behavior between different types of pet parents.

Whether it’s bought online or offline, dry and wet pet foods dominate the market. Accounting for 71.54% of the total market share in 2022, it is projected to grow from an estimated $2.63 billion (€2.43B) in 2024 to $3.24 (€2,99B) billion by 2029.

Premium customized pet foods, health trackers, and interactive toys designed to meet cognitive needs exemplify the industry’s adaptation to consumer demands. E-commerce platforms enhance the market by providing convenient access to these products.

Spanish pet food inflation and economic impact

The pet food inflation in Spain surged by 4.5% in January 2024, but the rate nearly halved by February and stood at 1.9% in May, showing a significant decline in inflationary pressures on pet products.

Spanish consumers have adapted to the lower prices, by increasing their shopping frequency, with an average of 181 trips to supermarkets last year, up from 162 in previous years.

In 2023, Spain’s pet food imports were mostly from Germany, totaling approximately $49.6 million (€45,8M).

The primary export destinations for Spanish industrial production continue to be the European Union, the rest of Europe, the Middle East, the Maghreb, the rest of Africa, America, and Southeast Asia.

Key market investments and sustainability

Spain has become a prime choice for many manufacturing companies in the pet industry looking to expand.

Pet food manufacturer Picart has opened a new 12,000-square-metre production plant in Llinars del Vallès, Barcelona, following a $12.9 million (€12M) investment in 2023.

Similarly, Eviosys, the largest metal food can manufacturer in the EMEA region, has invested $8.5 million (€8M) to expand production at two Spanish facilities. This move aims to meet the rising demand in the pet food and fish markets.

Spain is also playing a key role in the EU-backed ZEST project, which repurposes food waste, such as mushrooms, into nutrient-rich pet food ingredients, helping to promote a more sustainable pet industry.

From pet care to pet travel

Numerous scientific studies highlight the emotional, health, and economic benefits of having pets. Recognizing these advantages, the Spanish public train operator Renfe has, since 2023, permitted the transport of pets on all high-speed routes.

This policy includes dogs, cats, ferrets, guinea pigs, hamsters, and rabbits under 10 kilograms. Pet owners can now enjoy the company of their furry friends during their travels for a fee of $10.8 (€10), per trip, making it more convenient to keep their beloved animals close.

To meet the growing demand from passengers traveling with pets, Barcelona-based low-cost airline Vueling has partnered with Belgian pet food company Edgard & Cooper to offer ‘buy-on-board’ pet treats, making it the first airline in Europe to do so.

In 2023, Vueling also increased the number of in-cabin pets allowed per flight from 3 to 5, accommodating dogs, cats, birds (excluding birds of prey), and turtles/tortoises weighing 8 kg or less in specific carriers.

Spain’s growing pet industry reflects the nation’s strong connection to animals and the increasing role pets play in Spanish households. The country is making strides in pet care innovation and support, highlighting the important place pets hold in modern society.