The pet industry in the Philippines

An overview of the pet industry in the Philippines, including the most recent statistics and trends.

The Philippines’ pet industry is growing rapidly, and pet ownership is rising. However, challenges remain, such as a shortage of veterinarians. The $108 million (€103.7M) pet care sector has doubled over the past 5 years, signaling significant market potential.

Pet population in the Philippines

As pet ownership surges across Southeast Asia, the Philippines emerges as a key market. According to Statista, approximately 16.4 million dogs in 2024 and 2.06 million cats were found in 42% of households.

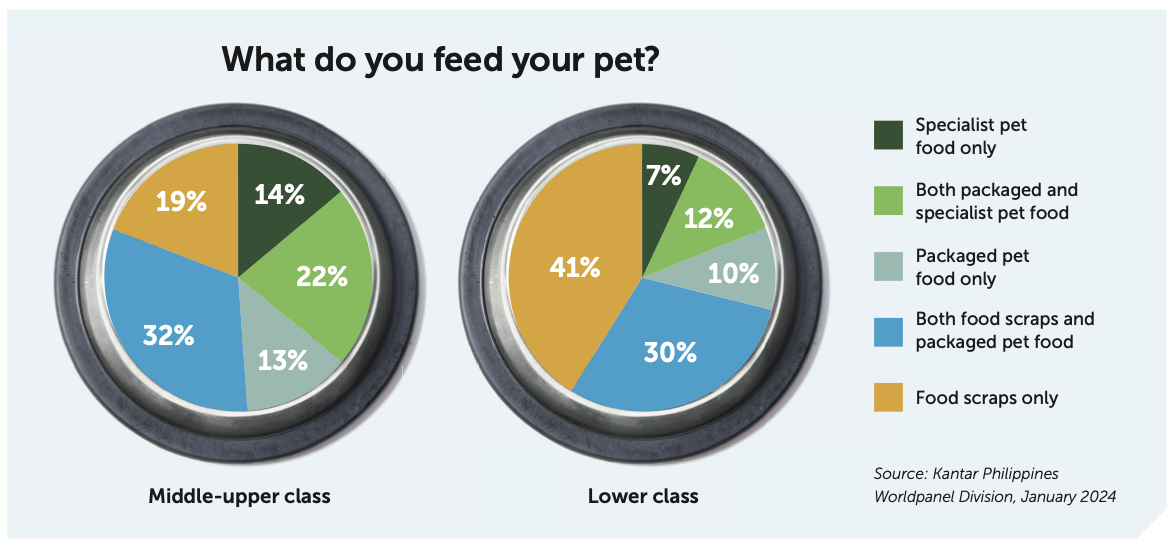

Socioeconomic factors play a key role in shaping consumer preferences in the Philippines. Higher-income groups treat pets as family members and opt for packaged pet food, while lower-income households often rely on food scraps.

Philippines’ pet industry booms with rising premium demand

The pet care industry in the Philippines is expanding, with more demand for grooming, specialty services and pet-friendly businesses. Pet salons, hotels and wellness products are becoming more common, creating new opportunities for brands to meet changing consumer needs.

The market, now worth around $108 million (€103.7M), has doubled since 2018 and continues to develop. While annual spending per pet is still lower than in some other countries, a strong focus on pet health and innovation is driving future growth.

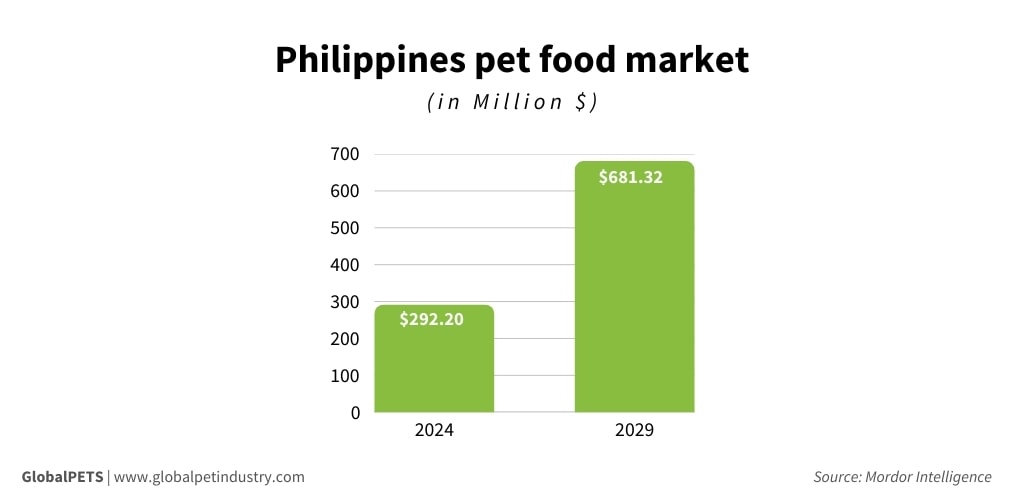

In 2022, the Philippines accounted for 34% of the Asia-Pacific region’s 9.33% increase in pet food production. Metro Manila leads pet food sales with 60% to 70% of the market, while online sales are growing fast. According to Mordor Intelligence, the Philippine pet industry is expected to reach $681.3 million (€654.8M) by 2029.

Local manufacturers like Pilmico Foods are expanding their reach alongside imports from 111 foreign companies. With both traditional and online sales channels growing, brands have plenty of opportunities to tap into shifting consumer demands.

The Philippines as a key market for global pet food exports

The Philippines ranked as the 9th largest market for US dog and cat food in 2021, with American brands holding a 26% share. The country also contributed to a 20% surge in US pet food exports in 2022. While premium pet foods like organic kibble and dental sticks are in demand, price sensitivity remains a factor for many pet owners.

Moreover, the US Pet Food Institute (PFI) is increasing its focus on the Philippines. It is allocating part of its $1.3 million (€1.2M) USDA Market Access Program funding to promote US-made pet food in the country. This effort emphasizes the importance of balanced pet nutrition while supporting local owners and enhancing US export opportunities in the growing market.

India has also expanded its pet food exports, shipping 1.4 million kg to the Philippines in the first half of 2024. Mukka Proteins, for example, supplies fish meal, fish oil and fish-soluble paste, supporting both the pet food and aqua feed industries in the Philippines.

Success in the market often depends on strong local relationships and direct negotiations. KIKA Group, for example, has expanded exports to the Philippines and other Southeast Asian markets by building trust and fostering partnerships.

E-commerce and retail growth transform the pet industry in the Philippines

TikTok Shop is emerging as a major sales channel for pet brands in the Philippines, directly engaging with younger consumers and driving sales. Since launching in the country alongside other Southeast Asian markets, the platform’s in-app shopping feature has become particularly popular among users aged 16-34.

At the same time, Pet Lovers Centre, Southeast Asia’s largest pet retailer, is expanding in the Philippines with new stores and stronger e-commerce efforts.

While brick-and-mortar stores remain key, the rapid growth of online shopping is changing how consumers buy pet products. Notably, searches for cat-related items – such as food, cages and condos – are increasing, signaling a growing demand for feline-focused products.

Other news about the pet industry in the Philippines

Gap in the market

The pet care landscape in the Philippines is evolving, with increasing opportunities in insurance, sustainability, and nutrition. Despite the surge in pet ownership, access to veterinary care remains challenging, with only 1 veterinarian for every 10,000 pet owners. To bridge this gap, Igloo, a digital insurance firm active in Southeast Asia, offers innovative microinsurance solutions in the Philippines, backed by a recent $36 million (€34.6M) funding round.

Sustainability

Sustainability initiatives are also rising, with Mars Petcare Thailand’s SWAP Recycling program now expanding to the Philippines. The program allows pet owners to exchange empty pet food bags for discounts on brands like Pedigree, Whiskas, Cesar and Sheba, promoting eco-friendly practices and reducing plastic waste.

As the Philippines’ pet industry continues to grow, it presents strong potential for innovation and investment, with both local and international players expanding to meet the rising demand.