Examining the pieces of the inflation puzzle

Good news is on the horizon as price levels stabilize globally. But how is the situation still affecting pet owners?

Inflation surges and the cost-of-living crisis were hallmarks of 2022 and 2023. These were years marked by significant price hikes across many different sectors, including pet food, and consumers are still grappling with the effects.

Past the peak

A journey through the global economic landscape reveals a sobering reality: headline inflation has reached heights not seen in two decades. But 2024 is election year in many countries, and there is a glimmer of hope as inflation levels are showing signs of easing.

Recent data from the EU’s statistical office Eurostat shows annual inflation in the Euro zone – countries that have the Euro as their currency – as 2.5% (as of June). This is a slight decline from 2.6% in May, and a far cry from 5.5% in June 2023. The harmonized index for pet-related products for the same month shows a modest 1.6%.

UK prices now dropped

In the UK, headline price hikes hit their peak in March 2023, with Consumer Price Index (CPI) inflation reaching 10.1%. Despite gradual deceleration, rates remained high for much of the year, finally dropping below 5% towards the end of last year.

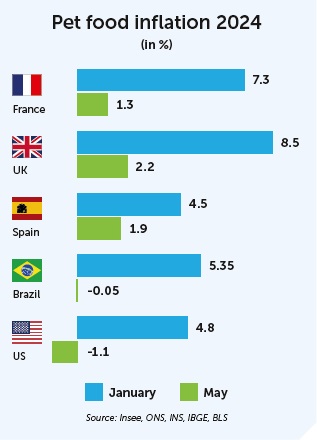

The latest data reveals that inflation reached 2% in June overall. Pet care inflation stood at 3.6%. This marks a significant decrease from its January 2024 high of 8.5%, and a considerable improvement from the April 2023 peak of 15.4% – the highest on record.

Downward trend in the US

In the US, the world’s largest pet care market, pet owners have also felt the strain of rising prices in recent years. Year-on-year inflation in the sector peaked in 2022, reaching a high of 15% in October, which spilled into early 2023. But by the end of that year, this had dropped to 5%, further declining to 4.8% in January 2024.

The downward trend has continued, with annual inflation in pet product prices decreasing to 1.8% in March, -0.1% in April, -1.1% in May and -3.6% in June. Despite these positive developments, pet food prices remain 23% higher than in 2019. Overall CPI stood at 3% in June – its slowest rate since the previous June, and a 0.1% decline from the previous month.

Similarities in European markets

Pet owners across European markets have not been immune to inflationary pressures either. The trends in several countries reflect a Europe-wide effort to control inflation and provide some relief to consumers, who have faced significant price increases in recent years.

In January, people in Spain were paying 4.5% more for pet food compared to the previous year, although the rate nearly halved in the following month. The latest data from May shows the inflation rate in this category at 1.9%, reflecting a 0.2% increase from April.

France experienced a similar trend. At the start of the year, pet food inflation was at 7.3%. The market in that country has since managed to bring the rate down to 1.3% (in May), showing significant progress has been made in efforts to curb inflation.

The pet owner experience in Italy is no different. In January 2024, Italian consumers were paying 5.4% more for pet food compared to the previous year.

However, inflation in the pet food sector has since decreased, currently standing at 1.5%, with a 0.2% variation from the previous month.

Finnish consumers have been feeling the pinch too. Annual CPI averaged 6% and pet food inflation reached 14.4% in 2023. But Finland is also on the right track now. From 5.5% in January, pet food inflation rates have consistently dropped, with the latest rate (May) standing at -0.6% – even less than the 1.5% CPI that month.

Relief in southern continents

Overall, Brazilian price increases stood at 4.2% in June, while consumers paid 0.6% less for their pet supplies. This represents a significant drop from January, when pet food prices were 5.4% higher than the previous year – more than the overall CPI of 4.5% at the time. The lower prices come as a relief to Brazilian pet owners.

In Australia, meanwhile, pet food inflation in the quarter to March 2024 stood at 3.6%. This marked the fifth consecutive quarter of lower annual inflation since the peak of 7.8% in the sector in the last quarter of 2022.

How consumers are coping

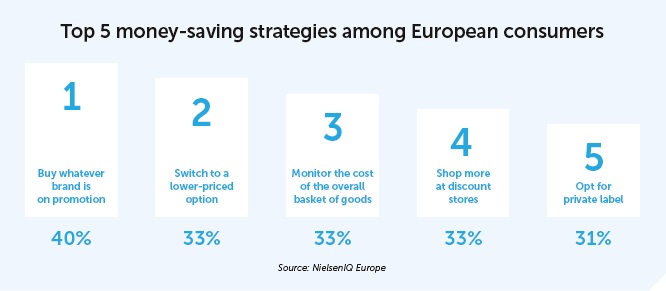

While all these figures are encouraging for consumers, the reality is that the prices they are paying for their supplies have not seen any substantial declines. So, pet owners have had to develop strategies to cope with the persistently higher costs.

According to NielsenIQ, an average 41% of European households are now worse off financially than they were a year ago.

So, to manage expenses, 93% of these consumers have changed how they shop, such as buying on promotion or stocking up. Unsurprisingly, brand loyalty has also been affected, with buyers opting for lower-priced options or private labels.

Another popular strategy in 2023 was going shopping more often. Across many markets, the number of consumer shopping trips has increased exponentially since the beginning of the pandemic. In 2019, the average in France was 112 trips, but last year this was 123.

Spanish consumers also increased their number of supermarket trips slightly – from 162 to 181.

Forecasting the future

European Commission forecasts have been revised downward, as inflation is expected to continue declining for the forecasted period. The International Monetary Fund (IMF) projects inflation to stand at 2.4% in the Euro area, declining to 2.1% in 2025 (2.4% for the whole EU) and 2% in 2026 (2.1% for the EU).