Analysis: Delivery platforms lean on pet supplies to expand their reach

Convenience and premium offerings are driving new ways for pet owners to get products delivered to their homes.

The growth in pet ownership in most countries, the premiumization of consumption and growing demand for rapid and easy purchases create fertile ground for a trend seen by three major European delivery platforms: increased sales of pet products.

Some numbers help explain the market. For example, German-founded Foodora reports that orders for pet products have doubled in the last 3 years, with 30% year-over-year (YoY) growth between February 2024 and February 2025. Between 2023 and 2024, the increase stood at 25% YoY.

Spanish-based Glovo reports even higher growth, with 70% more sales in July 2025 compared to the same month of last year. The number of partners with retailers offering pet supplies has also surged, having gone from over 30 to more than 100.

What drives the boom

The surge is pushed by a combination of shifting lifestyles and market growth. First, according to the European Pet Food Industry Federation (FEDIAF), Europe’s pet population expanded from 290 million in 2017 to over 299 million in 2023.

With fewer children being born, pets have become central members of households, driving higher spending.

Beyond convenience, the humanization and premiumization of pets continue to influence delivery behavior and expand purchases. This can be seen in the rise of wet and gourmet food, as well as accessories, comfort products and treats among the best-seller lists shared by the platforms.

Feeling guilty

Another example is the sentiment of “guilt” that 65% of pet owners have felt “when they have run out of their pet’s favorite food or treats when they needed it most,” according to a recent survey by Just Eat Takeaway.

The boom is also connected to the performance of digital platforms for general daily needs. “Across the globe, consumers expect to immediately access the products they need, and pet supplies are no exception,” the platform says.

Another “key indicator is basket penetration,” Foodora tells GlobalPETS, “which increased from 3% to 4.5% over the past year” on the platform. “We anticipate this positive trend to continue,” the company says.

Subscriptions, such as Foodora PRO or Just Eat Takeaway’s loyalty campaigns, make frequent purchases more affordable. In some markets, repeat order rates exceed 60%.

Strategies to keep growing

The challenge for platforms is to transform occasional orders into habits. Glovo says its strategy is to maximize variety and guarantee delivery within 30 minutes.

Just Eat Takeaway is expanding its private-label lines, with 4 of its global top 10 products coming from retailer brands. Omnichannel strategies are also important, as they integrate platforms and physical retailers.

For Foodora, the focus will lie on affordability and the strengthening of partnerships with regional brands. In recent months, the market has seen an increase in the number of collaborations between platforms and brands for the distribution of their products in various consumer markets, such as Canada and Mexico, highlighting expansion beyond Europe.

The platforms expect their pet categories to maintain similar growth levels for the rest of 2025, betting on the convenience factor to keep consumers loyal.

But as the market matures, challenges like competition and the impact of inflation and other financial headwinds can test the platforms’ ability to sustain growth.

Top products

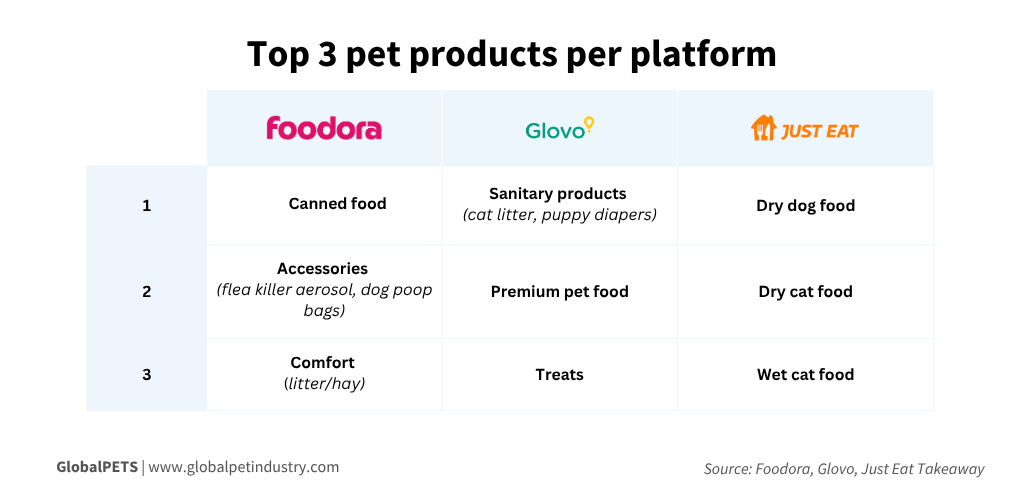

Although they report different products among consumer favorites, they all claim to see consistency across various markets, indicating that trends are supranational.

According to Just Eat Takeaway, the 5 most requested products on the platform are dry dog food, dry cat food, wet cat food, pet care and hygiene (including cat litter, dog shampoo, dog bags and hairbrushes) and dog wet food.

At Foodora, the top products are canned food, accessories (flea killer aerosol and dog poop bags), comfort (litter or hay), treats and grooming (brushes, etc.).

And while Glovo’s most popular segments are food, snacks and accessories for dogs and cats, their bestsellers are sanitary products (cat litter and puppy diapers), premium pet food, treats and toys.

Top cities

Operating in several European cities, the platforms also disclose that their largest consumer markets consist of capitals and urban centers. According to Foodora, the top buyers are in Budapest (Hungary), Vienna (Austria), Prague (Czech Republic), Stockholm (Sweden) and Gothenburg (Sweden).

For Just Eat Takeaway, the best performing cities are Coventry (UK), Dublin (Ireland), Winnipeg (Canada), Wolverhampton (UK) and Telford (UK), although Austria and Spain are also good markets, the platform says.

At Glovo, the largest consumers for pet product orders are Madrid (Spain), Bucharest (Romania), Barcelona (Spain), Lisbon (Portugal) and Zagreb (Croatia). In addition, other markets show significant growth, like Rome (a 1,000% YoY increase) and Warsaw (a 280% increase).