2015-2025: A decade of petflation

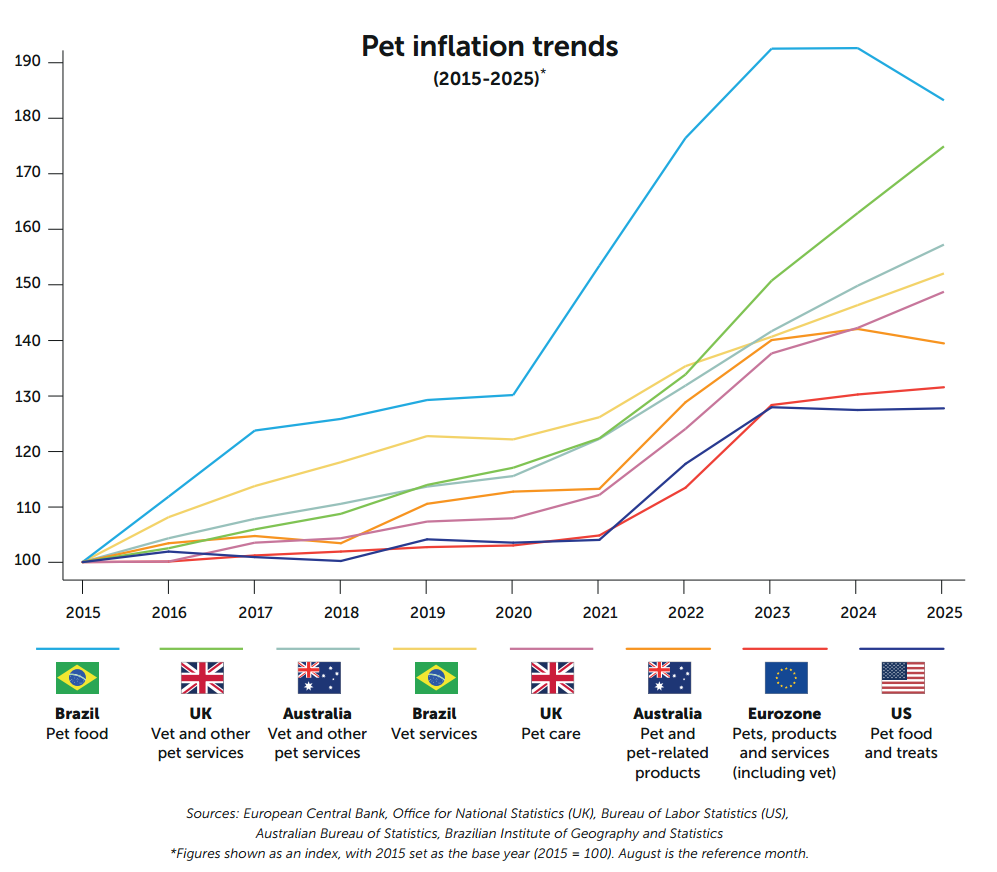

A PETS International analysis shows that pet-related price increases have been particularly steep in Brazil, the UK and Australia over the past 10 years.

The cost of keeping a pet has surged over the past decade in some of the world’s major economies. Official data from Europe, the UK, the US, Brazil and Australia shows that inflation related to pet products and particularly veterinary services has put mounting pressure on households.

The Eurozone and the US

In the Eurozone, the Harmonized Index of Consumer Prices indicates that products and services related to pets, including food and veterinary care, rose by 31.5% between 2015 and 2025. This figure is higher than general inflation, which grew by around 30% in the same 10-year period.

In the US, Consumer Price Index (CPI) figures from the Bureau of Labor Statistics show the same spiking trend for pet food and treats. The historical series has December 1997 as the base 100. Since then, the increase has been significant, reaching more than 191 in August 2025.

This number is lower than during the peaks of over 192 points recorded in 2023 but remains high. From August 2015 to August 2025, the average increase in the price of pet supplies has been 27.7%.

Brazil, the UK and Australia

In Brazil, the official inflation index tracks three prices linked to the pet market: treatment (clinics), hygiene services and food. All grew above the general index that measures consumer inflation in the country. Between 2015 and 2025, general consumer prices increased by 68.8%. Pet treatment rose less than that (52%), but for pet food the surge was considerable (83.2%), indicating significant pressure on pet owners.

The scenario is not much different in the UK. In the same period, cumulative inflation for pet care was 48.7% according to data from the Office for National Statistics (ONS). The index for veterinary and other pet services shows a surge of 74.9% between August 2015 and August 2025. Australia follows a similar pattern, although at a lower level. Over the past 10 years, prices for veterinary and other pet services have increased by 57.2%, according to the Australian Bureau of Statistics (ABS). The jump in pet and pet-related products was slightly smaller at 39.4%.

A closer look at 2025

Within the analyzed 10-year period, the market hit an inflation milestone: post-pandemic recovery, which led to record high prices in 2022. So although the jump is large, and higher than the general indices, pet inflation did start to normalize last year. Comparing 2023 and 2024 with 2025 helps to clarify the recent price trajectory, with most regions seeing some relief in cost upticks, while the UK shows an acceleration.

In Brazil, for example, pet food in 2025 was 4.9% cheaper than in 2024. Even though prices for pet treatment have been increasing (3.9%), this is less than in the previous year (4.1%). In the US, overall pet and pet product costs remained unaltered in the past two years. In the UK, however, pet care costs still increased (4.6%), at a rate higher than the previous year (3.3%).

Europe and Australia showed similar patterns: overall inflation for pet products and veterinary services continued to rise, but at a slower pace. In Europe, the annual rate declined from 1.4% in August 2024 to 1% in August 2025. In Australia, inflation eased from 5.8% in Q3 2024 to 5% in Q3 2025.

Almost all economies recorded lower price growth compared to the post-pandemic peak. “We’ve seen inflation really come down on all things like food and supplies, and prices have started to stabilize in that area,” says Andrea Binder, VP and Pet Industry Insights Leader at Nielsen IQ.

The high cost of vet services

According to Binder, veterinary care is one of the sectors where prices have yet to stabilize, with the US seeing an increase of around 6-7% versus 2024.

The American Veterinary Medical Association (AVMA) attributes rising veterinary fees to a combination of higher medical supply and pharmaceutical costs, increasing operational expenses and ongoing investment in advanced technologies. Longer pet lifespans further add to the trend, leading to more frequent and complex medical needs over time.

In the UK, consumers complain about poor cost transparency, as well as a lack of alternative and affordable treatments. In response, the Competition and Markets Authority (CMA) launched a market investigation earlier in 2025 to address “concerns” in the sector, including medicine being sold at up to three to four times the purchase price.

In October, the authority published its provisional decision in the case. The CMA found that pet owners pay, on average, 16.6% more at practices belonging to large veterinary groups than at independent practices, and that profits across a significant portion of the market are well above levels that would be expected under effective competition.

Rising price of pharmaceuticals

In Australia, a report by pet health tech company PetSure shows that the rising cost of pharmaceuticals, “which make up around 30% of total veterinary expenses” is a point of concern. In 2023, the gap between veterinary treatment inflation and average consumer price rises widened significantly, with veterinary costs rising faster than general inflation.

“While this gap narrowed slightly in 2024, veterinary pharmaceutical costs continued to outpace the broader cost of living,” PetSure says. According to ABS, Australia’s CPI rose by 2.4% last year, while pharmaceutical product price rises were higher, at 4%.

Knock-on effects

In the face of high inflationary pressure, consumers tend to change behavior and that can even affect pet ownership. They may switch to cheaper products, buy less often in larger volumes and postpone appointments.

This is already reflected in some companies’ investment decisions. In an interview with the UK newspaper The Financial Times, the CEO of Mars points to inflation’s trajectory as a driver of consumer spending cuts and a reason for the focus on diversification to reduce exposure.

It also represents greater pressure and potential risk. Meanwhile, General Mills reports modest expectations amid ongoing inflation in input costs and competitive pricing pressures.

In its Q3 2025 earnings report, Nordic pet retailer Musti Group flags concerns about both rising input costs and weakening consumer sentiment.

The company notes that higher energy, raw material and freight expenses have pushed up its cost base, leading to increased retail prices in order to protect profitability. “Higher inflation will also contribute to higher interest rates. These may have an impact on consumer behavior and price competition,” the company warns.

Although the accumulated inflation of pet products weighs on consumer pockets, price rises show signs of slowing down in most major economies, at least in terms of goods. Meanwhile, with increased consumer sensitivity and regulatory pressure on the veterinary segment, the sector will have to find a balance between cost recovery and affordability.