Premiumisation in pet food: beyond ingredients

For what kind of food is a pet parent prepared to spend more than usual? The key to a new successful product may well be its resemblance to human food.

Premiumisation trends: alive and well

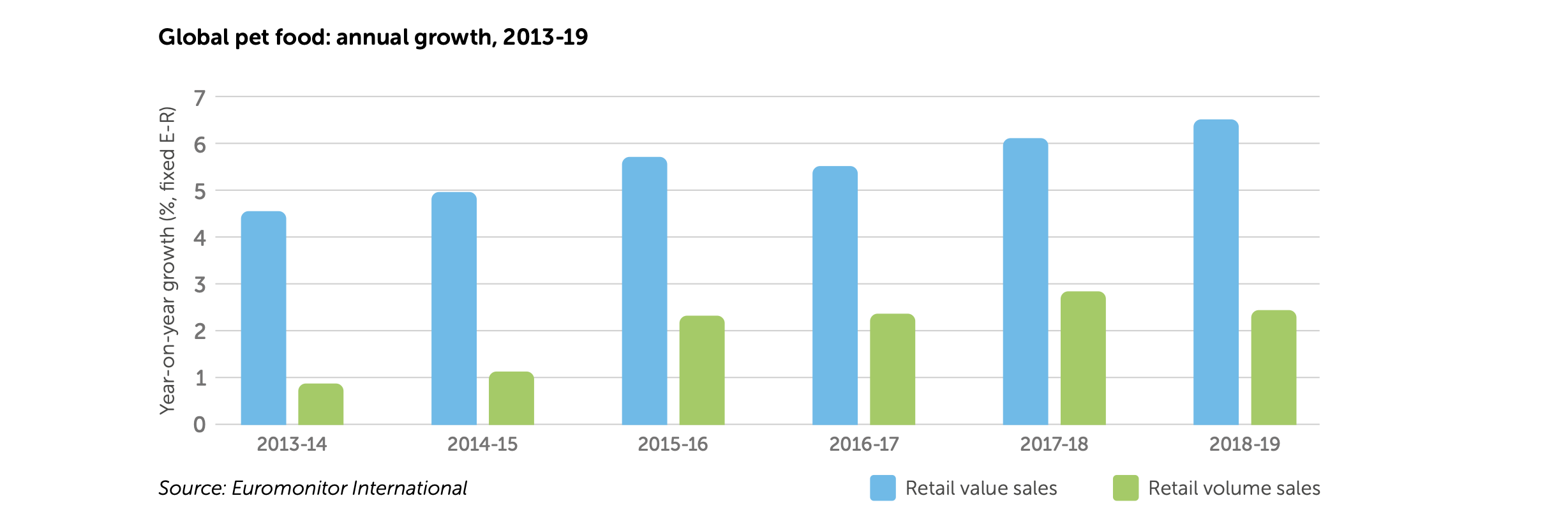

Premiumisation trends within global pet food are alive and well. After setting a new high in 2018, the industry topped itself again in 2019 with value sales growth reaching 6.5%. Emerging regions like Asia-Pacific, Eastern Europe and Latin America continued to post double-digit gains, while North America – the world’s largest market – nearly matched the global figure with 5.8% growth. Even Western Europe, the slowest-growing region in 2019, recorded its strongest growth since 2015.

Impressive value growth continues despite modest volume increases. While pet population and shrinking dog sizes still limit potential volume growth, people’s willingness to spend more money on premium food continues to expand. Pets are increasingly viewed as family members by owners who want quality food to keep their companion healthy, active and strong.

Premium frontiers: going for fresh

For decades, ingredients have been the primary battleground in premium food. Brands encourage shoppers to compare their ingredient list to competitors as a key point of differentiation. Ingredient-focused messages are seen in many advertising and marketing materials. While specific ingredient trends have changed over time – functional, high-meat, local, organic and sustainable traits are currently trending – this overarching focus on product formulation has not wavered.

As the industry moves into a new decade, there are signs that premium pet food may be on the precipice of a transformational shift. Owners are moving beyond ingredient lists to gauge the physical appearance of pet food. In many ways, the processing method used is becoming as important as the ingredients themselves.

This change is rooted in broader dietary shifts. Dried and processed food has generally fallen out of favour as consumers gravitate towards chilled or refrigerated offerings that maintain a ‘fresh’ or ‘less processed’ image. Across the supermarket – from dips and ready meals to breakfast cereals and snack bars – shoppers increasingly view shelf-stable categories in the centre of the store as more ‘processed’, with longer ingredient lists, than chilled products that reside alongside store perimeters with fresh produce, bakery and meat.

New formats driving growth

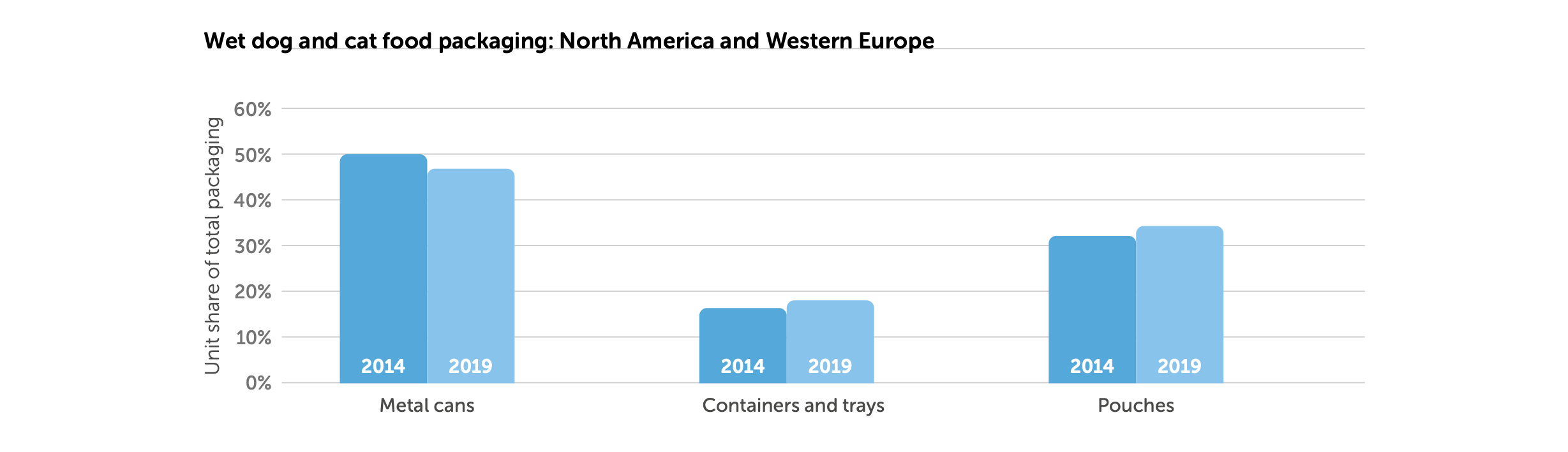

Dry food commands the lion’s share of global pet food sales, comprising nearly 70% of the market in 2019. As consumers look for less processed food, however, the opportunity is ripe for new formats. Wet food has been one important innovator on this front. Brands are developing product forms that resemble human foods. These could be soups, stews or fillets and are shifting from traditional metal cans (associated with processed food) to pouches, plastic containers or trays that resemble human food packaging.

Biologically Appropriate Raw Foods (BARF) also continue to gain ground as minimally processed alternatives to dry kibble. These foods appeal to pet owners by mimicking the carnivorous diets that the ancestors of dogs and cats ate in the wild. Disruptive brands like Chunky Menu Natural (Colombia), Fanni’s Barfshop (Hungary) and Barfbox (Thailand) continue to witness strong growth with freeze-dried or frozen offerings that sell at high price points.

Chilled/fresh pet food represents another major growth frontier with products that are ‘gently cooked’ and refrigerated to maintain freshness. These brands are preservative-free, claim to maintain the nutritional integrity of ingredients, and more closely resemble human food in appearance. Brands like FreshPet (US) and Billy + Margot (Australia) continue to expand their presence in refrigerators within retail outlets.

The explosion of direct-to-consumer brands in e-commerce has also driven tremendous growth for fresh pet food. Online-only brands like DogChef (Belgium), Lyka (Australia), The Farmer’s Dog (US) and Butternut Box (UK) offer subscription-based delivery of fresh pet food to a customer’s doorstep. Online business models also allow for customisation, with recipes designed for each animal’s breed, age, activity level, allergies, et cetera.

Judging by appearances

The future of premium pet food will increasingly be defined by physical format. Regardless of ingredient claims, dry kibble faces threats from wet, frozen, freeze-dried, refrigerated, fresh or chilled products that look like human food, claim to be less processed, and mirror the choices pet owners are making in their own diets.