The pet industry in the Netherlands

An overview of the Dutch pet industry in 2024, including the most recent statistics and trends.

Pet ownership statistics

Dutch people love pets even more than they do tulips! 86% of ‘Dutchies’ currently own a pet or had one in the past. An annual pet survey conducted by NVG and Dibevo, carried out by Ipsos I&O, shows that unconditional friendship is the main reason people in the small European country get a pet.

Around 3 million cats charmed their way into 23% of Dutch households in 2024, making felines the most popular pets. Unsurprisingly, dogs took second place, with 1.8 million of them in 18% of Dutch households.

The Dutch also embrace an array of other pets, such as aquarium fish (6.7 million), rabbits (0.4 million), reptiles (0.5 million) and horses (0.2 million), creating a diverse and lively pet population across the country.

With the nation’s pet population increasing, there has also been a notable rise in abandoned and stray animals in 2024. An alarming 48% of animal aid organizations cite increased surrenders, primarily due to financial and time pressures on pet owners.

The Dutch pet industry

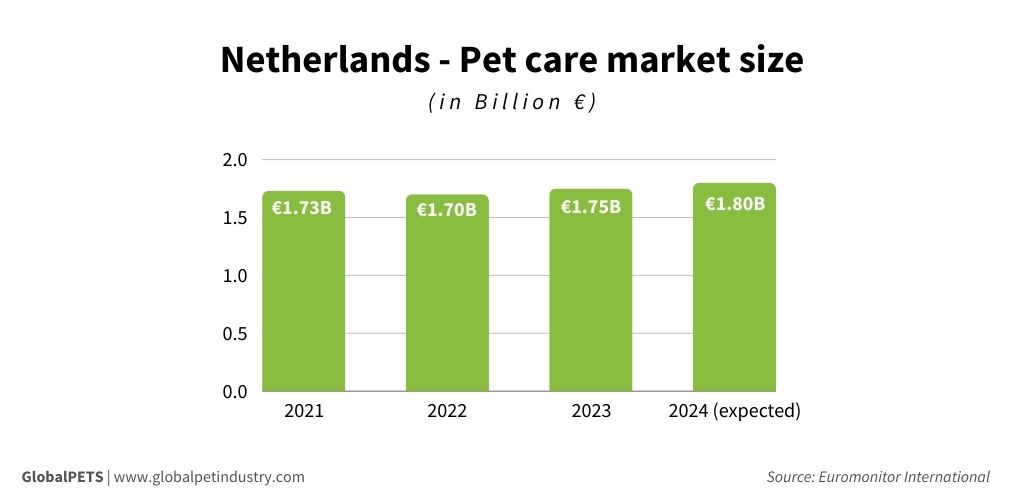

According to Euromonitor, the pet care market in the Netherlands was worth €1.75 billion ($1.85B) in 2023 and is forecast to reach €1.8 billion ($1.91B) in 2024.

Though cats are the most popular pet (with a 43.43% value share, making them the largest market), the biggest market growth is expected in the dogs category, with a 6.29% growth forecast for 2029.

The rising costs associated with pet ownership have not deterred Dutch pet owners, who are more likely to cut back on personal expenses rather than compromise on their pets’ needs.

Additionally, new pet food formulations and health products continue to emerge, reflecting the industry’s dynamic nature and commitment to pet welfare.

Dutch pet industry dynamics

The Netherlands has many new players, leading to more competition in the premium segment, compared to neighboring Belgium, which has a more traditional pet market with fewer, smaller players.

One of those new players is the German pet retailer Fressnapf, which is committed to expanding its footprint in the Netherlands. This became clear after the announcement of the strategic takeover of Dutch pet retailer Jumper.

Since then, Fressnapf has also opened 2 new Maxi Zoo stores in the Netherlands.

Another key player is Pets Place, an ambitious Dutch pet giant with 175 stores nationwide and approximately 12 new stores opening each year.

Pets Place is an omnichannel retailer focused on digital and consumer engagement and is known for its in-store services, online and offline channels, and hyper-personalization approach.

Find out more about Pets Place’s strategy in this interview with its CEO.