German pet market (I): Stability at €7 billion in 2024

Offline transactions hold steady, while online contributed more than 20% to last year’s revenue.

According to a new industry report by the German Pet Trade & Industry Association (ZZF) and the Industrial Association of Pet Care Producers (IVH), the pet industry in Germany has shown resilience despite consumers’ economic concerns in 2024.

The research concludes that the industry reached €7 billion ($8B) in 2024, the same figure as in 2023. That year, the industry had grown by 9.5% compared to 2022.

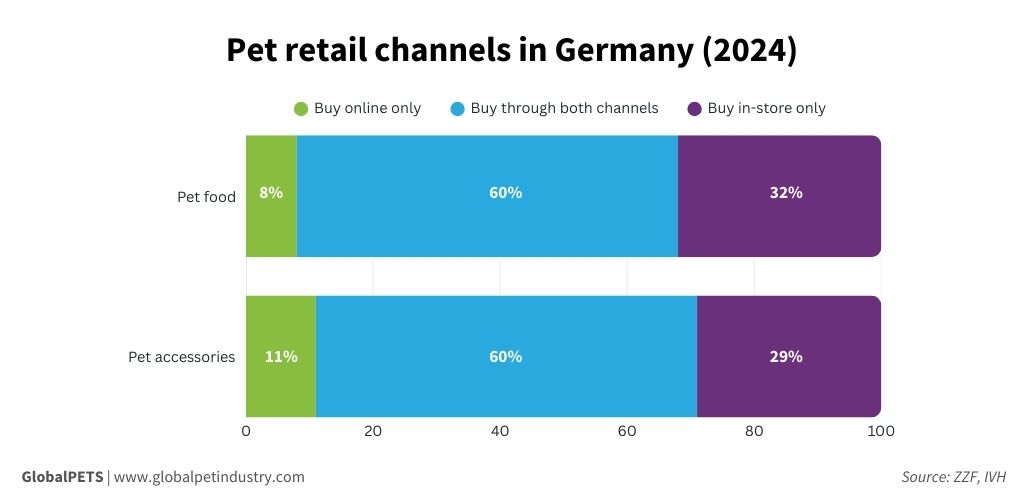

The ZZF and IVH’s data show that one-third of German pet owners shop only in-store, while 60% use both online and in-store retailing options.

Grocery vs. specialist

For pet food, the report reveals that grocery retailers (including drugstores and discounters) remain the top sales channel, with €2.8 billion ($3.2B) in revenue and a 65% share.

For accessories, specialty stores dominate with €858 million ($975M) in sales and a 77% share.

“Despite online growth, the sales space of the top 20 pet specialty retailers is increasing,” says ZZF President Norbert Holthenrich. “These stores are key contact points due to premium products, services, expert advice and immersive experiences.”

32% of pet parents buy pet food only in-store and 29% for accessories. This offline business represented €5.4 billion ($6.2B) in 2024, a slight increase from the previous year (€5.3B/$6.1B).

Online retailing

The estimated sales volume in online shops and marketplaces in 2024 was approximately €1.5 billion ($1.7B), an increase of 14.9% compared to 2023 (€1.3B/$1.5B).

The German E-Commerce and Distance Selling Association (bevh) calculates that the local online pet supply market reached a new record volume of €1.9 billion ($2.2B) in 2024.

Alongside online pure players, manufacturers and traditional retail chains increasingly launched their own e-commerce platforms, expanding online offerings for consumers.

For more insights:

German pet market (II): Pet population registers slight decline in 2024

German pet market (III): Inside 2024’s pet categories and retail dynamics