E-commerce in Europe matures as everyday online shopping gains ground

Europeans are buying items online more often and across a wider range of product categories, including pet supplies.

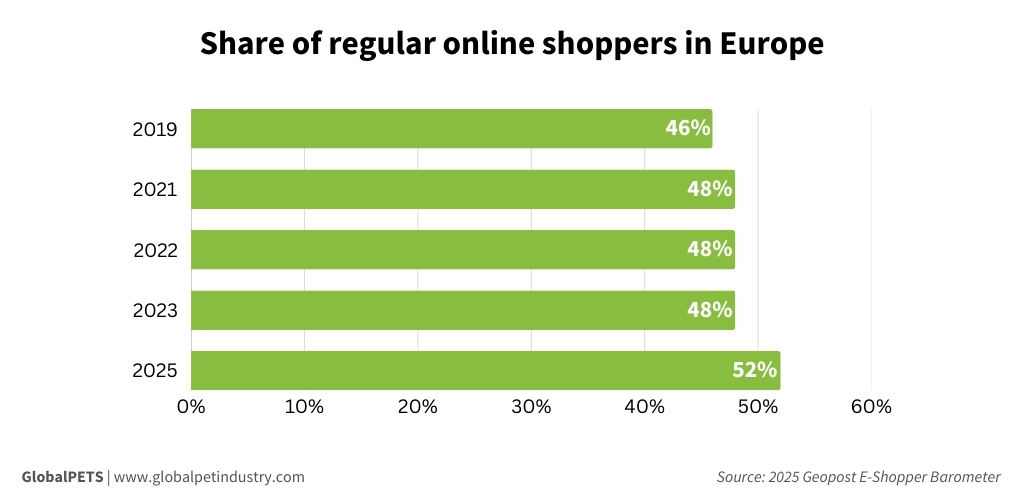

Rather than simply growing, e-commerce has been consolidating in Europe. Although there are slightly more e-shoppers in 2025 (77%) than in 2023 (76%), the number of regular online shoppers grew more significantly.

The Geopost E-Shopper Barometer, an analysis of the European e-commerce sector conducted by the parcel delivery and commerce company Geopost, found that the number of regular online shoppers increased from 48% to 52% this year.

Regulars are e-shoppers who make at least one online purchase per month, accounting for 89% of all online purchases analyzed.

Released in September, the study interviewed 30,697 people across 22 European countries since January. Although the survey doesn’t specifically distinguish pet products, it ranks the most popular product types on the continent. Among them, the top three are fashion, shoes, beauty and health care.

Pet food

Food, beverage, and groceries – which includes the pet category – rank sixth and seventh in terms of preference, with 35% of respondents saying they buy these types of products online.

These categories are also the most frequently purchased: 32% of respondents say they buy food and beverages online at least once a week, and 58% buy them at least once a month.

At the beginning of 2025, Geopost forecasted that fresh pet food “should see significant demand in many market segments.”

In a September presentation on the barometer results, the company highlighted pet retailers among those adopting Out of Home solutions. This is a hybrid network of parcel lockers and parcel shops designed to provide flexible delivery and pickup options for consumers.

What about pet parents?

An analysis of the pet care sector published by NielsenIQ in September showed that online shopping has also consolidated in the category.

According to Andrea Binder, VP and Pet Industry Insights Leader at the market research firm, online channels are “driving double-digit growth.”

Bedding accessories and pet repellents are seeing growth online but declining in stores. Despite the growth of online, the secret to performance lies in an omnichannel strategy: “82% of pet care dollars are now coming from consumers who buy both in-store and online,” says Binder.

A survey by Loop in August 2025 of 3,081 pet owners showed that the internet is the main channel for purchasing pet food in the United Kingdom (39% among dog owners and 43% among cat owners) and the second most common in France (35% for each animal).

In Italy, a July survey conducted by Mediatic of 295 pet owners found that 69% of the participants have made at least one online purchase of pet products in the last 12 months.

Like the Geopost barometer, the Mediatic survey also reported a jump in the number of regulars: pet owners who buy online at least once a month went from 52% in 2021 to 58% in 2025.

Diversification

The Geopost barometer also points to an increase in the number of product categories per purchase, with 6.2 categories bought on average (up from 5.9 in 2023).

The number of consumers buying from foreign e-commerce has grown 5 percentage points from 2023 to 2025, reaching 63% this year.

According to the report, the most popular countries to buy from were China (48%), the United States (29%) and Germany (26%).

Out-of-home delivery

Regardless of age or profile, demand for flexible delivery options is increasing as the continent sees a “notable shift toward out-of-home solutions.”

The Geopost analysis found that the preference for parcel lockers rose from 23% in 2023 to 27% in 2025, surpassing parcel shops and post offices.

It now ranks second, behind home. And although home is still the most chosen destination, “this preference decreases generationally,” with Gen Z leaning more toward out-of-home.

Buying on social media

When it comes to social media, Facebook is the most popular when it comes to direct commerce, with 22% of respondents “usually” using it to purchase online. It is followed by Instagram (19%) and YouTube (15%).

More than half of respondents (52%) state that they do not use social media for purchases.

The barometer, however, highlights social media’s role as conversion platforms. “TikTok and Instagram have achieved an impressive 41% conversion rate (percentage of website visitors who make a purchase),” according to the report.

When seeking inspiration, Instagram is the most popular (36%), followed by Facebook (32%) and YouTube (31%). In this regard, TikTok (25%) and Pinterest (15%) also stand out.