The building blocks of sustainability in the pet industry

Environmentally conscious growth is being propelled by both legislation and economic necessity, and savvy companies are focusing on innovative ingredients, better designed packaging and more resource-efficient operations.

As sustainability moves from a niche concern to a strategic priority in the pet food industry, PETS International takes a look at initiatives that are beginning to deliver measurable returns. However, some experts warn that uneven progress is creating a widening gap between industry leaders and those still laying the groundwork.

Possible competitive advantages

Whereas sustainability was once viewed primarily as a cost or reputational exercise, it is now becoming a source of competitive advantage in the pet food industry. There are some examples of how manufacturers are achieving operational and financial gains by improving their environmental footprint. These range from adapted ingredient sourcing strategies to a stronger focus on the efficient use of byproducts, recycled materials and renewable energy.

Developing new ingredients

Alternative proteins have emerged as one of the most advanced and widely discussed solutions for enhancing the sustainability of pet food. Options such as insect- based and cultivated meat and fermented ingredients are no longer experimental concepts but are beginning to reach the market thanks to growing interest from researchers and manufacturers.

Some of these alternatives are already gaining acceptance among consumers, according to Jenny Mace, Animal Welfare Researcher and Visiting Fellow at the University of St Andrews in Scotland. She notes that studies consistently suggest cultivated meat-based pet food is currently the most popular and sustainable alternative among dog and cat owners.

However, Mace argues that broader public surveys are still needed to better understand attitudes toward novel options.

Several recent product launches underscore the momentum in the alternative protein space. These include cultivated chicken pet food developed by UK brand Meatly, brewed protein from US firm Bond Pet Foods and cultured protein derived from fermented carbon by Calysta, which has been adopted by German brand Marsapet in its recently launched MicroBell dog kibble.

Plant-based options gain traction

Significant sustainability gains can also be achieved through plant-based proteins – a segment that is relatively small but expanding rapidly as both emerging and established brands introduce vegetarian and vegan ranges.

The vegan pet food category, in particular, is expected to see substantial expansion in the coming years. Billy Nicholles, a researcher at Bryant Research – a UK social science firm specializing in alternative protein – describes its current growth rate as notably fast, pointing to rising consumer awareness and increasing industry investment as key drivers.

Eco-conscious sourcing

Another promising avenue lies in improving how traditional proteins are sourced. Allison Reser, Director of Sustainability and Innovation at the Pet Sustainability Coalition (PSC), highlights the possibility of sourcing MSC-certified fish, for example.

Meanwhile, fermentation technologies and regenerative agricultural practices are increasingly viewed as viable ways to reduce environmental impact while maintaining nutritional standards. “Regenerative agricultural practices – such as soil restoration, improved biodiversity on farms and carbon sequestration – offer opportunities to make existing supply chains more resilient,” according to industry association UK Pet Food.

Utilization of byproducts

A focus on the effective use of animal byproducts – in other words, all parts of livestock that are not edible or not sold as food – is another way to achieve sustainability gains in the pet food industry. For Reser, this presents a “huge opportunity”.

Expanding the use of high-quality animal byproducts could “strengthen circularity within the food system”, agrees UK Pet Food. In an innovative example, in December 2025 Korean manufacturer Suchang unveiled Orange Dogs, a dog food made from byproducts of the citrus processing industry. According to the company, the product will be rolled out in selected markets, including the US, Japan, China and Europe.

In the case of byproducts, messaging and education are important. “As public understanding grows, there is potential to better communicate the environmental and nutritional value of byproducts, helping to shift perceptions from waste to resource,” states UK Pet Food. “It also means moving the conversation away from ideas such as ‘human grade’ – which reflect human food preferences – towards recognizing what is safe and nutritionally appropriate for the species we are feeding.”

The role of legislation

PSC’s Reser notes that increasingly stringent regulations will accelerate the adoption of alternative proteins and upcycled ingredients, which offer vastly lower carbon footprints than traditional livestock protein sources. As an example, she mentions the EU’s updated Product Environmental Footprint Category Rules (PEFCR) for pet food, which are standardizing how environmental impact is measured, compelling companies to track and report their emissions from farm to bowl.

Sustainable packaging is another area in which regulatory clarity – in combination with consumer pressure – is driving tangible progress in the pet food industry. For example, Extended Producer Responsibility (EPR) laws have been introduced in several European markets. As this legislation continues to expand and mature, packaging is increasingly viewed not only as an environmental challenge but also as a strategic lever.

Incentivizing improved design

Under EPR policies, producers are financially responsible for the end-of-life management of the packaging they place on the market. These schemes typically impose fees based on the weight, material composition and recyclability of bags, cartons and boxes, creating a direct cost incentive for brands to undertake redesigns with sustainability in mind.

“Pet food brands face per-pound fees for their packaging, with eco-modulation benefits that result in lower fees for more sustainable packaging,” explains PSC’s Reser. Eco-modulation refers to the adjustment of EPR fees to reward better design decisions, penalizing hard-to-recycle materials while favoring those that are widely recyclable.

Packaging innovations

Against this regulatory backdrop, major pet food players have accelerated their efforts to improve packaging sustainability. In 2025, Mars introduced 100% recyclable pouches across parts of its portfolio, while Nestle Purina partnered with plastics manufacturer Berry Global Group to incorporate mechanically recycled PET (rPET) into its cat treat canisters.

Smaller and regional players are also moving quickly. French manufacturer Saga Nutrition recently collaborated with sustainable packaging specialist Mondi to replace non-recyclable, multi-material plastics with recyclable mono-material solutions – an approach that aligns closely with EPR requirements and recyclability guidelines across Europe.

Operational advances

Pet industry players can also seize opportunities to create value through efficiency by improving their operational design. This can include investing in energy-efficient facilities, waste heat recovery, water reuse systems and optimized logistics such as electric vehicle fleets and route planning, says Reser.

These practices translate “directly into lower operational costs and better margins over the long term”, she adds, citing the example of the US animal feed ingredients producer Alltech. The company has invested $5.89 million (€5.04M) in efficiency and renewable projects since 2023, such as capturing and reusing waste heat from energy-intensive processes, and the expansion of solar arrays.

In 2024, Alltech already saw a 26% reduction in greenhouse gas (GHG) emissions compared to its 2021 baseline, according to PSC. The generated savings are expected to pay back on the investment in two to 3.5 years’ time.

Another example comes from the British pet food manufacturer Forthglade, which installed a solar array of 2,000 panels at its factory in Dartmoor, in the southwest of England. The array is expected to reduce energy costs by generating 25% of the electrical power needed for the site.

Leaders go beyond compliance

Reser sees a division in the industry between companies that are excelling in terms of their efforts and others that are still in the foundational stage of the process.

“The leading companies are implementing sustainable solutions well beyond what is required by law, establishing multi-year targets, investing heavily in supply chain transparency and reducing Scope 1, 2 and 3 emissions,” she explains. The others are, according to her, still “focused on compliance” and short-term solutions.

Scope 1 emissions include natural gas usage for heating, ventilation and air-conditioning (HVAC) systems as well as GHG emissions from fleet vehicles, while Scope 2 emissions come from purchased electricity. Scope 3 emissions relate to all indirect emissions throughout the value chain.

Ambition 2030 roadmap

To help reduce the environmental impact of the British pet food sector, UK Pet Food recently unveiled its Ambition 2030 roadmap. The document establishes some goals for companies, such as contributing to a 50% reduction in emissions across the agrifood supply chain by 2030, nature restoration and the adoption of non-deforested commodities.

The association has also prepared a toolkit that provides practical guidance on how to progress sustainability in line with Ambition 2030. This is aimed at driving action among all types of businesses – from those just starting out on a sustainability journey to those who are further along the maturity curve and seeking to accelerate impact.

Avoiding the costs of inaction

It is important to act now to avoid the “cost of inaction”, as PSC describes it, illustrating this with the example of regenerative agriculture. “Because soil health restoration requires a three- to five-year lead time, waiting to act leaves brands vulnerable to a lack of resilience in crop management, resulting in lower yields and increasingly unpredictable input costs,” explains Reser.

She adds that every dollar invested in climate adaptation and resilience can generate up to $19 (€16) in avoided losses, as per the data from the World Economic Forum (WEF). “A circular economy approach can make the supply chain more secure and less exposed to climate-related disruptions,” comments Reser.

Investment reaping rewards

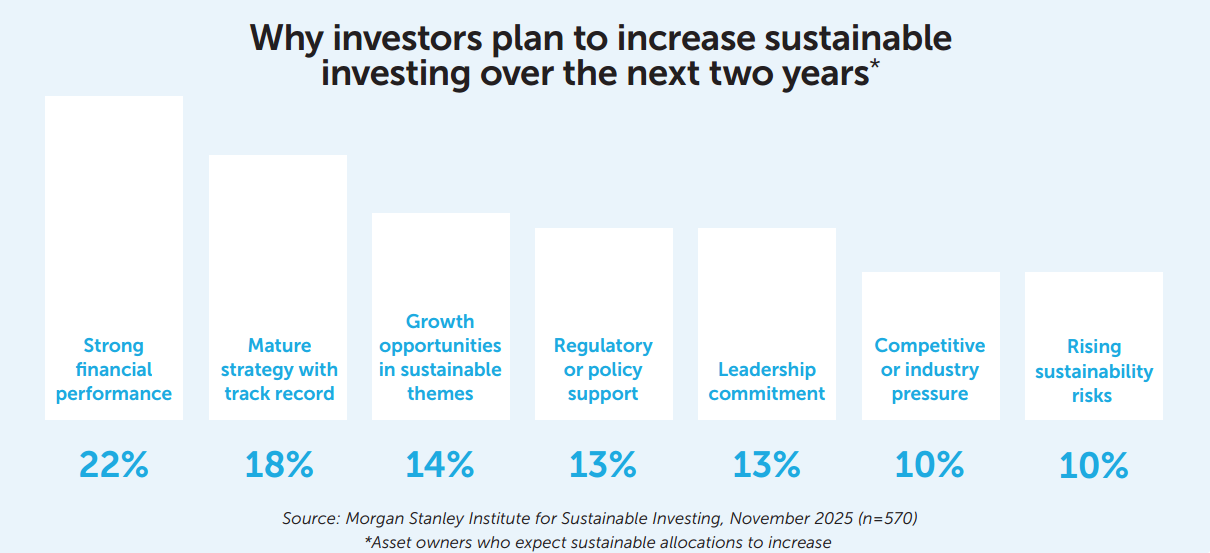

There is clear interest in wider climate-related efforts. According to the Morgan Stanley Institute for Sustainable Investing, following a 2025 survey of 900 institutional investors worldwide, 79% of asset managers and 86% of asset owners expect the proportion of sustainable assets in their portfolios to rise over the next two years.

Researcher Nicholles echoes this, highlighting that investments in sustainable pet food align with “emerging expectations” from investors, regulators and retailers.

Although the pet industry still faces challenges in scaling solutions, initiatives across the markets show that investment is beginning to pay off. This is increasing the willingness among manufacturers to develop and explore new opportunities to drive the low-carbon transition, benefiting companies, consumers and society as a whole.