South America has been in the news due to political instability in Brazil and Venezuela. In terms of pet care, however, South America has been the star performer.

Growing strongly

This performance is reflected in South America’s 5.7% value CAGR in the 2011-2016 period. Led by Brazil, Argentina and Mexico (which accounted for 83% of regional growth), South America has been the best-performing region, with real value sales of pet care up 32%, to $10 billion (€8.9 billion), between 2011 and 2016.Brazil and Mexico are the two main markets, with total value sales of well over $2 billion (€1.8 billion), followed by Argentina, Chile, Venezuela and Peru – the latter three with sales well under $1 billion (€889 million). Dogs are the most popular pets, with Brazil ranking second in terms of dog population and Mexico fourth, while Chile is the highest of 54 markets in percentage terms, with more than half of households owning a dog.

Brazil and Mexico in the lead

Despite all the economic hurdles in Brazil, where economic recession is expected to continue in 2016 and real GDP is projected to contract by 3.2%, other than the US, the country posted the greatest actual growth in value terms in 2011-2016, with additional sales of $760 million (€676 million) at constant 2016 prices. This is testament to the increasing humanization of pets and how consumer education is starting to pay off. Brazil is the largest pet care market in South America and one of the most mature ones. ‘Other pet products’ is expected to be one of the fastest-growing categories in 2016, as more Brazilians take to pampering their pets.Also in South America, Mexico, the region’s second largest pet care market, has experienced a good development, particularly in pet food, with current value gains of $675 million (€600 million) between 2011 and 2016. After the implementation of 16% VAT on pet food, which, in 2014, placed the industry under strain, pet food returned to positive growth in volume terms. Mexico is now among the top ten largest pet care markets. Dogs are the most popular pets, with dog food growing by 50% between 2011 and 2016, and humanization of pets set to gain momentum. Pet care development in the country has also been boosted by the strong development of superstores such as Petco, which entered the market in 2013. Internet retailing has been boosted, not only by Amazon, which made inroads in June 2015, but also by Petco, with its online shop. According to the Asociación Mexicana de Internet (AMIPCI), by the end of 2014 there were 54 million internet users in Mexico.

Varied scenario

In Colombia, the economic slowdown had an impact mainly on premium categories, more sensitive to changes in the economic cycle. On a similar note, in Argentina, the economic crisis and one of the highest rates of inflation in the world, surpassed only by Venezuela (and Ukraine), according to IMF figures, negatively impacted pet care in Argentina. After taking office in December 2015 the newly elected president eliminated barriers to imports, which had negatively affected supply in 2015. This will allow companies to import pet care products and introduce new brands. In Venezuela the domestic manufacture of pet care products in 2016 continued to be hampered by shortages of major raw materials and inputs, in turn leading to the reduced availability of various products and brands. Buyers could not find many of their preferred products and therefore volume sales declined. Both domestic producers and importers were unable to meet consumer demand, leading to many pet care categories recording a sharp decline in volume sales.

Mixed prospects

South America is expected to continue to enjoy a strong humanization trend, which, together with socio-demographic factors, will continue to drive the pet care market. An expected 5% value CAGR in South America for the next five years will generate gains in excess of $5 billion (€4.4 billion) over this period. Scenarios will remain varied, as Brazil is still expected to post some of the highest absolute value gains between 2016-2021 (right after the US), and Mexico, shrugging off the impact of the imposition of VAT on pet food for the first time in 2014, is set to expand by 38% as more owners feed their pets prepared products. However, some challenges will remain for the pet care industry as the region is plagued by economic and political instability.

The latest articles

Austria lists top retail and services firms, including pet players

These are the pet businesses that have ranked the highest in terms of customer satisfaction, customer service and affordability.

4 out of 10 British owners are in favor of work leave to take care of their sick dogs

A recent survey shows wide support for pet parents to enjoy the same rights as employees with children.

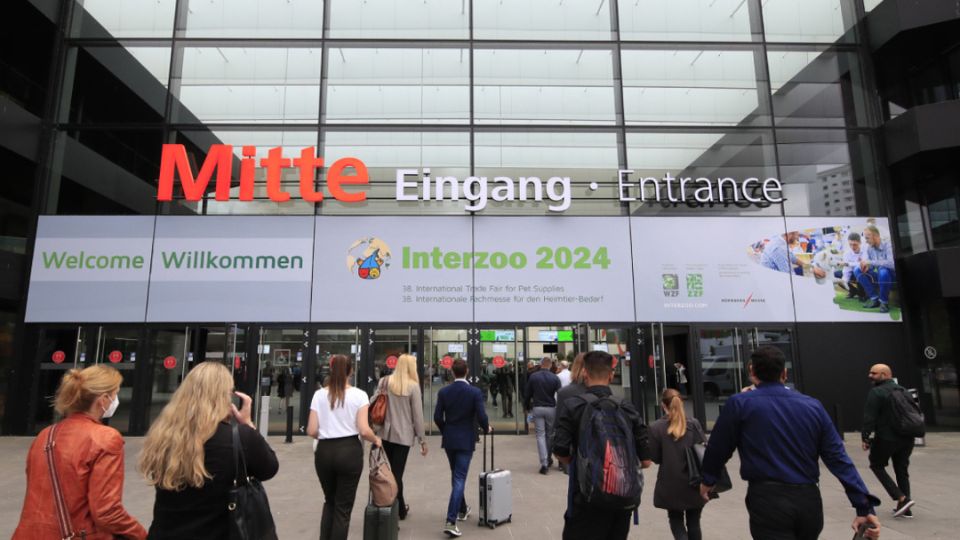

Interzoo 2024: what to expect

Just days before the European pet trade fair kicks off in Germany, GlobalPETS examines how it will unveil the latest trends in pet care.

Weekly newsletter to stay up-to-date

Discover what’s happening in the pet industry. Get the must-read stories and insights in your inbox.