American e-commerce players adjust supply chain and increase prices to counter tariff impacts

With more than half of their online products subject to tariffs, traders in the US forecast more strategic changes in the coming months.

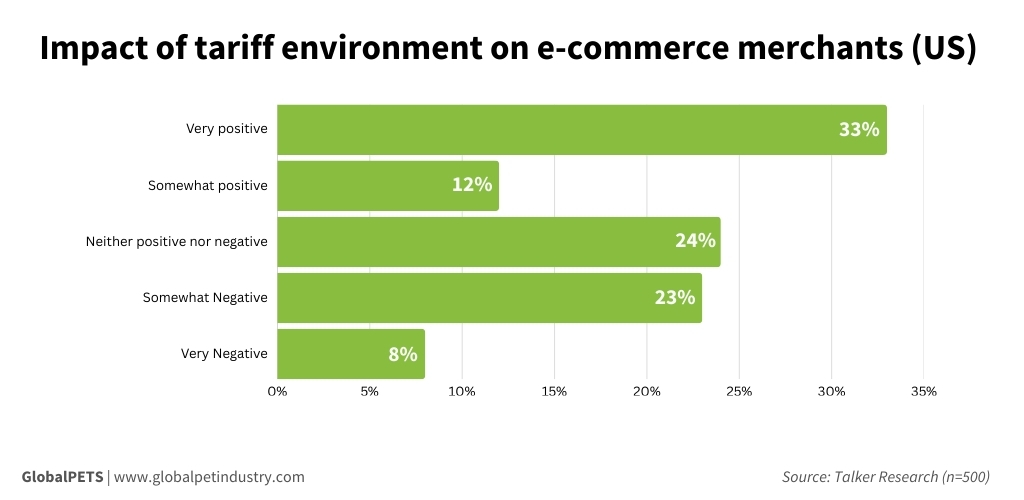

Pressured by the implementation of US reciprocal tariffs and uncertainty regarding global trade, American e-commerce has redesigned its supply chains and expects more changes in the future.

A survey conducted by Talker Research concludes that 6 out of 10 e-commerce merchants in the US have moved production from one country to another since the second quarter of 2024.

Furthermore, 7 out of 10 state they have switched suppliers from higher to lower tariff countries, accelerated imports from countries subject to tariffs and limited the countries they sell or ship to and from their online store. The results show an anticipated movement to improve competitiveness and reduce possible losses.

The survey was carried out among 500 e-commerce merchants in the US between the end of May and the beginning of June 2025.

Price strategy and jobs

The new trade dynamics have also influenced price and sales strategies. 76% of the respondents have increased their prices since last year, with a notable increase in the first quarters of this year.

Additionally, merchants have reduced discounts and promotions (74%) to lower their costs.

Although to a lesser extent, survey participants also report changes in the sector’s workforce and the physical presence of their businesses. 58% reported closing physical stores or reducing their business’s physical footprint in 2024 and 2025.

Regarding workforces, 55% reported laying off employees, and 63% decided to freeze any hirings.

Long-term doubts

The majority of respondents to the survey remain concerned about the mid to long-term effects of the policy on their businesses (78%), with a small portion (14%) showing uncertainty about meeting revenue and sales targets for the next 6 to 12 months.

As a result, 33% plan to increase prices. Furthermore, more than half of the goods (53%) that they source to sell online are subject to recently imposed tariffs.

Latin America and Asia in the spotlight

American e-commerce merchants presented a greater diversity of potential trading partners for their product-sourcing strategies. When asked which regions they were targeting in the past 12 months due to tariff concerns, the results were spread among 11 countries.

The biggest potential partner is Mexico (31%), followed by Vietnam (16%), India (12%), Taiwan (12%), Brazil (11%) and Singapore (11%).

Americans have also looked to source their products in the Philippines (10%), Indonesia (9%), Malaysia (9%), Egypt (6%) and Cambodia (4%). The trend indicates a growing interest in the Latin American and Asian markets, with limited entry into the EMEA region.

The results are substantially different from those recorded among Mexican traders, who rely much more on the domestic market (61%). Other expressive possibilities for product-sourcing strategies were Brazil (13%), Indonesia (9%) and India (8%).

Despite that, the number of respondents who haven’t looked for alternative markets was almost double among Americans (39%) than Mexicans (26%).

How the pet industry perceives it

The general sentiment is also felt by the pet industry, according to results of a PETS International survey of 831 subscribers. 72% of respondents expect US tariffs to impact their business in the coming months, especially in terms of loss of price competitiveness, margin pressure, higher production costs and volatility in the supply chain.

In response to potential impacts, the majority of businesses (76%) plan to pass costs on to customers, while a few intend to switch or diversify suppliers, scale back product ranges or volumes or take other actions (each with 12%).

Among the participants who said they didn’t expect the impact of tariffs on operations (28%), the vast majority (92%) attributed them to a lack of direct business with affected markets, while 8% said they already diversified suppliers and markets (8%).